WeightWatchers 2015 Annual Report Download - page 91

Download and view the complete annual report

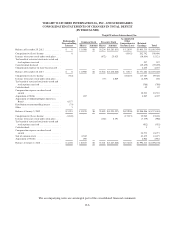

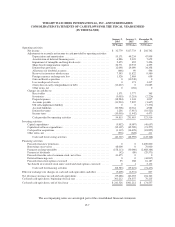

Please find page 91 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

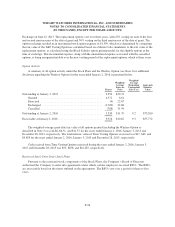

On March 4, 2013, the Company acquired substantially all of the assets of its Alberta and Saskatchewan,

Canada franchisees, Weight Watchers of Alberta Ltd. and Weight Watchers of Saskatchewan Ltd., for an

aggregate purchase price of $35,000. The total purchase price has been allocated to franchise rights acquired

($1,135), goodwill ($34,124), customer relationship value ($473), inventory ($218), fixed assets ($182) and

prepaid expenses ($3) offset by deferred revenue of $1,135. The franchise rights acquired were amortized over a

ten month useful life.

On July 15, 2013, the Company acquired substantially all of the assets of its West Virginia franchisee,

Weight Watchers of West Virginia, Inc., for a net purchase price of $16,028 less assumed assets, plus assumed

liabilities, net of $28. The total purchase price has been allocated to franchise rights acquired ($10,131), goodwill

($5,212), customer relationship value ($448) and fixed assets ($209).

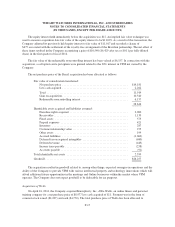

On July 22, 2013, the Company acquired substantially all of the assets of its Columbus, Ohio franchisee,

Weight Watchers of Columbus, Inc., for a net purchase price of $23,357 plus assumed liabilities of $143 and its

Reno, Nevada franchisee, Weight Watchers of Northern Nevada, Inc., for a net purchase price of $3,969 plus

assumed liabilities of $31. The aggregate total purchase price has been allocated to franchise rights acquired

($3,314), goodwill ($23,549), customer relationship value ($494), fixed assets ($116) and inventory ($27). The

franchise rights acquired for the Columbus, Ohio franchise purchase were amortized over a five month useful

life.

On October 28, 2013, the Company acquired substantially all of the assets of its Manitoba, Canada

franchisee, Weight Watchers of Manitoba Ltd., for a net purchase price of $5,197 plus assumed liabilities of

$28 and its Franklin and St. Lawrence Counties, New York franchisee, Weight Watchers of Franklin and St.

Lawrence Counties Inc., for a net purchase price of $274 plus assumed liabilities of $1. The total purchase price

of the Manitoba, Canada franchisee has been allocated to franchise rights acquired ($28), goodwill ($4,946),

customer relationship value ($249), inventory ($1) and prepaid expenses ($1). The franchise rights acquired were

amortized over a two month useful life. The total purchase price of the Franklin and St. Lawrence Counties,

New York franchisee has been allocated to franchise rights acquired ($38), goodwill ($223), customer

relationship value ($13) and prepaid expenses ($1). The franchise rights acquired were amortized over a nine

month useful life.

The weighted-average amortization period of the customer relationships acquired in the above acquisitions

was approximately 15 weeks. Due to the short-term nature of this asset, its estimated fair value has been recorded

as a component of prepaid expenses and other current assets. The acquisitions resulted in goodwill related to,

among other things, expected synergies in operations. The goodwill recorded in connection with these

acquisitions represents the intangible assets that did not qualify for separate recognition in the financial

statements. The Company expects that substantially all of the goodwill recorded in connection with the above

acquisitions will be deductible for tax purposes. The effect of these franchise acquisitions was not material to the

Company’s consolidated financial position, results of operations, or operating cash flows in the periods

presented.

Acquisition of Additional Equity Interest in Brazil

Prior to March 12, 2014, the Company had owned 35% of VPM, a Brazilian limited liability partnership. On

March 12, 2014, the Company acquired an additional 45% equity interest in VPM for a net purchase price of

$14,181 less cash acquired of $2,262. VPM was converted into a joint-stock corporation prior to closing and

subsequently operates as a subsidiary of the Company with rights to conduct typical business lines. As a result of

the acquisition, the Company gained a direct controlling financial interest in VPM and began to consolidate this

entity as of the date of acquisition.

F-16