Volvo 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

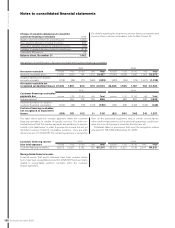

Notes to consolidated fi nancial statements

110

THE VOLVO GROUP

Financial information 2008

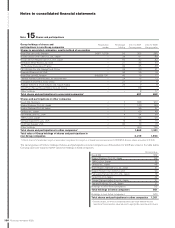

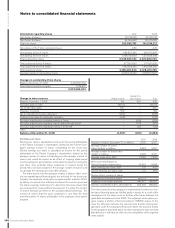

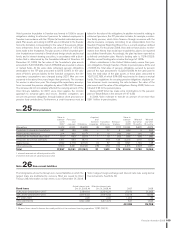

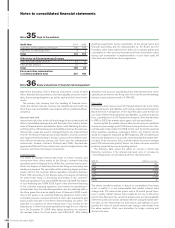

Other loans Actual interest rate,

Dec 31, 2008, %

Effective interest rate,

Dec 31, 2008, % 2007 2008

USD 2004–2008/2010–2018 2.15–5.17 2.17–5.27 3,522 10,134

EUR 2003–2008/2010–2017 3.45–6.50 3.48–6.50 4,076 5,419

GBP 2005–2008/2010–2012 2.63–6.72 2.66–6.89 520 1,952

SEK 2007–2008/2010–2017 2.69–7.98 2.72–8.22 1,228 3,778

CAD 2004–2008/2010–2013 2.84–4.07 2.87–4.13 1,518 2,712

MXN 2005–2007/2010–2012 8.81–9.33 9.17–9.74 1,239 1,197

JPY 2005–2008/2010–2016 1.22–2.07 1.22–2.08 4,631 17,076

CHF 2006/2011 2.53 2.55 1,141 735

BRL 2003/2017 8.42 8.89 2,085 2,994

Other loans 4.85–6.73 4.94–7.89 1,189 1,302

Total other non-current loans2 21,149 47,299

Deferred leasing income 2,894 2,508

Residual value liability 4,440 4,350

Other non-current fi nancial liabilities 523 1,658

Other non-current liabilities 425 995

Total 71,729 92,608

2 Whereof loans raised to fi nance the credit portfolio of the customer fi nancing operations 34,955 (13,449) and fi nancial derivatives 198 (74).

Of the above long-term loans, 374 (541) was secured.

Long-term loans mature as follows:

2010 23,951

2011 17,359

2012 6,703

2013 9,594

2014 4,500

2015 or later 20,990

Total 83,097

See note 16 for maturities of long-term customer fi nancing receivables.

Of other non-current liabilities the majority will mature within fi ve

years.

At year-end 2008, credit facilities granted but not utilized and which

can be used without restrictions amounted to approximately SEK 26.7

billion (23.2). These facilities consisted of stand-by facilities for loans

with varying maturities through the year 2013. A fee is normally

charged for the unused portion of credit facilities and is reported in

the income statement under other fi nancial income and expenses.

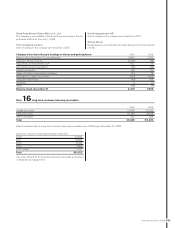

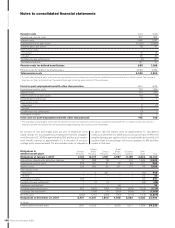

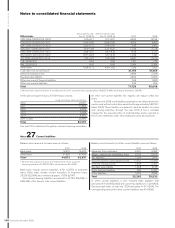

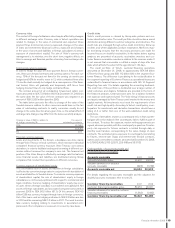

Note 27 Current liabilities

Balance sheet amounts for loans were as follows:

2007 2008

Bank loans 12,979 15,222

Other loans 31,893 47,409

Total144,872 62,631

1 Whereof loans raised to fi nance the credit portfolio of the customer

fi nancing operations 47,180 (32,797) and derivatives 604 (242).

Bank loans include current maturities, 4,701 (2,975), of long-term

loans. Other loans include current maturities of long-term loans,

26,336 (22,554), and commercial paper, 17,876 (6,547).

Non-interest-bearing liabilities accounted for 91,759 (85,406), or

59% (66) of the Group’s total current liabilities.

Balance sheet amounts for Other current liabilities were as follows:

2007 2008

Advances from customers 3,321 3,352

Wages, salaries and withholding taxes 6,703 6,978

VAT liabilities 1,524 1,455

Accrued expenses and prepaid income 12,161 13,440

Deferred leasing income 1,864 2,203

Residual value liability 1,928 2,138

Other fi nancial liabilities 982 5,430

Other liabilities 3,810 4,534

Total 32,293 39,530

In Other current liabilities is also included trade payables that

amounted to 51,025 (52,663) and current tax liabilities to 1,204 (451).

Secured bank loans at year-end 2008 amounted to 312 (264). The

corresponding amount for other current liabilities was 416 (590).