WeightWatchers 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

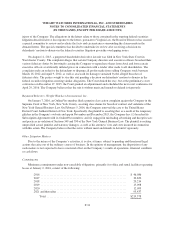

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

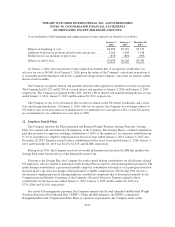

Exchange on June 22, 2015. The replacement options vest over three years, with 25% vesting on each of the first

and second anniversaries of the date of grant and 50% vesting on the third anniversary of the date of grant. The

option exchange resulted in an incremental stock option expense of $1,599, which was determined by comparing

the fair value of the T&P Vesting Option as calculated based on a Monte Carlo simulation, to the fair value of the

replacement options, as calculated using the Black-Scholes option pricing model, for the eligible options at the

time of exchange. This incremental expense, along with the unamortized expense associated with the cancelled

options, is being recognized ratably over the new vesting period of the replacement options, which is three years.

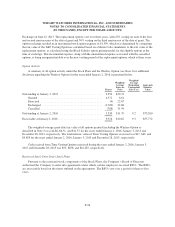

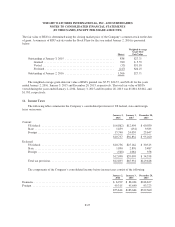

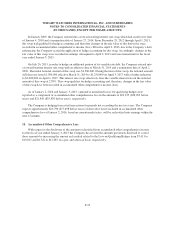

Option Activity

A summary of all option activity under the Stock Plans and the Winfrey Option (see Note 3 for additional

disclosure regarding the Winfrey Option) for the year ended January 2, 2016 is presented below:

Shares

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Life (Yrs.)

Aggregate

Intrinsic

Value

Outstanding at January 3, 2015 .............................. 3,250 $30.72

Granted ............................................. 4,572 6.61

Exercised ........................................... (4) 22.67

Exchanged .......................................... (1,700) 24.68

Cancelled ........................................... (788) 31.94

Outstanding at January 2, 2016 .............................. 5,330 $11.79 9.2 $73,260

Exercisable at January 2, 2016 ............................... 3,916 $10.62 9.3 $55,772

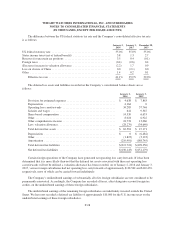

The weighted-average grant-date fair value of all options granted (including the Winfrey Option as

described in Note 3) was $4.86, $6.51, and $11.37 for the years ended January 2, 2016, January 3, 2015 and

December 28, 2013, respectively. The total intrinsic value of Time Vesting Options exercised was $17, $62, and

$9,858 for the years ended January 2, 2016, January 3, 2015 and December 28, 2013, respectively.

Cash received from Time Vesting Options exercised during the years ended January 2, 2016, January 3,

2015 and December 28, 2013 was $95, $658, and $16,187, respectively.

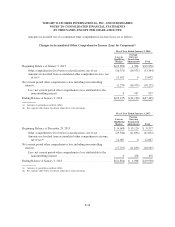

Restricted Stock Units Under Stock Plans

Pursuant to the restricted stock components of the Stock Plans, the Company’s Board of Directors

authorized the Company to enter into agreements under which certain employees received RSUs. The RSUs

are exercisable based on the terms outlined in the agreements. The RSUs vest over a period of three to five

years.

F-26