Volvo 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

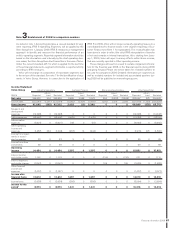

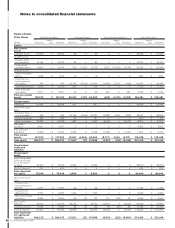

89

Financial information 2008

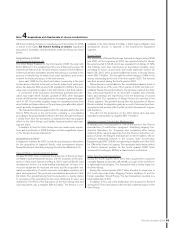

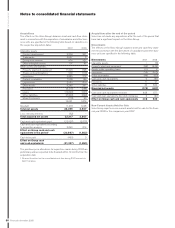

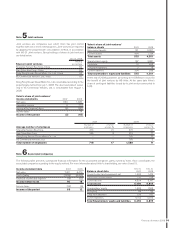

Note 4 Acquisitions and divestments of shares in subsidiaries

AB Volvo’s holding of shares in subsidiaries as of December 31, 2008

is shown in the table, AB Volvo’s holding of shares. Signifi cant

acquisitions, formations and divestments within the Group are listed

below.

Acquisitions in 2008

VE Commercial Vehicles Ltd.

The Volvo Group fi nalized, in the third quarter 2008, the deal with

Eicher Motors for the establishment of a new Indian joint venture, VE

Commercial Vehicles Ltd. The joint venture comprises Eicher Motors’

entire truck and bus operations and the Volvo Group is currently in the

process of transferring its Indian truck sales operations and service

network for trucks and buses, to the joint venture.

Volvo paid 1,845 for the direct and indirect ownership in the joint

venture and contributed to the joint venture its Indian truck sales oper-

ations fair valued at 530, whereof 234 equivalent to 50% of the over-

value, was recognized as a gain in the Volvo Group in the third quarter.

In connection to the acquisition, a preliminary purchase price allo-

cation was made which includes goodwill of 855, other intangible

assets of 564 and fair value adjustments on property, plant and equip-

ment of 157. The monthly negative impact on operating income from

amortization and depreciation on the purchase price allocation adjust-

ments amounts to approximately 7.

The transaction has been approved by the requisite authorities and

Volvo’s 50% interest in the joint-venture company is consolidated

according to the proportionate method in the Volvo Group from August

1 2008. Short term, the transaction is expected to have only marginal

effect on the Volvo Group’s profi tability, fi nancial position and earn-

ings per share.

In addition to that, the Volvo Group has only made minor acquisi-

tions and divestments in 2008 that have not had a signifi cant impact

on the Group’s fi nancial statements.

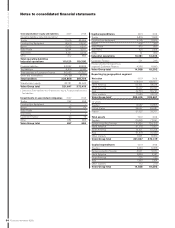

Acquisitions in 2007

Comparison numbers for 2007 include the purchase price allocations

for the acquisition of Ingersoll Rand’s road development division,

Nissan Diesel and Shandong Lingong Construction Machinery Co.

Ingersoll Rand’s road development division

On April 30 2007, Volvo completed the acquisition of American Inger-

soll Rand’s road development division, with the exception of the oper-

ations in India, which followed on May 4, 2007. Ingersoll Rand’s road

development division is a world-leading manufacturer of heavy con-

struction equipment for road and soil work, and the acquisition was

mainly an acquisition of assets; accounts receivables, inventory and

plant and equipment. The purchase consideration amounted to SEK

9.2 billion. The goodwill arising from the acquisition is mainly related

to synergies at the operating income level, attributed to sales and

distribution. The effect of the acquisition on the Volvo Group cash and

cash equivalents was a negative SEK 9.2 billion. The division is con-

solidated in the Volvo Group from May 1, 2007. Ingersoll Rand’s road

development division is reported in the Construction Equipment

segment.

Nissan Diesel

The acquisition of Nissan Diesel was achieved in stages during 2006

and 2007. At the beginning of 2007, the reported value for Nissan

Diesel amounted to 5,445, which was equivalent to holdings of 19%.

The holdings were then reported as an associated company, since

according to Volvo’s assessment, Volvo held signifi cant control. On

March 29, 2007, Volvo acquired additional shares in Nissan Diesel,

worth SEK 7.4 billion. This brought the total holdings to 96% of the

shares outstanding at the end of the fi rst quarter 2007. The minority

was then acquired during the fourth quarter 2007.

Nissan Diesel is consolidated in the consolidated balance sheet of

the Volvo Group as of the end of fi rst quarter of 2007. As Volvo con-

solidated Nissan Diesel according to the purchase method, the hold-

ings previosusly-reported as an associate company was reversed.

Sales and earnings are reported as from the beginning of second

quarter 2007. The operations of Nissan Diesel are reported in the

Trucks segment. The goodwill arising from the acquisition of Nissan

Diesel is related to integration gains as a result of increased purchas-

ing volumes and positive effects within product development, engines

and drivelines.

The effect of the acquisition on the Volvo Group cash and cash

equivalents amounted to a negative SEK 11.9 billion.

Shandong Lingong Construction Machinery Co.

In January 2007, the acquisition of 70% of the shares in the Chinese

manufacturer of construction equipment, Shandong Lingong Con-

struction Machinery Co. (Lingong), was completed, after having

obtained all the requisite approvals from the Chinese authorities. Lin-

gong is China’s third-largest manufacturer of wheel-loaders, with an

extensive dealership network in the country. Volvo Construction

Equipment paid CNY 328 M, corresponding to slightly more than 300,

for 70% of the shares in Lingong. The transaction had a limited effect

on Volvo’s fi nancial position. In the fourth quarter 2008, Volvo

increased its holdings to 85% by a shareholder’s contribution.

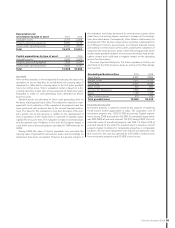

Other divestment and acquisitions

During the fourth quarter 2007, Volvo Aero acquired the composite

company Applied Composites AB, ACAB, as a part of the investment

in lightweight technologies. The transaction had a limited impact on

the Volvo Group.

During the second quarter 2007, Volvo divested its ownership in

U.S. truck stop chain Petro Stopping Centers Holding L.P. and the

former subsidiary Sörred Energi. The two transactions resulted in a

total capital gain of 516.

In addition to this, only a few dealerships were acquired or divested

during 2007. These transactions did not have a material impact on the

Volvo Group.