WeightWatchers 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to deliver against healthcare market needs. Management continues to believe that the Company has sufficient

liquidity to execute the transformation plan and does not believe the Company is constrained by its capital

structure. See “— Liquidity and Capital Resources”. While the Company’s turnaround is taking longer than

management had previously anticipated, we made significant progress against this plan in fiscal 2015.

Management remains committed to this transformation plan and its underlying strategies and is optimistic about

the resulting turnaround.

Market Trends

We believe that our revenues and profitability can be sensitive to major trends in the weight management

industry. In particular, we believe that our business could be adversely impacted by:

• increased competition from Internet, free mobile and other weight management apps and other

electronic weight management approaches;

• the development of more effective or more favorably perceived weight management methods,

including pharmaceuticals;

• a failure to develop and market new, innovative services and products or to successfully expand into

new channels of distribution or respond to consumer trends, including consumer focus on integrated

lifestyle and fitness approaches;

• a failure to successfully implement new strategic initiatives;

• a decrease in the effectiveness of our marketing, advertising, and social media programs;

• an impairment of the Weight Watchers brand and our other intellectual property;

• a failure of our technology or systems to perform as designed; and

• a downturn in general economic conditions or consumer confidence.

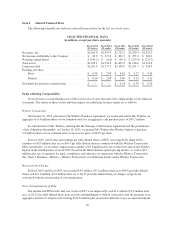

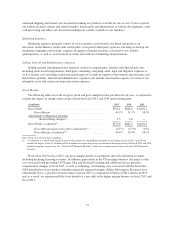

North America Metrics and Business Trends

In fiscal 2013, North America Total Paid Weeks declined 6.6%, driven by a decline in both Meeting Paid

Weeks of 9.4% and Online Paid Weeks of 4.4%, versus the prior year. The decline in Meeting Paid Weeks

primarily resulted from the lower Incoming Active Base in the meetings business at the beginning of fiscal 2013

versus the beginning of fiscal 2012 as well as from lower enrollments in fiscal 2013 versus the prior year,

primarily in the United States, due to the difficulty in attracting members to our brand.

In fiscal 2014, North America Total Paid Weeks declined 16.8%, driven by a decline in both Online Paid

Weeks of 17.5% and Meeting Paid Weeks of 15.8%, versus the prior year. Despite the launch of the new Simple

Start program at the beginning of the year, as well as new advertising and promotional tactics, recruitment

softness continued throughout the year. The popularity of activity monitors and free apps resulted in increased

competition which exacerbated the negative trend we began to experience in fiscal 2013 in subscriptions for our

Online subscription products. In addition, the increasing focus of consumers on more integrated lifestyle and

fitness approaches rather than just food, nutrition and diet also negatively impacted our recruitments.

In fiscal 2015, North America Total Paid Weeks declined 20.9%, driven by a decline in both Online Paid

Weeks of 22.6% and Meeting Paid Weeks of 18.8%, versus the prior year. The decline in North America Total

Paid Weeks primarily resulted from the lower Incoming Active Base at the beginning of fiscal 2015 versus the

beginning of fiscal 2014 as well as from lower recruitments in fiscal 2015 versus the prior year. In response to

weakening recruitment trends in early fiscal 2015, North America introduced new advertising and promotions.

Although recruitments remained lower year-over-year in fiscal 2015, the year-over-year recruitment trend in the

second and third quarters of fiscal 2015 improved as compared to the first quarter of fiscal 2015, benefitting

from these actions. In the fourth quarter of fiscal 2015, following the announcement of our partnership with

Ms. Winfrey in October and our early December launch of our new program through the end of the fiscal 2015,

recruitments increased as compared to the same period in the prior year.

40