WeightWatchers 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

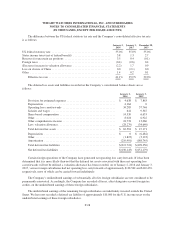

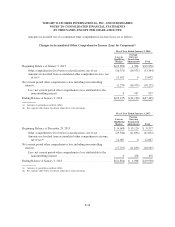

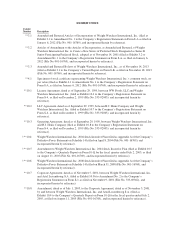

For the fiscal year ended January 2, 2016, the reconciliation of the liability balance for these restructuring

charges was as follows:

Balance as of January 3, 2015 .......................................... $2,570

Provision .......................................................... 8,412

Payments .......................................................... (9,173)

Balance as of January 2, 2016 .......................................... $1,809

The Company expects the $1,809 liability as of January 2, 2016 to be paid in fiscal 2016.

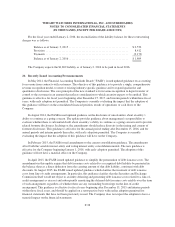

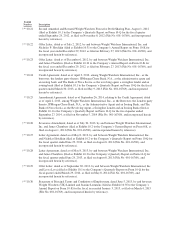

20. Recently Issued Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued updated guidance on accounting

for revenue from contracts with customers. The objective of this guidance is to provide a single, comprehensive

revenue recognition model, to remove existing industry specific guidance and to expand qualitative and

quantitative disclosures. The core principle of the new standard is for revenue recognition to depict transfer of

control to the customer in an amount that reflects consideration to which an entity expects to be entitled. This

guidance is effective for fiscal years beginning after December 15, 2017, and interim periods within those fiscal

years, with early adoption not permitted. The Company is currently evaluating the impact that the adoption of

this guidance will have on the consolidated financial position, results of operations or cash flows of the

Company.

In August 2014, the FASB issued updated guidance on the disclosure of uncertainties about an entity’s

ability to continue as a going concern. The update provides guidance about management’s responsibility to

evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to provide

related footnote disclosures. In doing so, the amendments should reduce diversity in the timing and content of

footnote disclosures. This guidance is effective for the annual period ending after December 15, 2016, and for

annual periods and interim periods thereafter, with early adoption permitted. The Company is currently

evaluating the impact that the adoption of this guidance will have on the Company.

In February 2015, the FASB issued amendments to the current consolidation guidance. The amendments

affect both the variable interest entity and voting interest entity consolidation models. The new guidance is

effective for the Company beginning January 1, 2016, with early adoption permitted. The adoption of this

guidance will not have a material effect on the Company.

In April 2015, the FASB issued updated guidance to simplify the presentation of debt issuance costs. The

amendments in this update require that debt issuance costs related to a recognized debt liability be presented in

the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt

discounts. In August 2015, the FASB issued updated guidance which clarifies the treatment of debt issuance

costs from line-of-credit arrangements. In particular, this guidance clarifies that the Securities and Exchange

Commission Staff would not object to an entity deferring and presenting debt issuance costs related to a line-of-

credit arrangement as an asset and subsequently amortizing the deferred debt issuance costs ratably over the term

of such arrangement, regardless of whether there are any outstanding borrowings on the line-of-credit

arrangement. This guidance is effective for fiscal years beginning after December 15, 2015 and interim periods

within those fiscal years, and should be applied on a retrospective basis with earlier adoption permitted for

financial statements that have not been previously issued. The Company does not expect the adoption to have a

material impact on the financial statements.

F-38