WeightWatchers 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

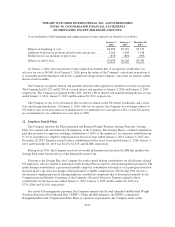

Company commenced an offer to prepay at a discount to par up to $75,000 in aggregate principal amount of term

loans outstanding under the Tranche B-1 Term Facility. On March 20, 2015, the Company accepted offers with a

discount equal to or greater than 9.00% in respect of such term loans. On March 25, 2015, the Company paid an

aggregate amount of cash proceeds totaling $57,389 plus an amount sufficient to pay accrued and unpaid interest

on the amount prepaid to prepay $63,065 in aggregate principal amount of such term loans under the

Tranche B-1 Term Facility. This expenditure reduced, on a dollar for dollar basis, the Company’s

$59,728 obligation to make a mandatory excess cash flow prepayment offer to the term loan lenders under the

terms of the Credit Agreement. In addition, the Company made a voluntary prepayment at par on March 25, 2015

of $2,500 in respect of such term loans under the Tranche B-1 Term Facility to reduce the remaining excess cash

flow prepayment obligation for fiscal 2014. As a result of this prepayment, the Company wrote-off fees of

$326, incurred fees of $601 and recorded a gain on early extinguishment of debt of $4,749, inclusive of these

fees, in the first quarter of fiscal 2015.

On June 17, 2015, the Company commenced another offer to prepay at a discount to par up to $229,000 in

aggregate principal amount of term loans outstanding under the Tranche B-1 Term Facility. On June 22, 2015,

the Company accepted offers with a discount equal to or greater than 9.00% in respect of such term loans. On

June 26, 2015, the Company paid an aggregate amount of cash proceeds totaling $77,225 plus an amount

sufficient to pay accrued and unpaid interest on the amount prepaid to prepay $84,862 in aggregate principal

amount of such term loans under the Tranche B-1 Term Facility. As a result of this prepayment, the Company

wrote-off fees of $321, incurred fees of $641 and recorded a gain on early extinguishment of debt of $6,677,

inclusive of these fees, in the second quarter of fiscal 2015.

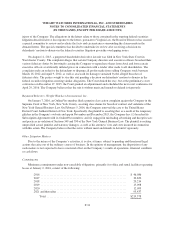

On July 14, 2015, the Company drew down the $48,000 available on its Revolving Facility in order to

enhance its cash position and to provide additional financial flexibility. The revolver borrowing has been

classified as a short-term liability in consideration of the fact that the terms of the Revolving Facility require an

assessment as to whether there have been any material adverse changes with respect to the Company in

connection with the Company’s monthly interest elections. Although the revolver borrowing has been classified

as a short-term liability, absent any change in fact and circumstance, the Company has the ability to extend and

not repay the Revolving Facility until its due date of April 2, 2018. At January 2, 2016, under the WWI Credit

Facility, the Company had $2,186,573 outstanding consisting entirely of term loans, and borrowings of $48,000

outstanding under the Revolving Facility. In addition, at January 2, 2016, the Revolving Facility had $1,819 in

issued but undrawn letters of credit outstanding thereunder and $181 in available unused commitments

thereunder. The proceeds from borrowings under the Revolving Facility (including swing line loans and letters of

credit) are available to be used for working capital and general corporate purposes.

Borrowings under the Credit Agreement bear interest at a rate equal to, at the Company’s option, LIBOR

plus an applicable margin or a base rate plus an applicable margin. LIBOR under the Tranche B-2 Term Facility

is subject to a minimum interest rate of 0.75% and the base rate under the Tranche B-2 Term Facility is subject to

a minimum interest rate of 1.75%. Under the terms of the Credit Agreement, in the event the Company receives a

corporate rating of BB- (or lower) from S&P and a corporate rating of Ba3 (or lower) from Moody’s, the

applicable margin relating to both of the Term Facilities would increase by 25 basis points. On February 21,

2014, both S&P and Moody’s issued revised corporate ratings of the Company of B+ and B1, respectively. As a

result, effective February 21, 2014, the applicable margin on borrowings under the Tranche B-1 Term Facility

went from 2.75% to 3.00% and on borrowings under the Tranche B-2 Term Facility went from 3.00% to 3.25%.

The applicable margin relating to the Revolving Facility will fluctuate depending upon the Company’s

Consolidated Leverage Ratio. At January 2, 2016, borrowings under the Tranche B-1 Term Facility bore interest

at LIBOR plus an applicable margin of 3.00% and borrowings under the Tranche B-2 Term Facility bore interest

at LIBOR plus an applicable margin of 3.25%. Based on the Company’s Consolidated Leverage Ratio as of

F-21