Volvo 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated fi nancial statements

98

THE VOLVO GROUP

Financial information 2008

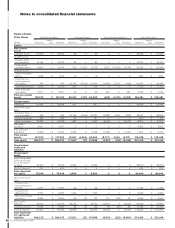

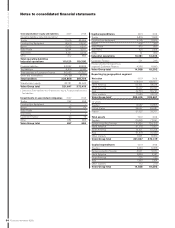

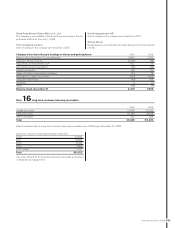

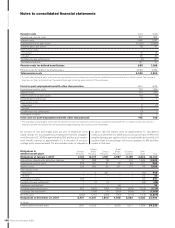

Accumulated depreciation and amortization Goodwill

Entrance

fees, industrial

programs

Product and

software

development

Other

intangible

assets

Total

intangible

assets

Value in balance sheet 2007 – 1,639 7,954 1,546 11,139

Depreciation and amortization – 60 2,864 362 3,286

Write-downs –––––

Sales/scrapping – 0 (547) (12) (559)

Acquired and divested operations3 – 0 (16) 0 (16)

Translation differences – 0 633 209 842

Reclassifi cations and other – 0 21 (12) 9

Value in balance sheet 2008 0 1,699 10,909 2,093 14,701

Net carrying value in balance sheet 2008424,813 1,870 12,381 4,894 43,958

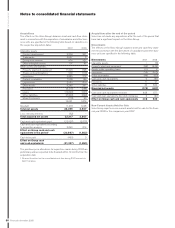

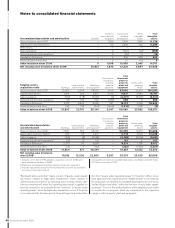

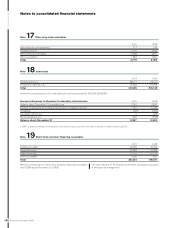

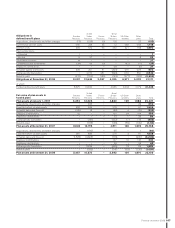

Tangible assets,

acquisition costs Buildings

Land and land

improvements

Machinery

and equipment2

Construction

in progress,

including

advance

payments

Total

investment

property,

property,

plant and

equipment

Assets under

operating

leases

Total

tangible

assets

Value in balance sheet 2007 25,903 9,544 58,992 3,166 97,605 32,975 130,580

Capital expenditures 1,504 328 4,410 3,735 9,977 5,440 15,417

Sales/scrapping (319) (118) (2,567) (3) (3,007) (5,397) (8,404)

Acquired and divested operations366 196 532 (239) 555 0555

Translation differences 4,218 2,603 8,055 297 15,173 3,359 18,532

Reclassifi cations and other 525 148 (278) (1,609) (1,214) 1,205 (9)

Value in balance sheet 2008 31,897 12,701 69,144 5,347 119,089 37,582 156,671

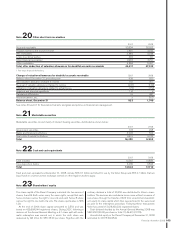

Accumulated depreciation

and amortization Buildings

Land and land

improvements

Machinery

and equipment2

Construction

in progress,

including

advance

payments

Total

investment

property,

property,

plant and

equipment

Assets under

operating

leases

Total

tangible

assets

Value in balance sheet 2007 11,831 559 38,005 – 50,395 10,473 60,868

Depreciation and amortization5983 65 4,670 – 5,718 4,520 10,238

Sales/scrapping (192) (8) (2,288) – (2,488) (2,993) (5,481)

Acquired and divested operations3(13) 0 115 – 102 0102

Translation differences 2,270 50 5,994 – 8,314 1,158 9,472

Reclassifi cations and other (75) 5 (152) – (222) (1,005) (1,227)

Value in balance sheet 2008 14,804 671 46,344 – 61,819 12,153 73,972

Net carrying value in balance

sheet 2008417,093 12,030 22,800 5,347 57,270 25,429 82,699

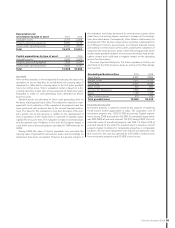

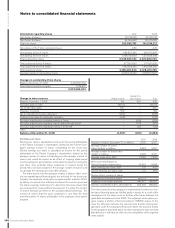

1 Includes on the date of IFRS adoption, acquisition costs of 14,184 and

accumulated amortization of 3,863.

2 Machinery and equipment pertains mainly to production equipment.

3 Includes subsidiaries and joint ventures that previously were accounted for

according to the equity method.

4 Acquisition costs less accumulated depreciation, amortization and write-downs.

5 Of which write-down 57 (0).

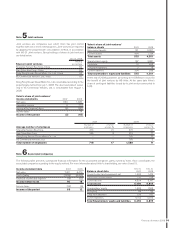

“Reclassifi cations and other” mainly consist of “assets under operat-

ing leases” related to legal sales transactions, where revenue is

deferred and accounted for as operating lease revenue. Assets clas-

sifi ed as inventory will, when the operating lease model is applied for

revenue recognition, be reclassifi ed from “inventory” to “assets under

operating leases”, when the legal sales transaction occurs. If the prod-

uct is returned after the lease period, there will again be a reclassifi ca-

tion from “assets under operating leases” to “inventory”. When a buy-

back agreement has expired, but the related product is not returned,

the acquisition cost and the accumulated depreciation are reversed in

“reclassifi cation and other”, within the line item “assets under operat-

ing leases”. Some of the reclassifi cations within tangible assets relate

to construction in progress, which are reclassifi ed to the respective

category within property, plant and equipment.