WeightWatchers 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

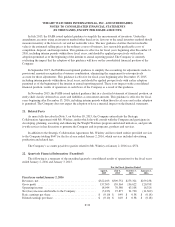

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

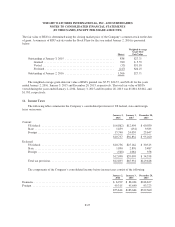

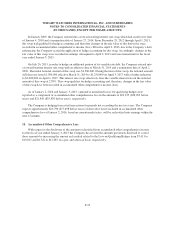

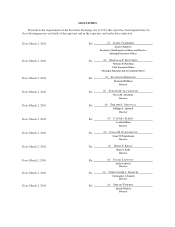

Fiscal Year Ended December 28, 2013

Loss on

Qualifying

Hedges

Foreign

Currency

Translation

Adjustments Total

Beginning Balance at December 29, 2012 ............................ $(6,602) $19,461 $ 12,859

Other comprehensive loss before reclassifications, net of tax ......... (4,124) (6,341) (10,465)

Amounts reclassified from accumulated other comprehensive income,

net of tax(b) .............................................. 6,123 0 6,123

Net current period other comprehensive loss including noncontrolling

interest ...................................................... 1,999 (6,341) (4,342)

Ending Balance at December 28, 2013 ............................... $(4,603) $13,120 $ 8,517

(a) Amounts in parentheses indicate debits

(b) See separate table below for details about these reclassifications

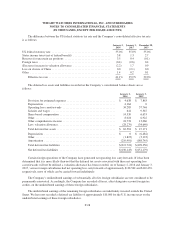

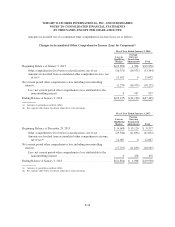

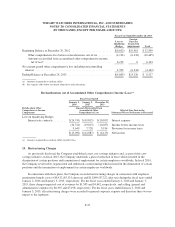

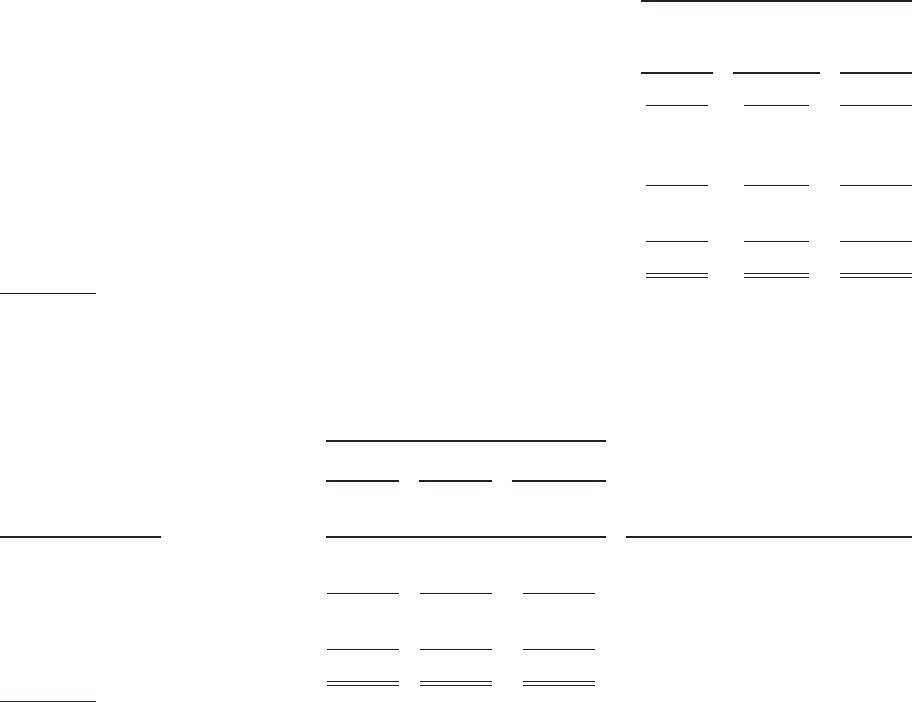

Reclassifications out of Accumulated Other Comprehensive Income (Loss)(a)

Fiscal Year Ended

January 2,

2016

January 3,

2015

December 28,

2013

Details about Other

Comprehensive Income

Components

Amounts Reclassified from

Accumulated Other

Comprehensive Loss

Affected Line Item in the

Statement Where Net Income is Presented

Loss on Qualifying Hedges

Interest rate contracts ......... $(24,741) $(19,815) $(10,037) Interest expense

(24,741) (19,815) (10,037) Income before income taxes

9,649 7,728 3,914 Provision for income taxes

$(15,092) $(12,087) $ (6,123) Net income

(a) Amounts in parentheses indicate debits to profit / loss

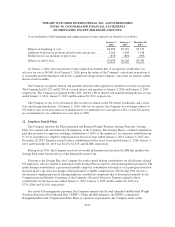

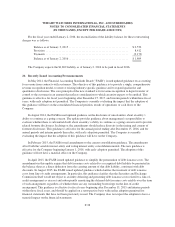

19. Restructuring Charges

As previously disclosed, the Company established a new cost-savings initiative and, as part of this cost-

savings initiative, in fiscal 2015, the Company undertook a plan of reduction in force which resulted in the

elimination of certain positions and termination of employment for certain employees worldwide. In fiscal 2014,

the Company reviewed its organization and undertook a restructuring which resulted in the elimination of certain

positions and the termination of employment for certain employees worldwide.

In connection with these plans, the Company recorded restructuring charges in connection with employee

termination benefit costs of $8,412 ($5,131 after tax) and $11,840 ($7,222 after tax) during the fiscal years ended

January 2, 2016 and January 3, 2015, respectively. For the fiscal years ended January 2, 2016 and January 3,

2015, these charges impacted cost of revenues by $1,505 and $4,642, respectively, and selling, general and

administrative expenses by $6,907 and $7,198, respectively. For the fiscal years ended January 2, 2016 and

January 3, 2015, all restructuring charges were recorded to general corporate expense and therefore there was no

impact to the segments.

F-37