Volvo 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

Financial information 2008

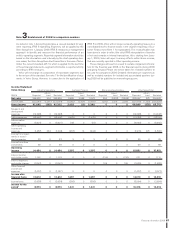

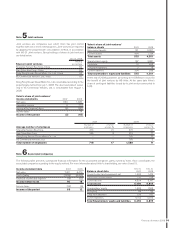

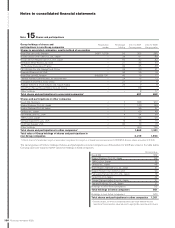

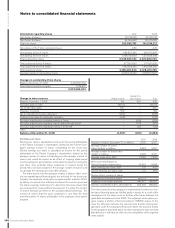

Specifi cation of deferred tax assets

and tax liabilities 2007 2008

Deferred tax assets:

Unused tax loss carryforwards 1,257 1,839

Other unused tax credits 97 100

Intercompany profi t in inventories 666 810

Valuation allowance for doubtful receivables 589 689

Provisions for warranties 1,510 1,596

Provisions for residual value risks 371 407

Provisions for

post-employment benefi ts 2,876 3,197

Provisions for restructuring measures 23 123

Adjustment to fair value at company

acquisitions 1,782 13

Fair value of derivative instruments 127 1,108

Other deductible temporary differences 3,066 6,366

Deferred tax assets before

deduction for valuation allowance 12,364 16,248

Valuation allowance (156) (245)

Deferred tax assets after

deduction for valuation allowance 12,208 16,003

2007 2008

Deferred tax liabilities:

Accelerated depreciation on property,

plant and equipment 2,660 3,885

Accelerated depreciation on leasing

assets 1,368 1,902

LIFO valuation of inventories 185 263

Capitalized product and

software development 2,021 4,244

Adjustment to fair value at company

acquisitions 2,885 503

Untaxed reserves 1,008 300

Fair value of derivative instruments 197 26

Other taxable temporary differences 2,228 1,960

Deferred tax liabilities 12,552 13,083

Deferred tax assets/liabilities, net1(344) 2,920

1 Deferred taxes are partially recognized in the balance sheet on a net basis

after taking into account offsetting possibilities. Changes in tax rates during

2008 and 2009 have been considered when measuring deferred tax assets

and deferred tax liabilities and have affected the income tax cost of the

year. Deferred tax assets and liabilities have been measured to the tax rates

that are expected to apply to the period when the asset is realized or the

liability is settled. Changes in tax rates are mostly related to Sweden, and

has had a positive effect of about 200.

The cumulative amount of undistributed earnings in foreign subsidiar-

ies, which Volvo currently intends to indefi nitely reinvest outside of

Sweden and upon which deferred income taxes have not been pro-

vided is approximately SEK 45 billion (43) at year end. There are dif-

ferent taxation rules depending on country, in some countries divi-

dends are not taxable and in some countries there are withholding

taxes. See note 36 how Volvo handles equity currency risk.

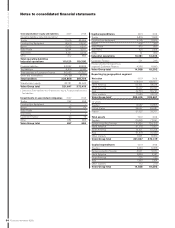

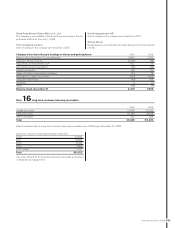

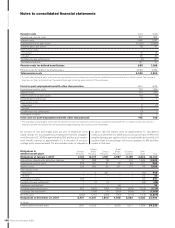

Note 14 Intangible and tangible assets

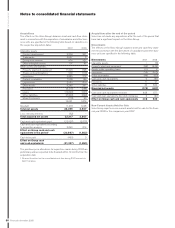

Note 13 Minority interests

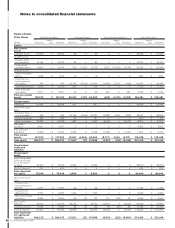

Intangible assets, acquisition costs Goodwill1

Entrance

fees, industrial

programs

Product and

software

development

Other

intangible

assets

Total

intangible

assets

Value in balance sheet 2007 19,969 3,168 19,123 5,387 47,647

Capital expenditures 0 399 2,150 326 2,875

Sales/scrapping 00(549) (14) (563)

Acquired and divested operations31,028 0 185 381 1,594

Translation differences 3,634 2 2,386 1,287 7,309

Reclassifi cations and other 182 0 (5) (380) (203)

Value in balance sheet 2008 24,813 3,569 23,290 6,987 58,659

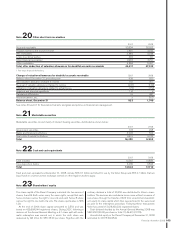

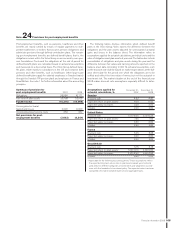

Minority interests in income (loss) for the period and in shareholders’ equity consisted mainly of the minority interests in Volvo Aero Norge A/S

(22%), in Wuxi da Hao Power Co, Ltd (30%), in Berliet Maroc S.A (30%), in Shandong Lingong Construction Machinery Co, Ltd (15%) as well

as in Nissan Diesel South Africa (Pty) Ltd (20%).