WeightWatchers 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other Expense, Net

Other expense, net, which consists of the impact of foreign currency on intercompany transactions, increased by

$2.6 million in fiscal 2014 versus the prior year.

Tax

Our effective tax rate was 35.9% for fiscal 2014 as compared to 39.0% for fiscal 2013. The decrease was due

mainly to the net tax benefit associated with the closure of our China business that was recorded in fiscal 2014 and a

shift in the mix of our domestic and foreign earnings which resulted in lower state income taxes. These were offset by

the recognition of a valuation allowance that was recorded in fiscal 2014 related to tax benefits previously recorded for

foreign losses that are not expected to be realized.

Net Income Attributable to the Company and Earnings Per Share

Net income attributable to the Company in fiscal 2014 declined 41.9% versus fiscal 2013. Excluding the impact of

the 2014 restructuring charges, the gain on the Brazil acquisition, the net tax benefit offset by the recognition of a

valuation allowance, and the early extinguishment of debt charge, net income attributable to the Company in fiscal

2014 would have declined 46.2% versus the adjusted prior year. This decline in net income attributable to the

Company was primarily driven by the decrease in operating income in fiscal 2014 versus the prior year.

EPS in fiscal 2014 decreased to $2.08 versus fiscal 2013. Excluding the impact of the 2014 restructuring charges,

the gain on the Brazil acquisition, the net tax benefit offset by the recognition of a valuation allowance and the early

extinguishment of debt charge, EPS would have been $2.05 in fiscal 2014 as compared to $3.86 in the prior year.

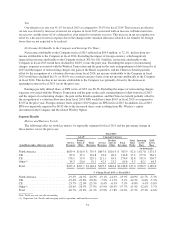

Segment Results

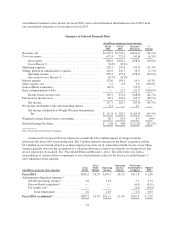

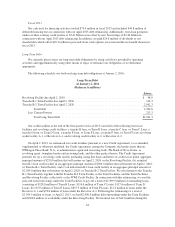

Metrics and Business Trends

The following tables set forth key metrics by reportable segment for fiscal 2014 and the percentage change in

those metrics versus the prior year:

Fiscal 2014

GAAP Constant Currency

(in millions unless otherwise stated)

Service

Revenues

Product

Sales &

Other

Total

Revenues

Service

Revenues

Product

Sales &

Other

Total

Revenues

Total

Paid

Weeks

Incoming

Active

Base

EOP

Active

Base

(in thousands)

North America .................. $ 794.4 $153.3 $ 947.7 $ 799.6 $153.8 $ 953.4 117.1 2,066.1 1,617.8

UK............................ 108.6 48.2 156.8 102.7 45.6 148.3 20.2 297.4 277.8

CE ............................ 230.9 68.0 298.9 230.5 67.6 298.1 35.6 528.4 551.9

Other(1) ........................ 48.0 28.4 76.5 50.6 29.4 79.9 4.9 71.1 62.1

Total .......................... $1,181.9 $298.0 $1,479.9 $1,183.4 $296.2 $1,479.6 177.8 2,962.9 2,509.5

% Change Fiscal 2014 vs. Fiscal 2013

North America ................... -18.0% -21.9% -18.6% -17.4% -21.6% -18.1% -16.8% -12.3% -21.7%

UK ............................ -5.5% -16.6% -9.2% -10.6% -21.2% -14.1% -9.2% -14.3% -6.6%

CE ............................ 1.2% -4.6% -0.2% 1.0% -5.2% -0.4% 3.1% 14.6% 4.4%

Other(1) ......................... -2.8% -25.1% -12.5% 2.4% -22.8% -8.5% -2.2% -7.1% -12.6%

Total ........................... -13.1% -18.0% -14.2% -13.0% -18.5% -14.2% -12.2% -8.6% -15.3%

Note: Totals may not sum due to rounding

(1) Represents Asia Pacific and emerging markets operations and franchise revenues.

57