WeightWatchers 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

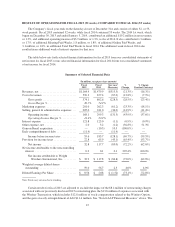

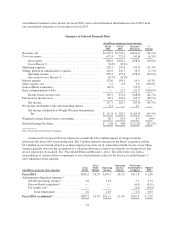

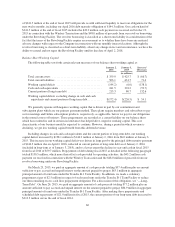

Note: Totals may not sum due to rounding

(1) As adjusted” is a non-GAAP financial measure that adjusts the consolidated statements of net income for fiscal 2014 to exclude the

impact of the $11.8 million ($7.2 million after tax) of restructuring charges associated with our previously disclosed 2014 restructuring

plan, the impact of the gain of $10.5 million ($6.4 million after tax) recognized in connection with our previously disclosed Brazil

acquisition due to an adjustment to our previously held equity interest to fair value offset by a charge associated with the settlement of

the royalty-free arrangement of the Brazilian partnership and the impact of the $2.4 million net tax benefit associated with an

intercompany loan write-off in connection with the closure of our China business partially offset by the recognition of a valuation

allowance related to tax benefits for foreign losses that are not expected to be realized. See “Non-GAAP Financials Measures” above for

an explanation of our use of non-GAAP financial measures.

Certain results for fiscal 2013 are adjusted to exclude the impact of the $21.7 million early extinguishment

of debt charge. See “Non-GAAP Financial Measures” above. The table below sets forth a reconciliation of those

components of our selected financial data for the fiscal year ended December 28, 2013 which have been adjusted.

(in millions, except per share amounts)

Income

Before

Taxes

Net Income

Attributable

to Company

Diluted

EPS

Fiscal 2013 ........................................................ $332.4 $202.7 $3.60

Adjustments to Reported Amounts(1)

Early extinguishment of debt(1) ..................................... 21.7 13.3 0.3

Total Adjustments ........................................... 21.7 13.3 0.3

Fiscal 2013, as adjusted(1) ............................................ $354.0 $216.0 $ 3.9

Note: Totals may not sum due to rounding

(1) “As adjusted” is a non-GAAP financial measure that adjusts the consolidated statements of net income for fiscal 2013 to exclude the

impact of the $21.7 million ($13.3 million after tax) early extinguishment of debt charge associated with our previously reported debt

refinancing. See “Non-GAAP Financials Measures” above for an explanation of our use of non-GAAP financial measures.

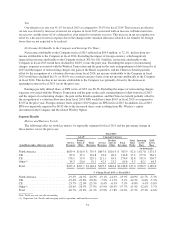

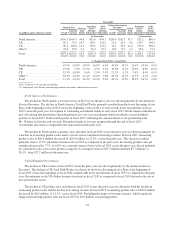

Consolidated Results

Revenues

Revenues in fiscal 2014 declined by 14.2% versus fiscal 2013 driven by revenue declines in the meetings

and Online businesses globally, most notably in North America. See “—Segment Results” for additional details

on revenues.

Cost of Revenues and Gross Profit

Total cost of revenues in fiscal 2014 declined $45.6 million, or 6.3%, versus the prior year. Excluding the

impact of the 2014 restructuring charges, total cost of revenues in fiscal 2014 would have declined $50.3 million,

or 7.0%, versus the prior year. Excluding the impact of the 2014 restructuring charges, gross profit for fiscal

2014 would have decreased by $193.9 million, or 19.4%, from fiscal 2013. Excluding the impact of the 2014

restructuring charges, gross margin in fiscal 2014 would have been 54.5%, as compared to gross margin of

58.1% in fiscal 2013. Gross margin compression was driven primarily by the decline in the North America gross

margin, which was partially offset by an increase in gross margin in Continental Europe. The decline in

North America gross margin was driven primarily by fixed cost deleverage and the impact of service provider

compensation changes and training and technology in support of the Personal Coaching offering, 24/7 Expert

Chat and healthcare initiatives.

Marketing

Marketing expenses for fiscal 2014 decreased $33.3 million, or 11.3%, versus fiscal 2013. The decline was

primarily driven by lower TV media and production costs resulting from the integration of TV spots for both our

meetings and Online businesses. The decline was also driven by lower and more efficient digital marketing spend

55