WeightWatchers 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

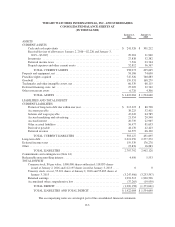

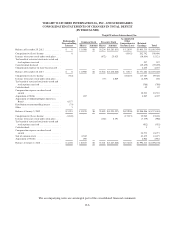

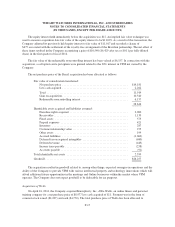

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE FISCAL YEARS ENDED

(IN THOUSANDS)

January 2,

2016

January 3,

2015

December 28,

2013

(52 Weeks) (53 Weeks) (52 Weeks)

Operating activities:

Net income ...................................................... $ 32,779 $117,733 $ 202,742

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation and amortization ................................... 53,171 49,234 47,909

Amortization of deferred financing costs .......................... 6,886 9,305 7,672

Impairment of intangible and long-lived assets ...................... 2,455 652 5,426

Share-based compensation expense ............................... 24,771 10,533 4,255

Deferred tax provision ......................................... 12,098 29,099 34,358

Allowance for doubtful accounts ................................. (446) 99 596

Reserve for inventory obsolescence .............................. 7,593 11,822 9,580

Foreign currency exchange rate loss .............................. 1,526 2,984 659

Gain on Brazil acquisition ...................................... 0 (10,540) 0

Loss on disposal of assets ...................................... 0 171 1,417

(Gain) loss on early extinguishment of debt ........................ (12,667) 0 21,685

Other items, net .............................................. 0 (184) 0

Changes in cash due to:

Receivables ................................................. 1,571 3,777 345

Inventories .................................................. (3,055) (3,218) (2,226)

Prepaid expenses ............................................. (18,284) 1,341 1,037

Accounts payable ............................................. (13,930) 7,807 (3,607)

UK self-employment liability ................................... 0 0 (7,272)

Accrued liabilities ............................................ (30,906) 10,361 4,988

Deferred revenue ............................................. 1,256 (7,915) (10,521)

Income taxes ................................................ (10,003) (1,442) 4,473

Cash provided by operating activities ............................. 54,815 231,619 323,516

Investing activities:

Capital expenditures .............................................. (3,952) (9,097) (40,657)

Capitalized software expenditures .................................... (32,307) (42,589) (21,277)

Cash paid for acquisitions .......................................... (3,112) (16,678) (83,825)

Other items, net .................................................. (936) (628) 411

Cash used for investing activities (40,307) (68,992) (145,348)

Financing activities:

Proceeds from new term loans ....................................... 0 0 2,400,000

Borrowings on revolver ............................................ 48,000 0 70,000

Payments on long-term debt ........................................ (158,113) (30,000) (2,488,364)

Payment of dividends ............................................. (42) (80) (29,571)

Proceeds from the sale of common stock, net of fees ..................... 41,475 0 0

Deferred financing costs ........................................... 0 0 (44,817)

Proceeds from stock options exercised ................................ 95 658 16,187

Tax benefit of restricted stock units vested and stock options exercised ...... 0 1 2,132

Cash used for financing activities (68,585) (29,421) (74,433)

Effect of exchange rate changes on cash and cash equivalents and other .......... (5,609) (6,551) 607

Net (decrease) increase in cash and cash equivalents ......................... (59,686) 126,655 104,342

Cash and cash equivalents, beginning of fiscal year .......................... 301,212 174,557 70,215

Cash and cash equivalents, end of fiscal year ............................... $241,526 $301,212 $ 174,557

The accompanying notes are an integral part of the consolidated financial statements.

F-7