Volvo 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

Financial information 2008

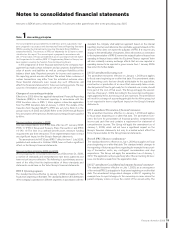

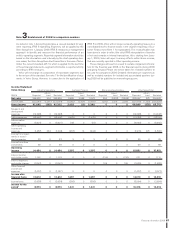

Note 3 Restatement of 2008 for comparison numbers

As stated in note 1 Accounting pinciples, a revised standard for seg-

ment reporting, IFRS 8 Operating Segments, will be applied by the

Volvo Group from 1 January 2009. IFRS 8 introduces a ‘management

approach’ to identify and measure the fi nancial performance of an

entity’s operating segments. Reported segment information should be

based on the information used internally by the chief operating deci-

sion maker, the Volvo Group Executive Committee in the case of Volvo.

Under the current standard, IAS 14, which is applied for the last time

in these fi nancial statements, segment information is reported strictly

according to IFRS measures.

Volvo will not change its composition of reportable segments due

to the revision of the standard. See note 7 for the identifi cation of seg-

ments in Volvo Group. However, in connection to the application of

IFRS 8 in 2009, Volvo will no longer reclassify operating leases on a

consolidated level to fi nance leases in the segment reporting of Cus-

tomer Finance (see Note 1 for explanation). The reclassifi cation has

been done in order to refl ect the strict IFRS interpretation of transfer

of risk and rewards in internal transactions. Also, starting from Janu-

ary 1, 2009, Volvo will report currency effects within Gross income,

that are currently reported in Other operating income.

These changes will result in a need to restate comparison informa-

tion for the fi nancial year 2008, in the fi nancial reports during 2009

and going forward. Please see below tables for restated numbers to

be used for comparison 2009. Detailed information per segments as

well as restated numbers for isolated and accumulated quarters dur-

ing 2008 will be published on www.volvogroup.com.

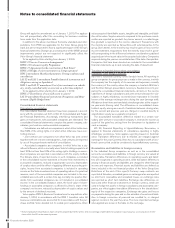

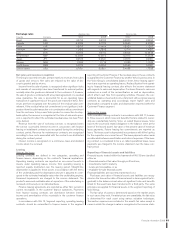

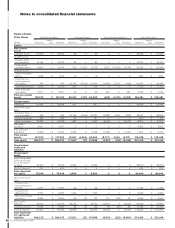

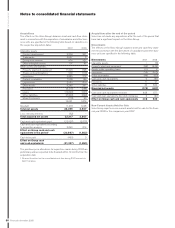

Income Statement

Volvo Group Industrial operations Customer Finance Elim and reclassifi cations Volvo Group Total

SEK M Reported

Adjust-

ment Restated Reported

Adjust-

ment Restated Reported

Adjust-

ment Restated Reported

Adjust-

ment Restated

Net sales 294,932 904 295,836 8,485 2,588 11,073 250 (2,518) (2,268) 303,667 975 304,642

Cost of sales (232,247) (1,267) (233,514) (5,082) (2,601) (7,683) (250) 2,518 2,268 (237,578) (1,350) (238,928)

Gross income 62,685 (363) 62,322 3,403 (13) 3,390 000 66,089 (376) 65,713

Research and

development

expenses (14,348) 0 (14,348) 000 000 (14,348) 0 (14,348)

Selling expenses (25,597) 0 (25,597) (1,532) 0 (1,532) 000 (27,129) 0 (27,129)

Administrative

expenses (6,921) 0 (6,921) (19) 0 (19) 000 (6,940) 0 (6,940)

Other operating

income and

expenses (1,457) 363 (1,094) (457) 13 (444) 000 (1,915) 376 (1,539)

Income from invest-

ments in associ-

ated companies 23 0 23 202 000 25 0 25

Income from other

investments 69 0 69 000 000 69 0 69

Operating

income 14,454 0 14,454 1,397 0 1,397 000 15,851 0 15,851

Interest income

and similar credits 1,297 0 1,297 000 (126) 0 (126) 1,171 0 1,171

Interest expenses

and similar charges (2,061) 0 (2,061) 000 126 0 126 (1,935) 0 (1,935)

Other fi nancial

income and

expenses (1,077) 0 (1,077) 00 0 000 (1,077) 0 (1,077)

Income after

fi nancial items 12,612 0 12,612 1,397 0 1,397 000 14,010 0 14,010

Income taxes (3,638) 0 (3,638) (356) 0 (356) 000 (3,994) 0 (3,994)

Income for the

period* 8,974 0 8,974 1,041 0 1,041 000 10,016 0 10,016