WeightWatchers 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal 2013

Net cash used for financing activities totaled $74.4 million in fiscal 2013 and included $44.8 million of

deferred financing fees in connection with our April 2013 debt refinancing. Additionally, term loan payments

under our then-existing credit facility of $2.41 billion were offset by new borrowings of $2.40 billion in

connection with our April 2013 debt refinancing. In addition, we paid $29.6 million of dividends to our

shareholders which offset $18.3 million in proceeds from stock options exercised and the tax benefit thereon in

fiscal 2013.

Long-Term Debt

We currently plan to meet our long-term debt obligations by using cash flows provided by operating

activities and opportunistically using other means to repay or refinance our obligations as we determine

appropriate.

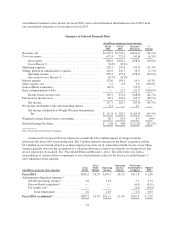

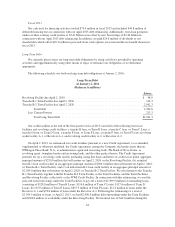

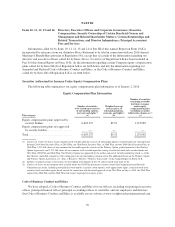

The following schedule sets forth our long-term debt obligations at January 2, 2016:

Long-Term Debt

At January 2, 2016

(Balances in millions)

Balance

Revolving Facility due April 2, 2018 .................................................... $ 48.0

Tranche B-1 Term Facility due April 2, 2016 .............................................. 144.3

Tranche B-2 Term Facility due April 2, 2020 .............................................. 2,042.3

Total Debt ................................................................. 2,234.6

Less Current Portion ............................................................. 213.3

Total Long-Term Debt ....................................................... $2,021.3

Our credit facilities at the end of the first quarter of fiscal 2013 consisted of the following term loan

facilities and revolving credit facilities: a tranche B loan, or Term B Loan, a tranche C loan, or Term C Loan, a

tranche D loan, or Term D Loan, a tranche E loan, or Term E Loan, a tranche F loan, or Term F Loan, revolving

credit facility A-1, or Revolver A-1, and revolving credit facility A-2, or Revolver A-2.

On April 2, 2013, we refinanced our credit facilities pursuant to a new Credit Agreement, or as amended,

supplemented or otherwise modified, the Credit Agreement, among the Company, the lenders party thereto,

JPMorgan Chase Bank, N.A., as administrative agent and an issuing bank, The Bank of Nova Scotia, as

revolving agent, swingline lender and an issuing bank, and the other parties thereto. The Credit Agreement

provides for (a) a revolving credit facility (including swing line loans and letters of credit) in an initial aggregate

principal amount of $250.0 million that will mature on April 2, 2018, or the Revolving Facility, (b) an initial

term B-1 loan credit facility in an aggregate principal amount of $300.0 million that will mature on April 2, 2016,

or Tranche B-1 Term Facility, and (c) an initial term B-2 loan credit facility in an aggregate principal amount of

$2,100.0 million that will mature on April 2, 2020, or Tranche B-2 Term Facility. We refer herein to the Tranche

B-1 Term Facility together with the Tranche B-2 Term Facility as the Term Facilities, and the Term Facilities

and Revolving Facility collectively as the WWI Credit Facility. In connection with this refinancing, we used the

proceeds from borrowings under the Term Facilities to pay off a total of $2,399.9 million of outstanding loans,

consisting of $128.8 million of Term B Loans, $110.6 million of Term C Loans, $117.6 million of Term D

Loans, $1,125.0 million of Term E Loans, $817.9 million of Term F Loans, $21.2 million of loans under the

Revolver A-1 and $78.8 million of loans under the Revolver A-2. Following the refinancing of a total of

$2,399.9 million of loans, at April 2, 2013, we had $2,400.0 million debt outstanding under the Term Facilities

and $248.8 million of availability under the Revolving Facility. We incurred fees of $44.8 million during the

63