WeightWatchers 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We also generate revenues from subscription sales for our magazines, third-party advertising in our

publications, the sale of third-party Internet advertising, ecommerce fees and the sale of By Mail

product.

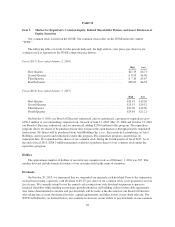

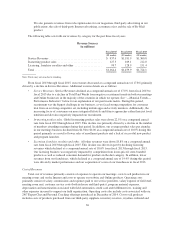

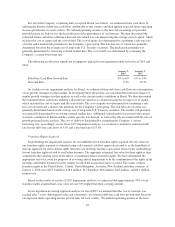

The following table sets forth our revenues by category for the past three fiscal years.

Revenue Sources

(in millions)

Fiscal 2015 Fiscal 2014 Fiscal 2013

(52 weeks) (53 weeks) (52 weeks)

Service Revenues ..................................... $ 937.4 $1,181.9 $1,360.8

In-meeting product sales ............................... 127.3 169.1 212.0

Licensing, franchise royalties and other ................... 99.7 128.9 151.4

Total ............................................... $1,164.4 $1,479.9 $1,724.1

Note: Totals may not sum due to rounding.

From fiscal 2013 through fiscal 2015, our revenues decreased at a compound annual rate of 17.8% primarily

driven by a decline in Service Revenues. Additional revenue details are as follows:

•Service Revenues. Service Revenues declined at a compound annual rate of 17.0% from fiscal 2013 to

fiscal 2015 due to a decline in Total Paid Weeks from negative recruitment trends in both our meetings

and Online businesses in the majority of the countries in which we operate. See “—Material Trends—

Performance Indicators” below for an explanation of our paid weeks metric. During this period,

recruitment was the biggest challenge in our business, as we faced strong competition for consumer

trial from an evolving competitor set, including mobile apps and activity monitors. Additionally, the

increasing focus of consumers on more integrated lifestyle and fitness approaches rather than just food,

nutrition and diet also negatively impacted our recruitment.

•In-meeting product sales. Global in-meeting product sales were down 22.5% on a compound annual

rate from fiscal 2013 through fiscal 2015. This decline was primarily driven by a decline in the number

of members attending meetings during that period. In addition, our average product sales per attendee

in our meetings business declined from $4.94 to $4.00 at a compound annual rate of 10.0% during this

period primarily as a result of lower sales of enrollment products and a lack of successful new product

and program launches.

•Licensing, franchise royalties and other. All other revenues were down 18.8% on a compound annual

rate from fiscal 2013 through fiscal 2015. This decline was driven in part by declining licensing

revenues which declined at a compound annual rate of 18.6% from fiscal 2013 through fiscal 2015.

Our licensing business was negatively impacted by competition from lower-priced, store-branded

products as well as reduced consumer demand for products in the diet category. In addition, lower

revenues from our franchisees, which declined at a compound annual rate of 19.4% during this period,

were driven by market performance and our acquisition of seven of our franchisees in fiscal 2013.

Cost of Revenues

Total cost of revenues primarily consists of expenses to operate our meetings, costs to sell products in our

meeting rooms and on the Internet and costs to operate our website and Online products. Operating costs

primarily consist of salary, commissions and expenses paid to our service providers, salary expense of field staff,

meeting room rent, customer service costs (both in-house and third-party), program material expenses,

depreciation and amortization associated with field automation, credit card and fulfillment fees, training and

other expenses incurred to support our field organization. Operating costs also include costs associated with our

24/7 Expert Chat and Personal Coaching offerings introduced in December of 2014. Cost to sell products

includes costs of products purchased from our third-party suppliers, inventory reserves, royalties, inbound and

36