WeightWatchers 2015 Annual Report Download - page 53

Download and view the complete annual report

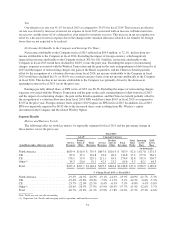

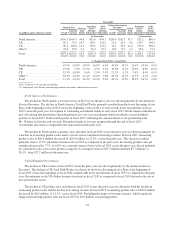

Please find page 53 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operating income margin in fiscal 2015 would have decreased to 16.3%, or 16.9% on a constant currency basis,

from 21.0% in fiscal 2014. This decline in operating income margin was driven by the decline in gross margin,

partially offset by the decline in marketing and selling, general and administrative expenses as a percentage of

revenue as compared to the prior year.

Interest Expense

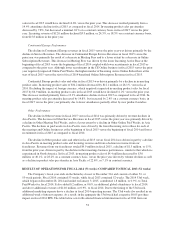

Interest expense in fiscal 2015 decreased $1.1 million, or 0.9%, versus fiscal 2014, which had an additional

week of interest expense of approximately $2.3 million as discussed above. Excluding this additional week of

interest expense from fiscal 2014, interest expense in fiscal 2015 would have increased by $1.1 million, or 0.9%,

versus the prior year. This increase in interest expense was driven primarily by the full year impact of the $1.5

billion interest rate swap which became effective on March 31, 2014, the difference in the notional amount of our

interest rate swaps in effect during fiscal 2015 versus the prior year and the interest associated with the revolver

borrowing drawn down on July 14, 2015. This increase in interest expense was offset in part by the decrease in

our average debt outstanding and a decline of $2.4 million in deferred financing costs which includes cycling

against the write-off of $1.6 million recorded in connection with the reduction in the amount of the Revolving

Facility from $250.0 million to $50.0 million as well as lower costs associated with lower debt. Our average debt

outstanding decreased by $95.9 million to $2,277.0 million in fiscal 2015 from $2,372.9 million in fiscal 2014.

This decrease was primarily due to our debt prepayments in March and June 2015. The effective interest rate on

our debt, based on interest incurred and our average borrowings during fiscal 2015 and 2014 and excluding the

impact of our interest rate swaps, increased by 0.12% per annum to 3.98% per annum at fiscal 2015 year end

from 3.86% per annum at fiscal 2014 year end. Including the impact of our interest rate swaps, our effective

interest rate on our debt, based on interest incurred and our average borrowings during fiscal 2015 and 2014,

increased to 5.07% per annum at fiscal 2015 year end from 4.67% per annum at fiscal 2014 year end. See “—

Liquidity and Capital Resources—Long-Term Debt” for additional details regarding interest rates on our debt

outstanding, the amendment to our Revolving Facility and our debt prepayments. For additional details on our

interest rate swap, see “Item 7A. Quantitative and Qualitative Disclosures about Market Risk” in Part III of this

Annual Report on Form 10-K.

Early Extinguishments of Debt

In March 2015, we paid an aggregate amount of cash proceeds totaling $57.4 million plus an amount sufficient

to pay accrued and unpaid interest on the amount prepaid to prepay $63.1 million in aggregate principal amount of

term loans under the Tranche B-1 Term Facility. In June 2015, we paid an aggregate amount of cash proceeds

totaling $77.2 million plus an amount sufficient to pay accrued and unpaid interest on the amount prepaid to prepay

$84.9 million in aggregate principal amount of term loans under the Tranche B-1 Term Facility. As a result of these

prepayments, we wrote-off fees of $0.6 million, incurred fees of $1.2 million and recorded a gain on early

extinguishment of debt of $11.4 million, inclusive of these fees, in fiscal 2015.

Gain on Brazil Acquisition

In March 2014, we acquired an additional 45% equity interest in our Brazilian partnership thereby

increasing our equity interest to 80%. As a result of this transaction, we adjusted our previously held equity

interest to fair value and recorded a charge associated with the settlement of the royalty-free arrangement of our

Brazilian partnership. The net effect of these items resulted in us recognizing a pre-tax gain of $10.5 million in

fiscal 2014.

Other Expense, Net

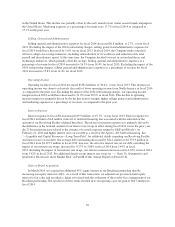

Other expense, net, which consists of the impact of foreign currency on intercompany transactions,

decreased by $1.2 million in fiscal 2015 versus the prior year.

50