WeightWatchers 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiscal 2016: Anticipated Business Metrics, Trends and Other Events

We expect that our fiscal 2016 revenues will increase as compared to fiscal 2015, driven by anticipated

recruitments that will establish a strong foundation for revenue growth and increased profitability in fiscal 2016.

Given the nature of our subscription-based payment model, revenue growth typically lags recruitment growth.

We expect an increase in revenues despite the approximately $20.0 million negative impact of the lower fiscal

2016 Incoming Active Base versus the prior year and an anticipated $16.0 million negative impact of foreign

currency on fiscal 2016 revenues based on current rates. We plan to use cash on hand to repay in full our

$144.3 million debt obligations due April 2016 under the WWI Credit Facilities.

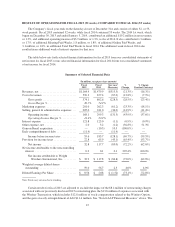

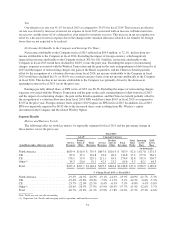

Non-GAAP Financial Measures

To supplement our consolidated results presented in accordance with accounting principles generally

accepted in the United States, or GAAP, we have disclosed non-GAAP financial measures of operating results

that exclude or adjust certain items. Gross profit and gross profit margin, operating income and operating

income margin, net income attributable to the Company, selling, general and administrative expenses and

earnings per fully diluted share, including components thereof, are discussed in this Annual Report on Form

10-K both as reported (on a GAAP basis) and as adjusted (on a non-GAAP basis), as applicable, as follows:

(i) with respect to fiscal 2015 and 2014 to exclude the impact of charges associated with our previously

disclosed plans to restructure our organization; (ii) with respect to fiscal 2015 to exclude the impact of

(a) expenses associated with the Winfrey Transaction and (b) the gains on early extinguishment of debt

associated with our previously reported debt prepayments in the period; (iii) with respect to fiscal 2014 to

exclude the impact of (a) the net tax benefit related to an intercompany loan write-off in connection with the

closure of our China business and the establishment of a valuation allowance related to tax benefits for foreign

losses that are not expected to be realized and (b) the gain recognized in connection with our previously

disclosed Brazil acquisition due to an adjustment of our previously held equity interest to fair value offset by a

charge associated with the settlement of the royalty-free arrangement of the Brazil partnership; and (iv) with

respect to fiscal 2013 to exclude the early extinguishment of debt charge. Income before taxes, effective tax

rate, net income attributable to the Company and earnings per fully diluted share are discussed in this Annual

Report on Form 10-K both as reported (on a GAAP basis) and as adjusted (on a non-GAAP basis) to exclude

from fiscal 2013 the impact from the early extinguishment of debt charge recorded in connection with our

previously announced April 2, 2013 refinancing of our long-term debt. We generally refer to such non-GAAP

measures as excluding or adjusting for the impact of the expenses associated with the Winfrey Transaction, the

restructuring charges, the gain on the early extinguishment of debt, the gain on the Brazil acquisition, the

China tax benefit partially offset by the recognition of a valuation allowance and the early extinguishment of

debt charge. Our management believes these non-GAAP financial measures provide supplemental information

to investors regarding the performance of our business and are useful for period-over-period comparisons of

the performance of our business. While we believe that these financial measures are useful in evaluating our

business, this information should be considered as supplemental in nature and is not meant to be considered in

isolation or as a substitute for the related financial information prepared in accordance with GAAP. In addition,

these non-GAAP financial measures may not be the same as similarly entitled measures reported by other

companies.

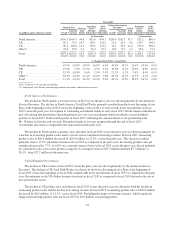

Use of Constant Currency

As exchange rates are an important factor in understanding period-to-period comparisons, we believe in

certain cases the presentation of results on a constant currency basis in addition to reported results helps improve

investors’ ability to understand our operating results and evaluate our performance in comparison to prior

periods. Constant currency information compares results between periods as if exchange rates had remained

constant period-over-period. We use results on a constant currency basis as one measure to evaluate our

performance. In this Annual Report on Form 10-K, we calculate constant currency by calculating current-year

results using prior-year foreign currency exchange rates. We generally refer to such amounts calculated on a

42