WeightWatchers 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

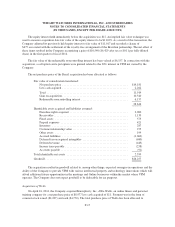

goodwill ($6,204), website development ($4,516), prepaid expenses ($4) and fixed assets ($1) offset by deferred

tax liabilities ($1,759). As a result of the acquisition, Wello became a wholly owned subsidiary of the Company

and the Company began to consolidate the entity as of the date of acquisition. The acquisition resulted in

goodwill related to, among other things, expected synergies in operations. The Company does not expect

goodwill to be deductible for tax purposes.

Acquisition of Weilos

On March 11, 2015, the Company acquired for a purchase price of $6,674 Weilos, a California-based

startup with an online social platform that provides a mobile health and weight loss community. Payment was in

the form of common stock issued ($2,810), restricted stock issued ($114) and cash ($2,775) plus cash in reserves

($975). The total purchase price of Weilos has been allocated to goodwill ($5,588), identifiable intangibles

($1,741) and other assets ($24) offset by deferred tax liabilities ($679). Restricted shares with a fair value at the

date of grant ($908) were issued to key employees, contingent upon 18 months post-combination employment,

and are accounted for as stock compensation cost in the post-combination financial statements. As a result of the

acquisition, Weilos became a wholly owned subsidiary of the Company and the Company began to consolidate

the entity as of the date of acquisition. The acquisition resulted in goodwill related to, among other things,

expected synergies in operations. The Company does not expect goodwill to be deductible for tax purposes.

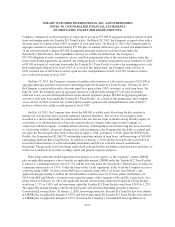

Shutdown of China Operations

On December 12, 2013, the Company made a strategic decision to shut down its China operations. As a

result of this decision, the Company incurred a charge of $2,500 related to severance and the impairment of

property, plant and equipment and amortizable intangible assets.

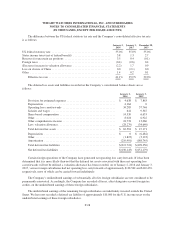

5. Franchise Rights Acquired, Goodwill and Other Intangible Assets

The Company performed its annual impairment review of goodwill and other indefinite-lived intangible

assets as of January 2, 2016 and January 3, 2015. As a result of this review, no impairment charges were

recorded for the fiscal years ended January 2, 2016 and January 3, 2015.

Franchise rights acquired are due to acquisitions of the Company’s franchised territories as well as the

acquisition of franchise promotion agreements and other factors associated with the acquired franchise territories.

For the fiscal year ended January 2, 2016, the change in the carrying value of indefinite-lived franchise rights

acquired is primarily due to the effect of exchange rate changes.

Goodwill primarily relates to the acquisition of the Company by H.J. Heinz Company in 1978, the

acquisition of WeightWatchers.com, Inc. in 2005, the acquisitions of the Company’s franchised territories, the

acquisitions of the majority interest in VPM and of Wello in fiscal 2014 and the acquisition of Weilos in fiscal

2015. See Note 4 for further information on certain acquisitions. For the fiscal year ended January 2, 2016, the

change in the carrying amount of goodwill is due to the Weilos acquisition and the effect of exchange rate

changes as follows:

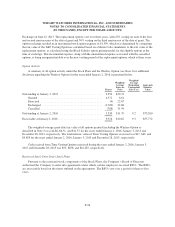

North America UK CE Other Total

Balance as of January 3, 2015 ..................... $134,611 $1,421 $7,661 $24,586 $168,279

Goodwill acquired during the period ................ 5,588 0 0 0 5,588

Effect of exchange rate changes .................... (6,791) (51) (401) (7,293) (14,536)

Balance as of January 2, 2016 ..................... $133,408 $1,370 $7,260 $17,293 $159,331

F-18