WeightWatchers 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART III

Items 10, 11, 12, 13 and 14. Directors, Executive Officers and Corporate Governance; Executive

Compensation; Security Ownership of Certain Beneficial Owners and

Management and Related Shareholder Matters; Certain Relationships and

Related Transactions, and Director Independence; Principal Accountant

Fees and Services

Information called for by Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K is

incorporated by reference from our definitive Proxy Statement to be filed in connection with our 2016 Annual

Meeting of Shareholders pursuant to Regulation 14A, except that (i) certain of the information regarding our

directors and executive officers called for by Items 401(a), (b) and (e) of Regulation S-K has been included in

Part I of this Annual Report on Form 10-K; (ii) the information regarding certain Company equity compensation

plans called for by Item 201(d) of Regulation S-K is set forth below and (iii) the information regarding our

Amended and Restated Code of Business Conduct and Ethics, or the Code of Business Conduct and Ethics,

called for by Item 406 of Regulation S-K is set forth below.

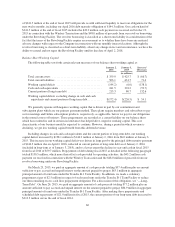

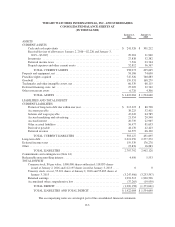

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes our equity compensation plan information as of January 2, 2016:

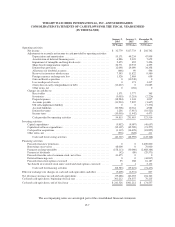

Equity Compensation Plan Information

Plan category

Number of securities

to be issued upon exercise

of outstanding options,

warrants and rights(1)

(a)

Weighted-average

exercise price of

outstanding options,

warrants and rights(2)

(b)

Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column (a))(3)

(c)

Equity compensation plans approved by

security holders ................... 6,603,327 $9.52 1,133,985

Equity compensation plans not approved

by security holders ................. — — —

Total .............................. 6,603,327 $9.52 1,133,985

(1) Consists of 1,816,513 shares of our common stock issuable upon the exercise of outstanding options awarded under our Amended and

Restated 2014 Stock Incentive Plan, or 2014 Plan, our 2008 Stock Incentive Plan, or 2008 Plan, and our 2004 Stock Incentive Plan, or

2004 Plan; 3,513,468 shares of our common stock issuable upon the exercise of the Winfrey Option granted pursuant to the Winfrey

Option Agreement; and 1,273,346 shares of our common stock issuable upon the vesting of restricted stock units awarded under our

2014 Plan, 2008 Plan and 2004 Plan. The Winfrey Option was approved by the written consent of Artal Luxembourg which, as of the

date thereof, controlled a majority of the voting power of our outstanding common stock. For additional details on the Winfrey Option

and Winfrey Option Agreement, see “Item 1. Business—History—Winfrey Transaction” of this Annual Report on Form 10-K.

(2) Includes weighted average exercise price of outstanding stock options of $11.79 and restricted stock units of $0.

(3) Consists of shares of our common stock issuable under our 2014 Plan pursuant to various awards the Compensation and Benefits

Committee may make, including non-qualified stock options, incentive stock options, stock appreciation rights, restricted stock units,

restricted stock and other equity-based awards. In connection with the initial approval of our 2014 Plan on May 6, 2014, the 2014 Plan

replaced the 2004 Plan and the 2008 Plan with respect to prospective equity grants.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics for our officers, including our principal executive

officer, principal financial officer, principal accounting officer or controller, and our employees and directors.

Our Code of Business Conduct and Ethics is available on our website at www.weightwatchersinternational.com.

70