WeightWatchers 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

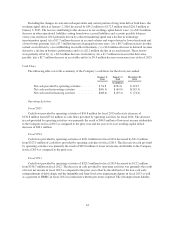

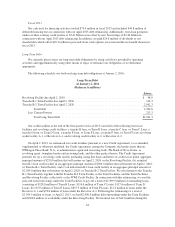

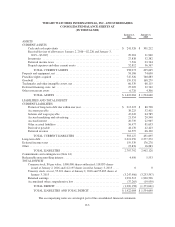

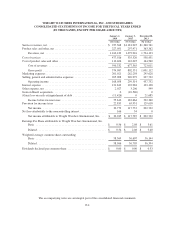

The following table summarizes our future contractual obligations as of the end of fiscal 2015:

Payment Due by Period

Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

(in millions)

Long-Term Debt(1)

Principal(2) .................................. $2,234.5 $213.3 $ 42.0 $1,979.2 $ —

Interest(2) ................................... 349.1 84.9 163.8 100.4 —

Operating leases and non-cancelable agreements ....... 219.5 46.1 50.8 27.2 95.4

Other long-term obligations(3) ....................... 10.6 0.7 1.0 0.1 8.8

Total ...................................... $2,813.7 $345.0 $257.6 $2,106.9 $104.2

(1) Due to the fact that all of our debt is variable rate based, we have assumed for purposes of this table that the interest rate on all of our

debt as of the end of fiscal 2015 remains constant for all periods presented. The above does not include the impact of our interest rate

swap which has a fair value of $44.2 million, or the $17.7 million of interest expense which is expected to be reclassified from

accumulated other comprehensive loss into earnings in fiscal 2016.

(2) The Revolving Facility principal amount of $48.0 million is classified as current and included in the “less than 1 year” caption. As we

have the option to extend and not repay until 2018, interest amounts are included in the respective periods in the table above.

(3) “Other long-term obligations” primarily consist of deferred rent costs. The provision for income tax contingencies included in other long-

term liabilities on the consolidated balance sheet is not included in the table above due to the fact that the Company is unable to estimate

the timing of payment for this liability.

We currently plan to meet our long-term debt obligations by using cash flows provided by operating

activities and opportunistically using other means to repay or refinance our obligations as we determine

appropriate. We believe that cash flows from operating activities, together with cash on hand, will provide

sufficient liquidity for the next 12 months to fund currently anticipated capital expenditure and working capital

requirements, as well as debt service requirements.

Franchise Acquisitions

Although we did not acquire any franchises in fiscal 2015 and 2014, in fiscal 2013, we made the following

franchise acquisitions:

In March 2013, we acquired substantially all of the assets of our Alberta and Saskatchewan, Canada

franchisees, Weight Watchers of Alberta Ltd. and Weight Watchers of Saskatchewan Ltd., for an aggregate

purchase price of $35.0 million.

In July 2013, we acquired substantially all of the assets of our West Virginia franchisee, Weight Watchers

of West Virginia, Inc., for a net purchase price of $16.0 million, our Columbus, Ohio franchisee, Weight

Watchers of Columbus, Inc., for a net purchase price of $23.3 million and our Reno, Nevada franchisee, Weight

Watchers of Northern Nevada, Inc., for a net purchase price of $4.0 million.

In October 2013, we acquired substantially all of the assets of our Manitoba, Canada franchisee, Weight

Watchers of Manitoba Ltd., for a net purchase price of $5.2 million and our Franklin and St. Lawrence Counties,

New York franchisee, Weight Watchers of Franklin and St. Lawrence Counties Inc., for a net purchase price of

$0.3 million.

Acquisition of Additional Equity Interest in Brazil

Prior to March 12, 2014, we had owned 35% of VPM, a Brazilian limited liability partnership. On

March 12, 2014, we acquired an additional 45% equity interest in VPM for a net purchase price of $14.2 million.

66