WeightWatchers 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

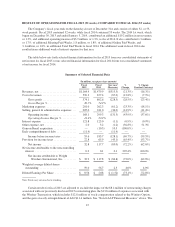

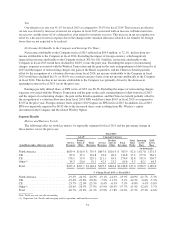

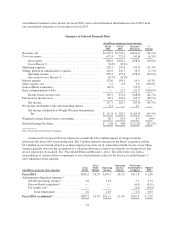

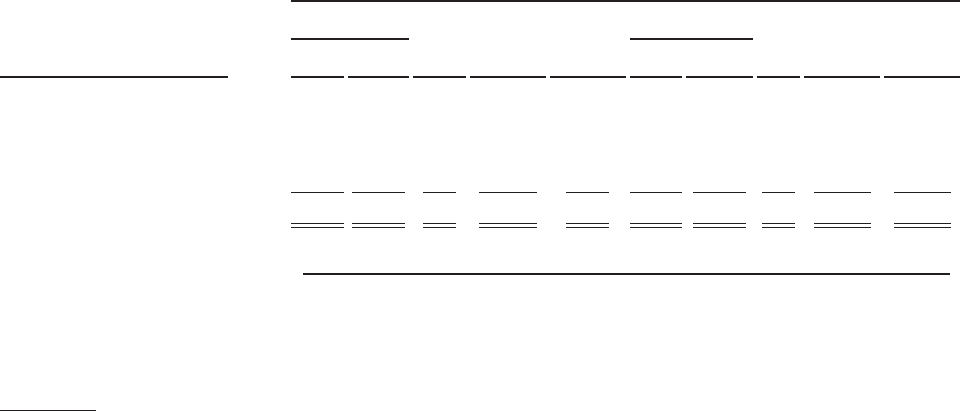

Fiscal 2015

Meeting Fees Meeting

Paid

Weeks

Incoming

Active

Meeting

Subscribers

EOP

Active

Meeting

Subscribers

Online Subscription

Revenues Online

Paid

Weeks

Incoming

Active

Online

Subscribers

EOP

Active

Online

Subscribers(in millions unless otherwise stated) GAAP

Constant

Currency GAAP

Constant

Currency

(in thousands) (in thousands)

North America ..................$399.5 $404.3 40.8 692.6 645.1 $239.9 $242.7 51.7 925.2 886.4

UK ........................... 65.1 70.3 10.7 158.1 153.2 22.4 24.2 6.6 119.7 109.9

CE ........................... 99.4 118.6 11.6 178.2 172.4 76.7 92.5 21.2 373.6 358.3

Other(1) ........................ 23.8 29.8 2.4 26.4 27.2 10.5 12.7 1.9 35.6 37.2

Total ..........................$587.8 $623.1 65.5 1,055.4 997.9 $349.6 $372.1 81.4 1,454.1 1,391.8

% Change Fiscal 2015 vs. Fiscal 2014

North America ................ -19.5% -19.0% -18.9% -16.9% -6.9% -19.6% -19.2% -22.6% -25.0% -4.2%

UK ......................... -19.4% -7.9% -13.5% -4.7% -3.1% -19.5% -8.1% -15.9% -8.9% -8.2%

CE ......................... -25.5% -10.8% -9.6% -2.9% -3.3% -21.2% -5.2% -7.0% 8.4% -4.1%

Other(1) ...................... -30.3% -16.2% -11.4% -22.0% 2.8% -24.3% -15.1% -11.5% -4.1% 4.4%

Total ........................ -21.1% -16.3% -16.2% -13.3% -5.4% -20.1% -15.2% -18.3% -16.7% -4.3%

Note: Totals may not sum due to rounding

(1) Represents Asia Pacific and emerging markets operations and franchise revenues.

North America Performance

The decline in North America revenues in fiscal 2015 versus the prior year was driven primarily by the decline in

Service Revenues. The decline in North America Total Paid Weeks primarily resulted from the lower Incoming Active

Base at the beginning of fiscal 2015 versus the beginning of fiscal 2014 as well as from lower recruitments in fiscal

2015 versus the prior year. In response to weakening recruitment trends in early fiscal 2015, North America introduced

new advertising and promotions which benefitted year-over-year recruitment trends in both the second and third

quarters of fiscal 2015. In the fourth quarter of fiscal 2015, following the announcement of our partnership with

Ms. Winfrey in October and our early December launch of our new program through the end of fiscal 2015,

recruitments increased as compared to the same period in the prior year.

The decline in North America product sales and other in fiscal 2015 versus the prior year was driven primarily by

a decline in in-meeting product sales and to a lesser extent a decline in licensing revenue. In fiscal 2015, in-meeting

product sales of $64.8 million decreased by $20.4 million, or 23.9%, versus the prior year. This decrease resulted

primarily from a 17.5% attendance decline in fiscal 2015 as compared to the prior year. In-meeting product sales per

attendee decreased by 7.7%, or 6.8% on a constant currency basis, in fiscal 2015 versus the prior year, driven primarily

by a decline in sales across most product categories. Licensing revenue of $27.5 million declined $9.7 million, or

26.1%, from $37.2 million in the prior year.

United Kingdom Performance

The decline in UK revenues in fiscal 2015 versus the prior year was driven primarily by the decline in Service

Revenues. The decline in UK Total Paid Weeks was driven by the lower Incoming Active Base at the beginning of

fiscal 2015 versus the beginning of fiscal 2014 coupled with lower recruitments in fiscal 2015 as compared to the prior

year. Recruitments in the UK Online business increased in fiscal 2015 as compared to fiscal 2014 driven by the use of

new promotional tactics.

The decline in UK product sales and other in fiscal 2015 versus the prior year was driven by both the decline in

in-meeting product sales and the decline in licensing revenue. In fiscal 2015, in-meeting product sales of $23.8 million

decreased by $6.4 million, or 21.1%, versus fiscal 2014. Excluding the impact of foreign currency, which negatively

impacted in-meeting product sales for fiscal 2015 by $2.0 million, in-meeting product

52