Volvo 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial strategy

The purpose of Volvo’s long-term fi nancial strategy is to ensure the best use

of Group funds in providing shareholders with a favorable return and offer-

ing creditors reliable security. The Volvo Group’s three fi nancial targets are:

Growth, Operating Margin and Capital Structure.

Focus on commercial

transport solutions

The streamlining of the Volvo Group, which

commenced with the sale of passenger car

operations in 1999 and continued in the form

of a number of acquisitions, has created a

strong group with a focus on commercial vehi-

cles and equipment. The Volvo Group’s new

composition has provided resources which

have been reinvested in product development,

acquisitions and efforts for geographic expan-

sion. In turn, this has resulted in geographic

and product diversifi cation that has also

reduced risk in the company. Moreover, the

Volvo Group’s stronger focus on aftermarket

operations, which are less sensitive to eco-

nomic trends, has contributed to reducing risk.

The organization with business units with

Group-wide responsibility for engines and

product development, purchasing and product

planning has fuelled in-house effi ciency pro-

grams to ensure the realization of considerable

potential synergies that have been created.

Individually, the Group's business areas have

strong positions in their particular markets, in

part thanks to capitalizing fully on the potential

offered for coordination and cooperation deriv-

ing from the dramatically higher volumes of

engines and other products.

Financial strategy

The purpose of Volvo’s long-term fi nancial

strategy is to ensure the best use of Group

funds in providing shareholders with a favorable

return and offering creditors reliable security.

A prerequisite for the long-term competitive

development of the company is the availability

of suffi cient fi nancial resources to secure

investments, thereby maintaining a strategically

competitive position in all business areas.

The Volvo Group’s capital is intended for

organic growth, the fi nancing of acquisitions

and for maintaining a high level of fi nancial

fl exibility.

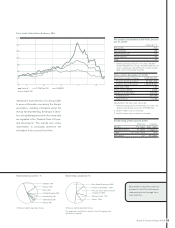

Long-term credit rating

The purpose of Volvo’s capital structure is to

balance expectations from the shareholders

and other fi nancial stakeholders. Each year,

Volvo meets with credit rating institutes to dis-

cuss the lender’s view of the company and to

assess the Group’s future ability to repay loans.

The Group’s goal is to maintain good credit

ratings as a base for favorable fi nancing

through loans.

On January 23, 2009 Standard & Poor’s

assigned an “A-“ long-term corporate credit

rating with stable outlook for AB Volvo and

affi rmed the A2 short-term rating. In their

credit report Standard & Poor’s says the

assigned rating refl ects AB Volvo’s “leading

market positions worldwide” and the fact that

“Volvo also benefi ts from a conservative fi nan-

cial profi le and high fi nancial fl exibility”. On

February 20, Standard & Poor's changed the

outlook to negative.

On February 13, the credit rating company

Moody’s Investor Services lowered AB Volvo's

long-term credit rating from A3 to Baa1 with

stable outlook and maintained the short-term

P-2 rating with stable outlook.

A high long-term credit rating provides access

to additional sources of fi nancing and improved

access to the fi nancial market.

Funding

The fi nancial crisis that dominated the second

half of 2008 and the beginning of 2009, and

the associated credit crunch, has resulted in a

high level of cautiossness among customers

with regard to investment decisions, which has

led to lower demand for Volvo’s products.

The turbulence on the global fi nancial mar-

kets affects the availability of credit lines and

loan fi nancing, which may adversely affect cus-

tomers, suppliers, distributors and the Volvo

Group. Volvo is working actively to achieve an

appropriate balance between its short-term and

long-term borrowing, and ensuring fi nancial pre-

paredness in the form of credit facilities to satisfy

the future fi nancing requirements of the Volvo

Group.

Financial targets

– Growth in net sales should increase by at

least 10% annually over a business cycle.

– Operating margin should exceed 7% for the

Group's industrial operations over the busi-

ness cycle.

– Net debt including provisions for post-

employment benefi ts in the industrial oper-

ations should be a maximum of 40% of

shareholders’ equity.

The growth target of 10% annually shall be

achieved through organic growth and through

acquisitions.

The Volvo Group’s profi tability target is that

30 Board of Directors’ Report 2008