WeightWatchers 2015 Annual Report Download - page 87

Download and view the complete annual report

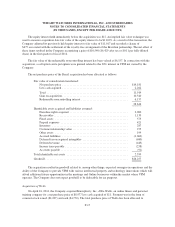

Please find page 87 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

maintenance and enhancements, including the cost of website content, which do not result in additional

functionality, are expensed as incurred.

Revenue Recognition:

WWI earns revenue by conducting meetings, for which it charges a fee, predominantly through monthly

commitment plans, prepayment plans or the “pay-as-you-go” arrangement. WWI also earns revenue from

monthly subscriptions for its Online products, selling products in its meetings, on the Internet and to its

franchisees, collecting commissions from franchisees, collecting royalties related to licensing agreements, selling

magazine subscriptions, selling advertising space on its website and in copies of its magazines, ecommerce fees

and By Mail product sales.

Monthly commitment plans, prepaid meeting fees and magazine subscription revenue is recorded to

deferred revenue and amortized into revenue over the period earned. Online Subscription Revenues, consisting of

the fees associated with subscriptions for the Company’s Online subscription products, including its Personal

Coaching product, are recognized over the period that products are provided. One-time sign-up fees are deferred

and recognized over the expected customer relationship period. Online Subscription Revenues that are paid in

advance are deferred and recognized on a straight-line basis over the subscription period. Revenue from “pay-as-

you-go” meeting fees, product sales, ecommerce fees, By Mail, commissions and royalties is recognized when

services are rendered, products are shipped to customers and title and risk of loss pass to the customers, and

commissions and royalties are earned, respectively. Revenue from advertising in magazines is recognized when

advertisements are published. Revenue from magazine sales is recognized when the magazine is sent to the

customer. In the meetings business, WWI generally charges non-refundable registration and starter fees in

exchange for an introductory information session and materials it provides to new members. Revenue from these

registration and starter fees is recognized when the service and products are provided, which is generally at the

same time payment is received from the customer. Discounts to customers, including free registration offers, are

recorded as a deduction from gross revenue in the period such revenue was recognized. Revenue from

advertising on its website is recognized when the advertisement is viewed by the user.

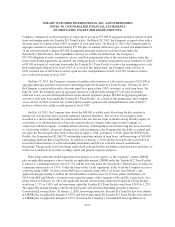

The Company grants refunds in aggregate amounts that historically have not been material. Because the

period of payment of the refund generally approximates the period revenue was originally recognized, refunds

are recorded as a reduction of revenue when paid.

Advertising Costs:

Advertising costs consist primarily of television and digital media. All costs related to advertising are

expensed in the period incurred, except for media production-related costs, which are expensed the first time the

advertising takes place. Total advertising expenses for the fiscal years ended January 2, 2016, January 3, 2015

and December 28, 2013 were $191,060, $251,954, and $285,298, respectively.

Income Taxes:

Deferred income tax assets and liabilities result primarily from temporary differences between the financial

statement and tax bases of assets and liabilities, using enacted tax rates in effect for the year in which differences

are expected to reverse. If it is more-likely-than-not that some portion of a deferred tax asset will not be realized,

a valuation allowance is recognized. The Company considers historic levels of income, estimates of future

taxable income and feasible tax planning strategies in assessing the need for a tax valuation allowance.

F-12