WeightWatchers 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

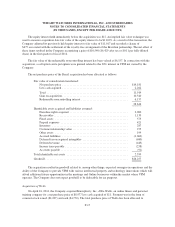

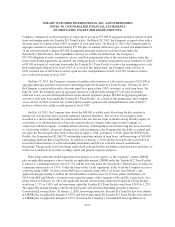

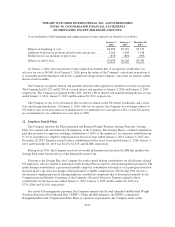

The carrying values of finite-lived intangible assets as of January 2, 2016 and January 3, 2015 were as

follows:

January 2, 2016 January 3, 2015

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Capitalized software costs ............................ $119,658 86,134 $107,581 $ 72,590

Website development costs ........................... 100,105 68,673 95,717 63,405

Trademarks ........................................ 10,960 10,435 10,836 10,213

Other ............................................. 7,976 7,118 7,014 6,825

Trademarks and other intangible assets .............. $238,699 $172,360 $221,148 $153,033

Franchise rights acquired ............................. 4,182 4,059 4,735 3,690

Total finite-lived intangible assets .................. $242,881 $176,419 $225,883 $156,723

Aggregate amortization expense for finite-lived intangible assets was recorded in the amounts of $34,719,

$29,372, and $27,567, for the fiscal years ended January 2, 2016, January 3, 2015 and December 28, 2013,

respectively. The franchise rights acquired related to the VPM acquisition are being amortized ratably over a 2

year period.

Estimated amortization expense of existing finite-lived intangible assets for the next five fiscal years and

thereafter is as follows:

2016 ............................................................. $32,094

2017 ............................................................. $24,726

2018 ............................................................. $ 8,451

2019 ............................................................. $ 1,125

2020 and thereafter .................................................. $ 66

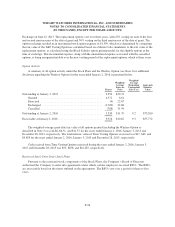

6. Property and Equipment

The components of property and equipment were:

January 2,

2016

January 3,

2015

Equipment .................................................... $122,789 $ 124,788

Leasehold improvements ........................................ 79,115 79,496

201,904 204,284

Less: Accumulated depreciation and amortization ..................... (143,718) (129,634)

$ 58,186 $ 74,650

Depreciation and amortization expense of property and equipment for the fiscal years ended January 2,

2016, January 3, 2015 and December 28, 2013 was $18,452, $20,635, and $20,342, respectively.

F-19