WeightWatchers 2015 Annual Report Download - page 89

Download and view the complete annual report

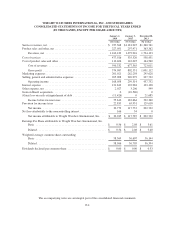

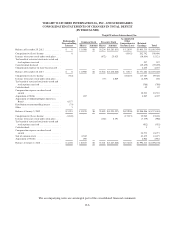

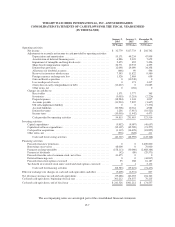

Please find page 89 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

December 28, 2013 the cumulative balance of changes in fair value of derivative instruments, net of taxes, was

$(23,135), $(21,856) and $(4,603), respectively. At January 2, 2016, January 3, 2015 and December 28, 2013, the

cumulative balance of the effects of foreign currency translations, net of taxes, was $(14,130) and $1,906 and

$13,120, respectively.

Restructuring Expense:

The Company records estimated expense for restructuring initiatives when such costs are deemed probable

and estimable, when approved by the appropriate corporate authority and by accumulating detailed estimates of

costs for such plans. These expenses include the estimated costs of employee severance and related benefits,

impairment or accelerated depreciation of property, plant and equipment and capitalized software, and any other

qualifying exit costs. Such costs represent the Company’s best estimate, but require assumptions about the plans

that may change over time, including attrition rates. Estimates are evaluated periodically to determine whether an

adjustment is required.

Reclassification:

Certain prior year amounts have been reclassified to conform to the current year presentation.

3. Winfrey Transaction

On October 18, 2015 (the “Agreement Date”), the Company entered into the following agreements with

Oprah Winfrey: a Strategic Collaboration Agreement, the Winfrey Purchase Agreement (defined below), and the

Winfrey Option Agreement (defined below). The transactions contemplated by these agreements are collectively

referred to herein as the “Winfrey Transaction”. Details of the Strategic Collaboration Agreement, Winfrey

Purchase Agreement and Winfrey Option Agreement are below. See Note 21 for related party transactions with

Ms. Winfrey.

Strategic Collaboration Agreement

The Company and Ms. Winfrey granted each other certain intellectual property rights under the Strategic

Collaboration Agreement. The agreement has an initial term of five years, with additional successive one-year

renewal terms. During the term of this agreement, Ms. Winfrey will consult with the Company and participate in

developing, planning, executing and enhancing the Weight Watchers program and related initiatives, and provide

it with services in her discretion to promote the Company and its programs, products and services.

Winfrey Purchase Agreement

On October 19, 2015, pursuant to the Share Purchase Agreement between the Company and Ms. Winfrey

(the “Winfrey Purchase Agreement”), the Company issued and sold to Ms. Winfrey an aggregate of 6,362 shares

of the Company’s common stock (the “Purchased Shares”) at a price per share of $6.79 for an aggregate cash

purchase price of $43,199. The Company recorded fees related to the issuance of the Purchased Shares totaling

$2,315, of which $1,700 was recorded as a reduction of equity. The Purchased Shares are subject to certain

demand registration rights and piggyback rights held by Ms. Winfrey under the Winfrey Purchase Agreement.

The Purchased Shares may not be transferred by Ms. Winfrey within the first two years of the Agreement

Date, subject to certain limited exceptions. Thereafter, Ms. Winfrey may generally transfer up to 15% of the

F-14