WeightWatchers 2015 Annual Report Download - page 83

Download and view the complete annual report

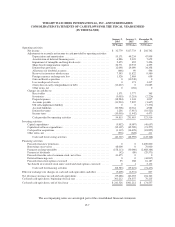

Please find page 83 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

1. Basis of Presentation

The accompanying consolidated financial statements include the accounts of Weight Watchers International,

Inc. and all of its subsidiaries. The terms “Company” and “WWI” as used throughout these notes is used to

indicate Weight Watchers International, Inc. and all of its operations consolidated for purposes of its financial

statements. The Company’s “meetings” business refers to providing access to meetings to the Company’s

monthly commitment plan subscribers, “pay-as-you-go” members, Total Access subscribers and other meeting

members. “Online” refers to Weight Watchers Online, Weight Watchers OnlinePlus, Personal Coaching and

other digital subscription products.

The consolidated financial statements have been prepared in conformity with accounting principles

generally accepted in the United States of America (“GAAP”) and include all of the Company’s majority-owned

subsidiaries. As further discussed in Note 4, (1) as a result of the acquisition of an additional equity interest in

Vigilantes do Peso Marketing Ltda. (“VPM”) in March 2014, the Company gained a direct controlling financial

interest in VPM and began to consolidate this entity as of the date of acquisition; (2) as a result of the acquisition

of Knowplicity, Inc., d/b/a Wello, in April 2014, Wello became a wholly owned subsidiary of the Company and

the Company began to consolidate the entity as of the date of acquisition and (3) as a result of the acquisition of

Weilos, Inc. (“Weilos”), in March 2015, Weilos became a wholly owned subsidiary of the Company and the

Company began to consolidate the entity as of the date of acquisition. All intercompany accounts and

transactions have been eliminated in consolidation.

Out-of-Period Adjustments:

In fiscal 2015, the Company identified and recorded out-of-period adjustments related to immaterial errors

in prior period financial statements that increased income before income taxes by $1,650, provision for income

taxes by $1,970, and decreased net income attributable to the Company by $320.

2. Summary of Significant Accounting Policies

Fiscal Year:

The Company’s fiscal year ends on the Saturday closest to December 31st and consists of either 52 or

53-week periods. Fiscal year 2015 contained 52 weeks, fiscal year 2014 contained 53 weeks and fiscal year 2013

contained 52 weeks. In 2014, when the Company realigned its organizational structure and changed the

determination of its reportable segments, the Company’s Online business accordingly changed its fiscal year end

to be the same as the Company’s fiscal year end, which did not have a material effect on the consolidated

financial statements. See Note 15 for further information on the Company’s reportable segments. In fiscal year

2013, the Company’s Online business’ fiscal year ended on December 31st. This difference in fiscal years did not

have a material effect on the consolidated financial statements.

Use of Estimates:

The preparation of financial statements, in conformity with GAAP, requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and

liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the

reporting period. On an ongoing basis, the Company evaluates its estimates and judgments, including those

related to inventories, the impairment analysis for goodwill and other indefinite-lived intangible assets, share-

based compensation, income taxes, tax contingencies and litigation. The Company bases its estimates on

historical experience and on various other factors and assumptions that it believes to be reasonable under the

F-8