WeightWatchers 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of $241.5 million at the end of fiscal 2015 will provide us with sufficient liquidity to meet our obligations for the

next twelve months, including our April 2016 debt maturity obligation of $144.3 million. Our cash on hand of

$241.5 million at the end of fiscal 2015 includes the $43.2 million cash payment we received on October 19,

2015 in connection with the Winfrey Transaction and the $48.0 million of proceeds from our revolver borrowing

under the Revolving Facility. The revolver borrowing is classified as a short-term liability in consideration of the

fact that the terms of the Revolving Facility require an assessment as to whether there have been any material

adverse changes with respect to the Company in connection with our monthly interest elections. Although the

revolver borrowing is classified as a short-term liability, absent any change in fact and circumstance, we have the

ability to extend and not repay the Revolving Facility until its due date of April 2, 2018.

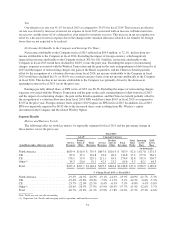

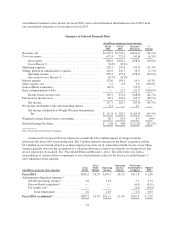

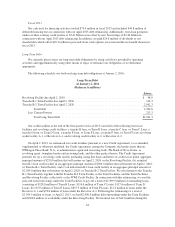

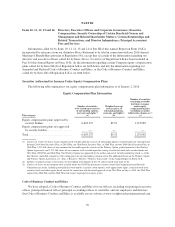

Balance Sheet Working Capital

The following table sets forth certain relevant measures of our balance sheet working capital at:

January 2,

2016

January 3,

2015

Increase/

(Decrease)

(in millions)

Total current assets ................................... $359.0 $ 425.7 $ (66.7)

Total current liabilities ................................. 503.1 431.7 71.4

Working capital deficit ................................ (144.2) (6.0) (138.1)

Cash and cash equivalents .............................. 241.5 301.2 (59.7)

Current portion of long-term debt ........................ 213.3 80.7 132.6

Working capital deficit, excluding change in cash and cash

equivalents and current portion of long-term debt .......... $(172.4) $(226.5) $ 54.1

We generally operate with negative working capital that is driven in part by our commitment and

subscription plans which are our primary payment method. These plans require members and subscribers to pay

us for meetings and Online subscription products, respectively, as applicable, before we pay for our obligations

in the normal course of business. These prepayments are recorded as a current liability on our balance sheet

which has resulted in, and in certain circumstances has helped drive, negative working capital. This core

characteristic of our business model is expected to continue. However, during a period in which revenue is

declining, we get less working capital benefit from this deferred revenue.

Including changes in cash and cash equivalents and the current portion of long-term debt, our working

capital deficit increased by $138.1 million to $144.2 million at January 2, 2016 from $6.0 million at January 3,

2015. This increase in our working capital deficit was driven in large part by the principal debt maturity payment

of $144.3 million due on April 2, 2016, reflected in current portion of long-term debt as of January 2, 2016

(included in long-term as of January 3, 2015), and to a lesser extent the decline in year-end cash in fiscal 2015

from fiscal 2014 of $59.7 million. Prepayments of debt during fiscal 2015 as detailed in the following paragraph

totaled $150.5 million, which more than offset cash provided by operating activities, the $43.2 million cash

payment we received in connection with the Winfrey Transaction and the $48.0 million of proceeds from our

revolver borrowing under our Revolving Facility.

On March 25, 2015, we paid an aggregate amount of cash proceeds totaling $57.4 million plus an amount

sufficient to pay accrued and unpaid interest on the amount prepaid to prepay $63.1 million in aggregate

principal amount of term loans under the Tranche B-1 Term Facility. In addition, we made a voluntary

prepayment at par of $2.5 million in respect of such term loans under the Tranche B-1 Term Facility to reduce

our then remaining excess cash flow prepayment obligation. For a discussion of this obligation, see “—Long-

Term Debt”. On June 26, 2015, we paid an aggregate amount of cash proceeds totaling $77.2 million plus an

amount sufficient to pay accrued and unpaid interest on the amount prepaid to prepay $84.9 million in aggregate

principal amount of term loans under the Tranche B-1 Term Facility. After making these prepayments and

scheduled debt repayments of $21.0 million in fiscal 2015, the current portion of our long-term debt increased to

$213.3 million versus the end of fiscal 2014.

60