WeightWatchers 2015 Annual Report Download - page 90

Download and view the complete annual report

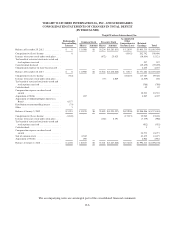

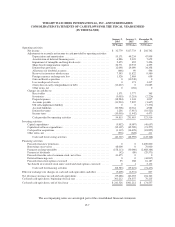

Please find page 90 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Purchased Shares prior to the third anniversary of the Agreement Date, up to 30% prior to the fourth anniversary

of the Agreement Date and up to 60% prior to the fifth anniversary of the Agreement Date. On or after the fifth

anniversary of the Agreement Date, Ms. Winfrey will be permitted to transfer all of the Purchased Shares. In the

event that Ms. Winfrey proposes to transfer any Purchased Shares or Winfrey Option Shares (defined below), the

Company will have (a) a right of first offer with respect to such shares if such transfer is (i) for 1% or more of the

Company’s issued and outstanding common stock that is proposed to be made pursuant to Rule 144 under the

Securities Act of 1933, as amended or (ii) proposed to be sold under a resale shelf registration statement or (b) a

right of first refusal with respect to such shares if such transfer is (i) for 1% or more of the Company’s issued and

outstanding common stock and is proposed to be made to a competitor of the Company or (ii) for 5% or more of

the Company’s issued and outstanding common stock. Such transfer restrictions, right of first offer and right of

first refusal terminate if Ms. Winfrey then has the right to be nominated as a director and has met certain

eligibility requirements under the Winfrey Purchase Agreement, but is not elected as a director of the Company.

If Ms. Winfrey is elected as a director of the Company, she shall receive compensation for her services as a

director consistent with that of other non-executive directors of the Company. Such transfer restrictions also

terminate if there is a change of control, including if another person (or group), other than Artal Luxembourg

S.A. and Ms. Winfrey and their respective affiliates, acquires more than 50% of the total voting power of the

Company.

Winfrey Option Agreement

In consideration of Ms. Winfrey entering into the Strategic Collaboration Agreement and the performance

of her obligations thereunder, on the Agreement Date, the Company granted Ms. Winfrey a fully vested option

(the “Winfrey Option”) to purchase 3,513 shares of common stock at an exercise price of $6.97 per share. The

term sheet, and related terms and conditions, for the Winfrey Option are referred to herein as the “Winfrey

Option Agreement”. Based on the Black Scholes option pricing method, the Company recorded $12,759 of

compensation expense in the fourth quarter of fiscal 2015 for the Winfrey Option. At the date of the grant, the

Company used a dividend yield of 0.0%, 63.88% volatility and a risk-free interest rate of 1.36%. Compensation

expense is included as a component of selling, general and administrative expenses.

Subject to certain limited exceptions, shares of common stock issuable upon exercise of the Winfrey Option

(the “Winfrey Option Shares”) generally may not be transferred by Ms. Winfrey within the first year of the

Agreement Date. Thereafter, Ms. Winfrey generally may transfer up to 20% of the Winfrey Option Shares prior

to the second anniversary of the Agreement Date, up to 40% prior to the third anniversary of the Agreement

Date, up to 60% prior to the fourth anniversary of the Agreement Date and up to 80% prior to the fifth

anniversary of the Agreement Date. On or after the fifth anniversary of the Agreement Date, Ms. Winfrey will be

permitted to transfer all of the Winfrey Option Shares. Pursuant to the Winfrey Purchase Agreement, in the event

that Ms. Winfrey proposes to transfer any Winfrey Option Shares, the Company will have a right of first offer or

a right of first refusal with respect to such shares as described above. Such transfer restrictions terminate under

the same director service and change of control circumstances that would result in the termination of the transfer

restrictions relating to the Purchased Shares as described above.

4. Acquisitions and Shutdown of China Operations

Acquisitions of Franchisees

The acquisitions of franchisees have been accounted for under the purchase method of accounting and,

accordingly, earnings of acquired franchisees have been included in the consolidated operating results of the

Company since the applicable date of acquisition. During fiscal 2013, the Company acquired certain assets of its

franchisees as outlined below.

F-15