WeightWatchers 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

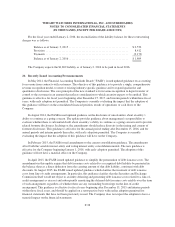

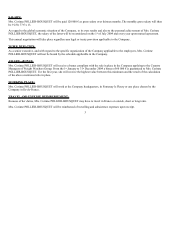

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

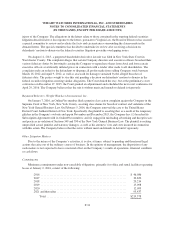

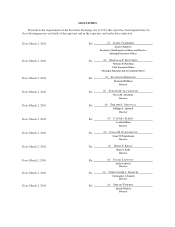

For the Fiscal Quarters Ended

March 29,

2014

June 28,

2014

September

27, 2014

January 3,

2015

Fiscal year ended January 3, 2015

Revenues, net ........................................

Gross profit .........................................

$409,358

222,900

$397,547

225,814

$345,184

187,567

$327,827

166,270

Operating income .................................... 51,053 114,564 91,394 42,303

Net income attributable to the Company ................... 21,531 54,002 37,892 4,362

Basic earnings per share ............................... $ 0.38 $ 0.95 $ 0.67 $ 0.08

Diluted earnings per share .............................. $ 0.38 $ 0.95 $ 0.67 $ 0.08

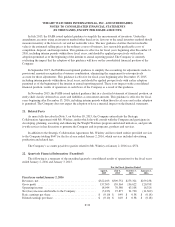

Basic and diluted EPS are computed independently for each of the periods presented. Accordingly, the sum

of the quarterly EPS amounts may not agree to the total for the year.

As discussed in further detail in Note 19, the Company recorded restructuring charges of $5,761

($3,514 after tax), $232 ($142 after tax), $1,081 ($660 after tax) and $1,338 ($815 after tax) during the first,

second, third and fourth quarters of fiscal 2015, respectively, in connection with employee termination benefit

costs associated with its previously disclosed cost-savings initiative plan to restructure its organization, reducing

gross profit, operating income, net income attributable to the Company and to EPS all four quarters of fiscal

2015. The Company recorded restructuring charges of $3,656 ($2,235 after tax), $6,498 ($3,964 after tax),

$713 ($430 after tax) and $973 ($593 after tax) during the first, second, third and fourth quarters of fiscal 2014,

respectively, in connection with employee termination benefit costs associated with its previously disclosed cost-

savings initiative plan to restructure its organization, reducing gross profit, operating income, net income

attributable to the Company and EPS all four quarters of fiscal 2014.

As discussed in further detail in Note 3, operating income, net income and EPS during the fourth quarter of

fiscal 2015 were impacted by the Company recording expenses of $13,593 ($8,292 after tax and $0.13 per fully

diluted share) in connection with the Winfrey Transaction in the fourth quarter of fiscal 2015.

As discussed in further detail in Note 7, net income and EPS were impacted by a gain on the early

extinguishment of debt of $4,749 ($2,897 after tax), and $6,727 ($4,103 after tax), or $0.05 and $0.07 per fully

diluted share, during the first and second quarters of fiscal 2015, respectively.

As discussed in Note 1, the Company identified and recorded out-of-period adjustments related to

immaterial errors in prior period financial statements that impacted net income attributable to the Company by

$420 and $410 for the second and fourth quarter of fiscal 2015, respectively.

As discussed in further detail in Note 4, in the first quarter of fiscal 2014, net income and EPS were

impacted by a gain of $10,540 ($6,396 after tax), or $0.11 per fully diluted share, recognized in connection with

the Brazil acquisition due to an adjustment of the Company’s previously held equity interest to fair value offset

by a charge associated with the settlement of the royalty-free arrangement of the Brazilian partnership.

In the second quarter of fiscal 2014, net income and EPS were impacted by a $2,350, or $0.04 per fully

diluted share, net tax benefit related to an intercompany loan write-off in connection with the closure of our

China business partially offset by the recognition of a valuation allowance related to tax benefits for foreign

losses that are not expected to be realized.

F-40