WeightWatchers 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

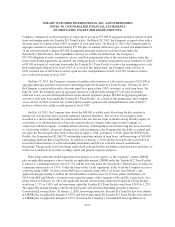

January 2, 2016, borrowings under the Revolving Facility bore interest at LIBOR plus an applicable margin of

2.50%. On a quarterly basis, the Company will pay a commitment fee to the lenders under the Revolving Facility

in respect of unutilized commitments thereunder, which commitment fee will fluctuate depending upon the

Company’s Consolidated Leverage Ratio. Based on the Company’s Consolidated Leverage Ratio as of January 2,

2016, the commitment fee was 0.50% per annum. For the fiscal year ended January 2, 2016, the Company paid

$186 in commitment fees. The Company also will pay customary letter of credit fees and fronting fees under the

Revolving Facility, which totaled $48 for the fiscal year ended January 2, 2016.

The Credit Agreement contains customary covenants including covenants that, in certain circumstances,

restrict the Company’s ability to incur additional indebtedness, pay dividends on and redeem capital stock, make

other payments, including investments, sell its assets and enter into consolidations, mergers and transfers of all or

substantially all of its assets. The WWI Credit Facility does not require the Company to meet any financial

maintenance covenants and is guaranteed by certain of the Company’s existing and future subsidiaries.

Substantially all of the Company’s assets secure the WWI Credit Facility.

At January 2, 2016 and January 3, 2015, the Company’s debt consisted entirely of variable-rate instruments.

Interest rate swaps were entered into to hedge a portion of the cash flow exposure associated with the Company’s

variable-rate borrowings. The weighted average interest rate on the Company’s debt, exclusive of the impact of

swaps, was approximately 3.93% and 3.90% per annum based on interest rates at January 2, 2016 and January 3,

2015, respectively. The weighted average interest rate on the Company’s debt, including the impact of swaps,

was approximately 5.03% and 4.93% per annum based on interest rates at January 2, 2016 and January 3, 2015,

respectively.

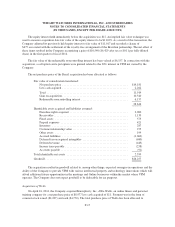

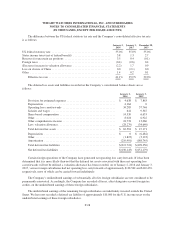

Maturities

At January 2, 2016, the aggregate amounts of the Company’s existing long-term debt maturing in each of

the next five fiscal years were as follows:

2016 ........................................................... $ 213,323

2017 ........................................................... 21,000

2018 ........................................................... 21,000

2019 ........................................................... 21,000

2020 ........................................................... 1,958,250

$2,234,573

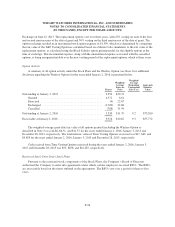

8. Treasury Stock

On October 9, 2003, the Company’s Board of Directors authorized and the Company announced a program

to repurchase up to $250,000 of the Company’s outstanding common stock. On each of June 13, 2005, May 25,

2006 and October 21, 2010, the Company’s Board of Directors authorized and the Company announced adding

$250,000 to the program. The repurchase program allows for shares to be purchased from time to time in the

open market or through privately negotiated transactions. No shares will be purchased from Artal Holdings,

Sp. z o.o., Succursale de Luxembourg and its parents and subsidiaries under the program. The repurchase

program currently has no expiration date.

During the fiscal years ended January 2, 2016, January 3, 2015 and December 28, 2013, the Company

purchased no shares of its common stock in the open market under the repurchase program. As of the end of

fiscal 2015, $208,933 remained available to purchase shares of our common stock under the repurchase program.

F-22