WeightWatchers 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

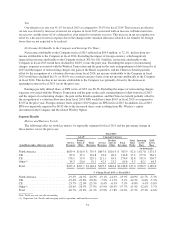

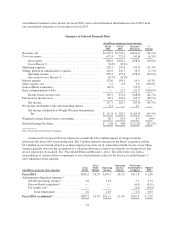

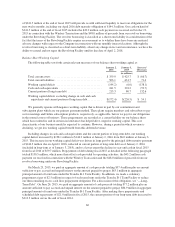

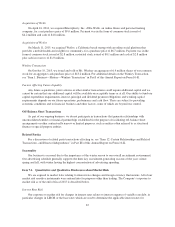

Fiscal 2014

Meeting Fees Meeting

Paid

Weeks

Incoming

Active

Meeting

Subscribers

EOP Active

Meeting

Subscribers

Online

Subscription

Revenues Online

Paid

Weeks

Incoming

Active

Online

Subscribers

EOP

Active

Online

Subscribers(in millions unless otherwise stated) GAAP

Constant

Currency GAAP

Constant

Currency

(in thousands) (in thousands)

North America .............$496.2 $499.3 50.3 833.2 692.6 $298.2 $300.3 66.8 1,232.9 925.2

UK ...................... 80.8 76.4 12.4 166.0 158.1 27.9 26.4 7.9 131.4 119.7

CE ...................... 133.4 133.0 12.8 183.6 178.2 97.4 97.5 22.8 344.8 373.6

Other(1) ................... 34.1 35.6 2.7 33.9 26.4 13.9 15.0 2.1 37.1 35.6

Total .....................$744.6 $744.3 78.2 1,216.7 1,055.4 $437.4 $439.1 99.6 1,746.2 1,454.1

% Change Fiscal 2014 vs. Fiscal 2013

North America ............ -16.6% -16.1% -15.8% -11.7% -16.9% -20.1% -19.6% -17.5% -12.6% -25.0%

UK ..................... -5.2% -10.4% -9.6% -18.7% -4.7% -6.2% -11.3% -8.6% -8.0% -8.9%

CE ..................... -2.8% -3.1% -2.5% -0.9% -2.9% 7.3% 7.4% 6.5% 25.0% 8.4%

Other(1) .................. 0.3% 4.8% 6.2% -3.4% -22.0% -9.6% -2.9% -11.0% -10.2% -4.1%

Total .................... -12.6% -12.6% -12.3% -11.1% -13.3% -14.1% -13.8% -12.2% -6.7% -16.7%

Note: Totals may not sum due to rounding

(1) Represents Asia Pacific and emerging markets operations and franchise revenues.

North America Performance

North America continued to face strong competition for consumer trial from an evolving competitor set, including

mobile apps and activity monitors, during fiscal 2014. The Company believes this competition drove declines in all

revenue categories in North America in fiscal 2014 versus the prior year. The decline in North America Total Paid

Weeks primarily resulted from the lower Incoming Active Base at the beginning of fiscal 2014 versus the beginning of

fiscal 2013 as well as from lower recruitments in fiscal 2014 versus the prior year. In response to weakening

recruitment trends in early fiscal 2014, North America introduced new advertising and implemented new promotional

tactics. In addition, the United States launched its 2014 winter season brand campaign one month early.

The decline in North America product sales and other was driven primarily by a decline in in-meeting product

sales and to a lesser extent a decline in licensing revenue. In fiscal 2014, in-meeting product sales of $85.2 million

decreased by $33.9 million, or 28.5%, versus the prior year. This decrease resulted primarily from a 15.3% attendance

decline in fiscal 2014 as compared to the prior year. In-meeting product sales per attendee decreased by 15.5% in fiscal

2014 versus the prior year, driven primarily by a decline in sales of enrollment products. Licensing revenue of $37.2

million declined $1.4 million, or 3.7%, from $38.6 million in the prior year.

United Kingdom Performance

The decline in UK revenues in fiscal 2014 versus the prior year was driven primarily by the decline in product

sales and to a lesser extent a decline in Service Revenues. The decline in UK Total Paid Weeks was driven by the

lower Incoming Active Base at the beginning of fiscal 2014 versus the beginning of fiscal 2013 coupled with lower

recruitments in fiscal 2014 as compared to the prior year. In response to weakening recruitment trends, primarily in the

meetings business, early in fiscal 2014, the United Kingdom introduced new advertising, implemented new

promotional tactics and invested in a local marketing campaign to combat a strong local competitor. As a result of

these initiatives, although still negative in fiscal 2014, the United Kingdom experienced an improvement in its

recruitment trend in the second half of fiscal 2014 as compared to the prior year period.

The decline in UK product sales and other in fiscal 2014 versus the prior year was driven primarily by a decline in

in-meeting product sales and to a lesser extent a decline in licensing revenue. In fiscal 2014, in-meeting product sales

58