WeightWatchers 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

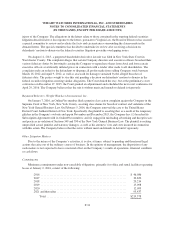

Option Awards with Time and Performance Vesting Criteria

Pursuant to the option components of the Stock Plans, the Company’s Board of Directors authorized the

Company to enter into agreements under which certain employees received stock options with both time and

performance vesting criteria (“T&P Vesting Options”). As of the end of fiscal 2015, there were no

outstanding T&P Vesting Options. The options were exercisable based on the terms outlined in the

agreements. During fiscal 2015, fiscal 2014 and fiscal 2013, the Company granted 37, 1,601 and 687 T&P

Vesting Options, respectively, to certain employees that would have vested based on the achievement of

both time and performance vesting criteria. The time-vesting criteria would have been 100% satisfied on the

third anniversary of the date of the grant and the performance criteria was contingent upon meeting or

exceeding certain stock price hurdles. With respect to the performance-vesting criteria, the stock options

would have fully vested in 20% increments upon the first date that the average closing stock price for the 20

consecutive preceding trading days was equal to or greater than specified stock price hurdles. The fair value

of the T&P Vesting Options was estimated on the date of grant and was based on the likelihood of the

Company achieving the performance conditions. The Company estimated the fair value using a Monte Carlo

simulation that used various assumptions that included expected volatility, a risk free rate and an expected

term.

Expected volatility was based on the historical volatility of the Company’s stock. The risk-free interest rate

was based on the U.S. Treasury yield curve in effect on the date of grant which most closely corresponds to the

performance measurement period. The expected term represents the period from the grant date to the end of the

five year performance period. Compensation expense on T&P Vesting Options is recognized ratably over the

three year required service period as this period is longer than the derived service period calculated by the Monte

Carlo simulation.

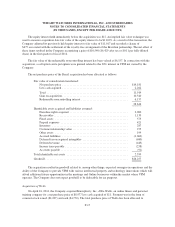

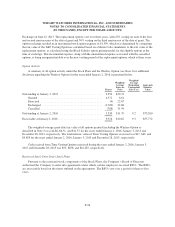

January 2,

2016

January 3,

2015

December 28,

2013

Dividend yield ................................... 0.0% 0.0% 0.0%

Volatility ....................................... 40.5% 37.8% 36.5%

Risk-free interest rate .............................. 1.6% 1.4% - 1.8% 2%

Expected term (years) ............................. 5.0 5.0 5.0

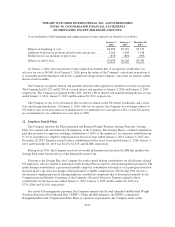

On May 7, 2015, the Company’s shareholders approved an amendment to the 2014 Plan to permit a

one-time stock option exchange program under which the Company would offer eligible employees the

opportunity to exchange certain eligible T&P Vesting Options on a (a) two-for-one basis for new stock

options for all eligible employees, other than the Company’s Chief Executive Officer (i.e., so that the new

stock options would cover half as many shares as the corresponding surrendered options) and (b) 3.5-for-one

basis for new stock options for the Company’s Chief Executive Officer (i.e., so that the new stock options

would cover a number of shares equal to the quotient of the number of shares covered by the corresponding

surrendered options divided by 3.5). The option exchange program was designed to create better incentives

for employees to remain with the Company and contribute to the attainment of its business and financial

objectives.

On May 22, 2015, the Company launched a tender offer in connection with the option exchange program

which expired on June 22, 2015. Pursuant to the offer, employees tendered options to purchase 1,700 shares of

common stock (representing 99.6% of the total shares of common stock underlying the options eligible for

exchange) with a weighted-average exercise price of $24.68 per share. The Company cancelled and replaced

those options on June 22, 2015 with options to purchase 734 shares of common stock with an exercise price of

$5.25 per share, which was the closing price per share of the Company’s common stock on the New York Stock

F-25