WeightWatchers 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

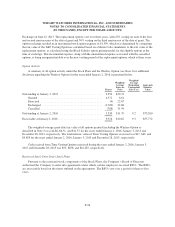

The equity interest held immediately before the acquisition was $12. An implied fair value technique was

used to measure acquisition date fair value of the equity interest to be $11,029. As a result of this transaction, the

Company adjusted its previously held equity interest to fair value of $11,017 and recorded a charge of

$477 associated with the settlement of the royalty-free arrangement of the Brazilian partnership. The net effect of

these items resulted in the Company recognizing a gain of $10,540 ($6,429 after tax or $0.11 per fully diluted

share) in the first quarter of fiscal 2014.

The fair value of the redeemable noncontrolling interest has been valued at $6,157. In connection with the

acquisition, a call option and a put option were granted related to the 20% interest in VPM not owned by the

Company.

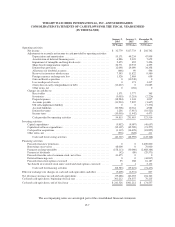

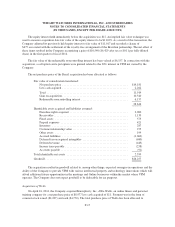

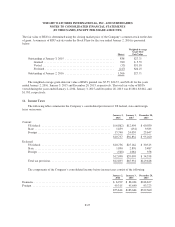

The net purchase price of the Brazil acquisition has been allocated as follows:

Fair value of consideration transferred:

Net purchase price .............................................. $14,181

Less cash acquired .............................................. 2,262

Total ......................................................... 11,919

Gain on acquisition .............................................. 10,540

Redeemable noncontrolling interest ................................. 6,157

28,616

Identifiable assets acquired and liabilities assumed:

Franchise rights acquired ......................................... 2,000

Receivables .................................................... 1,139

Fixed assets ................................................... 575

Prepaid expenses ............................................... 421

Inventory ..................................................... 287

Customer relationship value ....................................... 275

Other assets ................................................... 199

Accrued liabilities .............................................. (1,063)

Deferred tax on acquired intangibles ................................ (680)

Deferred revenue ............................................... (445)

Income taxes payable ............................................ (258)

Accounts payable ............................................... (91)

Total identifiable net assets ........................................... 2,359

Goodwill .......................................................... $26,257

The acquisition resulted in goodwill related to, among other things, expected synergies in operations and the

ability of the Company to provide VPM with various intellectual property and technology innovations which will

afford additional future opportunities in the meetings and Online businesses within the market where VPM

operates. The Company does not expect goodwill to be deductible for tax purposes.

Acquisition of Wello

On April 16, 2014, the Company acquired Knowplicity, Inc., d/b/a Wello, an online fitness and personal

training company for a net purchase price of $8,977 less cash acquired of $11. Payment was in the form of

common stock issued ($4,207) and cash ($4,770). The total purchase price of Wello has been allocated to

F-17