WeightWatchers 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

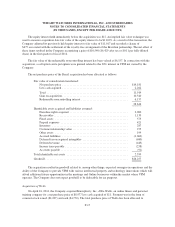

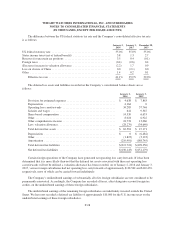

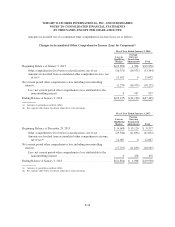

The fair value of RSUs is determined using the closing market price of the Company’s common stock on the date

of grant. A summary of RSU activity under the Stock Plans for the year ended January 2, 2016 is presented

below:

Shares

Weighted-Average

Grant-Date

Fair Value

Outstanding at January 3, 2015 .................................. 838 $27.71

Granted ................................................. 780 $ 5.55

Vested .................................................. (35) $51.18

Forfeited ................................................ (217) $26.25

Outstanding at January 2, 2016 .................................. 1,366 $27.71

The weighted-average grant-date fair value of RSUs granted was $5.55, $24.37, and $38.40 for the years

ended January 2, 2016, January 3, 2015 and December 28, 2013, respectively. The total fair value of RSUs

vested during the years ended January 2, 2016, January 3, 2015 and December 28, 2013 was $1,804, $3,042, and

$1,705, respectively.

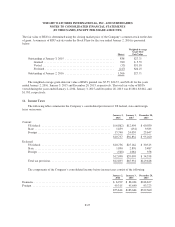

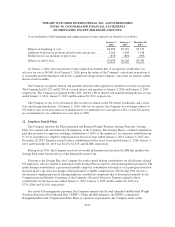

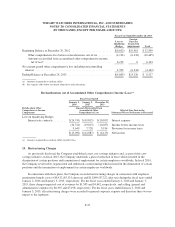

11. Income Taxes

The following tables summarize the Company’s consolidated provision for US federal, state and foreign

taxes on income:

January 2,

2016

January 3,

2015

December 28,

2013

Current:

US federal ................................................ $(6,862) $12,904 $ 60,030

State ..................................................... 1,859 (131) 9,583

Foreign ................................................... 15,740 24,059 25,647

$10,737 $36,832 $ 95,260

Deferred:

US federal ................................................ $10,756 $25,162 $ 30,513

State ..................................................... 1,890 2,876 3,487

Foreign ................................................... (548) 1,061 358

$12,098 $29,099 $ 34,358

Total tax provision .......................................... $22,835 $65,931 $129,618

The components of the Company’s consolidated income before income taxes consist of the following:

January 2,

2016

January 3,

2015

December 28,

2013

Domestic ..................................................... $ 6,299 $ 88,024 $248,637

Foreign ...................................................... 49,315 95,640 83,723

$55,614 $183,664 $332,360

F-27