WeightWatchers 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

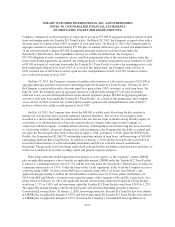

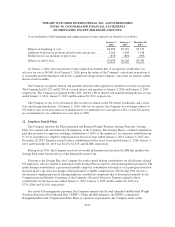

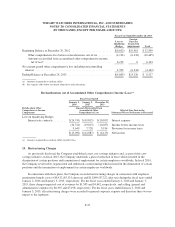

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

January 2,

2016

January 3,

2015

December 28,

2013

Balance at beginning of year ............................. $6,268 $5,784 $5,319

Additions based on tax positions related to the current year .... 2,106 1,304 1,428

Reductions for tax positions of prior years .................. (676) (820) (963)

Balance at end of year .................................. $7,698 $6,268 $5,784

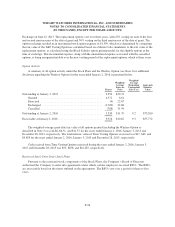

At January 2, 2016, the total amount of unrecognized tax benefits that, if recognized, would affect our

effective tax rate is $6,948. As of January 2, 2016, given the nature of the Company’s uncertain tax positions, it

is reasonably possible that there will not be a significant change in the Company’s uncertain tax benefits within

the next twelve months.

The Company recognizes interest and penalties related to unrecognized tax benefits in income tax expense.

The Company had $1,229 and $2,300 of accrued interest and penalties at January 2, 2016 and January 3, 2015,

respectively. The Company recognized $(266), $83, and $(1,188) in interest and penalties during the fiscal years

ended January 2, 2016, January 3, 2015 and December 28, 2013, respectively.

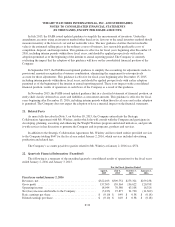

The Company or one of its subsidiaries files income tax returns in the US federal jurisdiction, and various

state and foreign jurisdictions. At January 2, 2016, with few exceptions, the Company was no longer subject to

US federal, state or local income tax examinations by tax authorities for years prior to 2012, or non-US income

tax examinations by tax authorities for years prior to 2009.

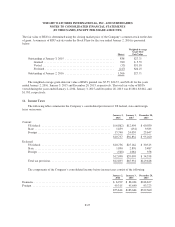

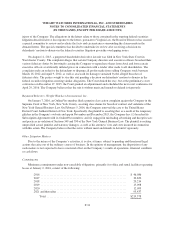

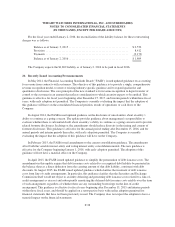

12. Employee Benefit Plans

The Company sponsors the Third Amended and Restated Weight Watchers Savings Plan (the “Savings

Plan”) for salaried and certain hourly US employees of the Company. The Savings Plan is a defined contribution

plan that provides for employer matching contributions of 100% of the employee’s tax deferred contributions up

to 3% of an employee’s eligible compensation for the fiscal years ended January 2, 2016, January 3, 2015 and

December 28, 2013. Expense related to these contributions for the fiscal years ended January 2, 2016, January 3,

2015 and December 28, 2013 was $2,454, $2,525, and $2,888, respectively.

During fiscal 2014, the Company received a favorable determination letter from the IRS that qualifies the

Savings Plan under Section 401(a) of the Internal Revenue Code.

Pursuant to the Savings Plan, the Company also makes profit sharing contributions for all full-time salaried

US employees who are eligible to participate in the Savings Plan (except for certain management personnel). The

profit sharing contribution is a guaranteed monthly employer contribution on behalf of each participant based on

the participant’s age and a percentage of the participant’s eligible compensation. The Savings Plan also has a

discretionary supplemental profit sharing employer contribution component that is determined annually by the

Compensation and Benefits Committee of the Company’s Board of Directors. Expense related to these

contributions for the fiscal years ended January 2, 2016, January 3, 2015 and December 28, 2013 was

$733, $266, and $1,658, respectively.

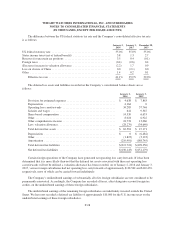

For certain US management personnel, the Company sponsors the Second Amended and Restated Weight

Watchers Executive Profit Sharing Plan (“EPSP”). Under the IRS definition, the EPSP is considered a

Nonqualified Deferred Compensation Plan. There is a promise of payment by the Company made on the

F-29