WeightWatchers 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.negatively impacted our revenues for fiscal 2015 by $74.4 million, revenues in fiscal 2015 would have declined

16.3% versus fiscal 2014. See “—Segment Results” for additional details on revenues.

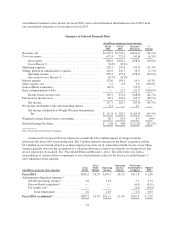

Cost of Revenues and Gross Profit

Total cost of revenues in fiscal 2015 declined $ 87.0 million, or 12.8%, versus the prior year. Excluding the

impact of the 2015 and 2014 restructuring charges from fiscal 2015 and fiscal 2014, as applicable, total cost of

revenues in fiscal 2015 would have declined $83.9 million, or 12.5%, versus the prior year. Gross profit for fiscal

2015 declined $228.5, million or 28.5%, versus the prior year. Excluding the impact of the 2015 and 2014

restructuring charges, gross profit for fiscal 2015 would have decreased by $231.6 million, or 28.7%, from fiscal

2014. Excluding the impact of foreign currency, which negatively impacted our gross profit for fiscal 2015 by

$40.9 million, gross profit in fiscal 2015 would have decreased 23.4% versus fiscal 2014. Excluding the impact

of the 2015 and 2014 restructuring charges, gross margin in fiscal 2015 would have been 49.4% as compared to

gross margin of 54.5% in fiscal 2014. Gross margin compression was driven primarily by the decline in the

North America gross margin. The decline in North America gross margin was driven primarily by fixed cost

deleverage, and the impact of costs to support 24/7 Expert Chat and technology cost in support of our strategic

initiatives. See “—Transformation Plan” for a discussion of our strategic initiatives.

Marketing

Marketing expenses for fiscal 2015 decreased $61.2 million, or 23.3%, versus fiscal 2014. Excluding the

impact of foreign currency, which decreased marketing expenses for fiscal 2015 by $13.7 million, marketing

expenses in fiscal 2015 would have declined 18.1% versus fiscal 2014. The decline in marketing expense was

primarily driven by lower TV media and production costs globally as well as lower agency fees and celebrity and

talent costs primarily in the United States. Marketing expenses as a percentage of revenue were 17.3% in fiscal

2015 as compared to 17.7% in the prior year.

Selling, General and Administrative

Selling, general and administrative expenses for fiscal 2015 decreased $36.0 million, or 14.9%, versus fiscal

2014. Excluding the impact of foreign currency, which decreased selling, general and administrative expenses for

fiscal 2015 by $8.5 million, selling, general and administrative expenses in fiscal 2015 would have declined

11.4% versus fiscal 2014. Excluding the impact of restructuring charges from fiscal 2015 and the expenses

associated with the Winfrey Transaction, and excluding the impact of restructuring charges from fiscal 2014,

selling, general and administrative expenses for fiscal 2015 would have decreased by 21.1%, or 17.5% on a

constant currency basis, versus fiscal 2014. In fiscal 2015, the Company continued its concerted efforts to reduce

costs and continued to invest in certain strategic initiatives during fiscal 2015 which partially offset its reduced

costs. See “—Transformation Plan” for a discussion of our strategic initiatives. Selling, general and

administrative expenses as a percentage of revenue for fiscal 2015 increased to 17.6% from 16.3% for fiscal

2014. Excluding the impact of restructuring charges and the expenses associated with the Winfrey Transaction

from fiscal 2015, and excluding the impact of restructuring charges from fiscal 2014, on a constant currency

basis, selling, general and administrative expenses as a percentage of revenue for fiscal 2015 would have been

15.6% as compared to 15.8% for fiscal 2014.

Operating Income

Operating income for fiscal 2015 decreased $131.3 million, or 43.9%, versus fiscal 2014. Excluding the

impact of foreign currency, which negatively impacted operating income for fiscal 2015 by $18.7 million,

operating income in fiscal 2015 would have declined 37.6% versus the prior fiscal year. This decrease in

operating income was predominately the result of lower operating income from North America in fiscal 2015 as

compared to the prior year. Excluding the impact of restructuring charges and the expenses associated with the

Winfrey Transaction from fiscal 2015, and excluding the impact of restructuring charges from fiscal 2014, our

49