WeightWatchers 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

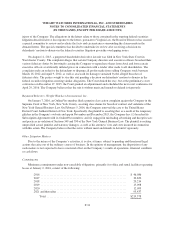

16. Fair Value Measurements

Accounting guidance on fair value measurements for certain financial assets and liabilities requires that

assets and liabilities carried at fair value be classified and disclosed in one of the following three categories:

• Level 1—Quoted prices in active markets for identical assets or liabilities.

• Level 2—Observable inputs other than Level 1 prices, such as quoted prices for similar assets or

liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be

corroborated by observable market data for substantially the full term of the assets or liabilities.

• Level 3—Unobservable inputs that are supported by little or no market activity and that are significant

to the fair value of the assets or liabilities.

When measuring fair value, the Company is required to maximize the use of observable inputs and

minimize the use of unobservable inputs.

Fair Value of Financial Instruments

The Company’s significant financial instruments include long-term debt and interest rate swap agreements.

The fair value of the Company’s borrowings under the Revolving Facility approximates a carrying value of

$48,000 due to the nature of the debt.

The fair value of the Company’s Term Facilities is determined by utilizing average bid prices on or near the

end of each fiscal quarter (Level 2 input). As of January 2, 2016 and January 3, 2015, the fair value of the

Company’s long-term debt was approximately $1,682,778 and $1,888,051, respectively, as compared to carrying

value of $2,186,573 and $2,358,000, respectively.

Derivative Financial Instruments

The fair values for the Company’s derivative financial instruments are determined using observable current

market information such as the prevailing LIBOR interest rate and LIBOR yield curve rates and include

consideration of counterparty credit risk. See Note 17 for disclosures related to derivative financial instruments.

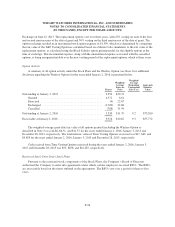

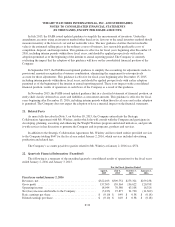

The following table presents the aggregate fair value of the Company’s derivative financial instruments:

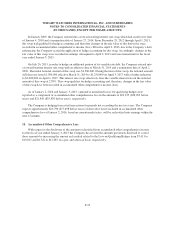

Fair Value Measurements Using:

Total

Fair

Value

Quoted Prices in

Active Markets

for Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Interest rate swap liability at January 2, 2016 ....... $44,170 $0 $44,170 $0

Interest rate swap liability at January 3, 2015 ....... $42,423 $0 $42,423 $0

The Company did not have any transfers into or out of Levels 1 and 2, and did not maintain any assets or

liabilities classified as Level 3, during the fiscal years ended January 2, 2016 and January 3, 2015.

17. Derivative Instruments and Hedging

As of January 2, 2016 and January 3, 2015, the Company had in effect an interest rate swap with a notional

amount totaling $1,500,000.

F-34