WeightWatchers 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

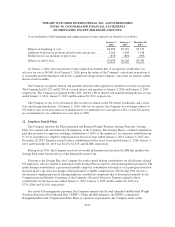

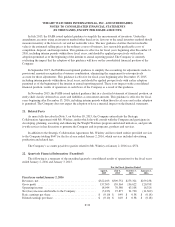

employees’ behalf instead of an individual account with a cash balance. The EPSP provides for a guaranteed

employer contribution on behalf of each participant based on the participant’s age and a percentage of the

participant’s eligible compensation. The EPSP has a discretionary supplemental employer contribution

component that is determined annually by the Compensation and Benefits Committee of the Company’s Board of

Directors. The account is valued at the end of each fiscal month, based on an annualized interest rate of prime

plus 2%, with an annualized cap of 15%. Expense related to this commitment for the fiscal years ended

January 2, 2016, January 3, 2015 and December 28, 2013 was $1,950, $1,090, and $2,651, respectively.

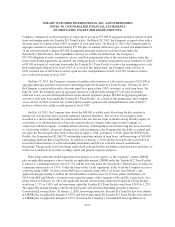

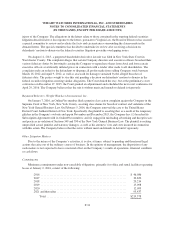

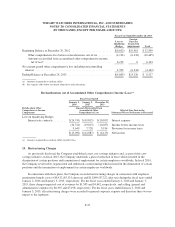

13. Cash Flow Information

January 2,

2016

January 3,

2015

December 28,

2013

Net cash paid during the year for:

Interest expense ........................................... $117,602 $123,100 $99,687

Income taxes .............................................. $ 25,566 $ 35,232 $87,071

Noncash investing and financing activities were as follows:

Fair value of net assets/(liabilities) acquired in connection with

acquisitions ............................................. $ 1,439 $ 359 $ (175)

Change in Capital expenditures and Capitalized software included in

accounts payable and accrued expenses ....................... $ (1,969) $ 3,347 $ (5,432)

Dividends declared but not yet paid at year-end .................. $ 0 $ 0 $ 177

14. Commitments and Contingencies

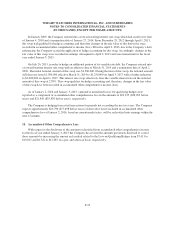

In re Weight Watchers International, Inc. Securities Litigation

In March 2014, two substantially identical putative class action complaints alleging violation of the federal

securities laws were filed by individual shareholders against the Company, certain of the Company’s current and

former officers and directors, and Artal Group S.A. (“Artal”) in the United States District Court for the Southern

District of New York. The complaints were purportedly filed on behalf of all purchasers of the Company’s

common stock, no par value per share, between February 14, 2012 and October 30, 2013, inclusive (the “Class

Period”). The complaints allege that, during the Class Period, the defendants disseminated materially false and

misleading statements and/or concealed material adverse facts. The complaints allege claims under Sections

10(b) and 20(a) of the Securities Exchange Act of 1934, as amended, and Rule 10b-5 thereunder. The plaintiffs

seek to recover unspecified damages on behalf of the class members. In June 2014, the Court consolidated the

cases and appointed lead plaintiffs and lead counsel. On August 12, 2014, the plaintiffs filed an amended

complaint that, among other things, reduced the Class Period to between February 14, 2012 and February 13,

2013 and dropped all current officers and certain directors previously named as defendants. On October 14, 2014,

the defendants filed a motion to dismiss. The plaintiffs filed an opposition to the defendants’ motion to dismiss

on November 24, 2014 and the defendants filed a reply in support of their motion to dismiss on December 23,

2014. The Company continues to believe that the suits are without merit and intends to defend them vigorously.

Tracey Mead, Derivatively on Behalf of Weight Watchers International, Inc. vs. Artal Group et. al. and Weight

Watchers International, Inc.

On May 29, 2014 and June 23, 2014, the Company received shareholder litigation demand letters alleging

breaches of fiduciary duties and unjust enrichment by Company officers and directors and Artal, to the alleged

F-30