Volvo 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risks and uncertainties

All business operations involve risk – managed risk-taking is a condition of

maintaining a sustained favorable profi tability.

Risk may be due to events in the world and can

affect a given industry or market. Risk can be

specifi c to a single company. At Volvo work is

carried out daily to identify, measure and man-

age risk – in some cases the Group can infl u-

ence the likelihood that a risk-related event will

occur. In cases in which such events are

beyond the Group’s control, the Group strives

to minimize the consequences.

External-related risks – such as the

cyclical nature of the commercial vehicles

business, intense competition, changes in

prices for commercial vehicles and govern-

ment regulations;

Financial risks – such as currency fl uc-

tuations, interest levels fl uctuations, valuations

of shares or similar instruments, credit risk and

liquidity risk and;

Operational risks – such as market recep-

tion of new products, reliance on suppliers,

protection and maintenance of intangible

assets, complaints and legal actions by cus-

tomers and other third parties and risk related

to human capital.

In 2008 a new Group-wide risk manage-

ment model based on the Enterprise Risk

Management concept was introduced.

Short-term risk factors

The fi nancial turmoil and credit tightening has

led to an extreme cautiousness among cus-

tomers when it comes to deciding on invest-

ments, which in turn may cause a decrease in

demand for Volvo products.

The development of the fi nancial markets

during the second half of the year has led to an

intensifi cation of Volvo’s work with fi nancial

risks. The credit risks are continuously man-

aged through active credit monitoring and

there are regular controls that provisions are

made on incurred losses for doubtful receiv-

ables in accordance with applicable account-

ing principles.

The present market conditions also limit the

accessibility to credits and loan fi nancing,

which may negatively affect customers, sup-

pliers, dealers as well as the Volvo Group. Sup-

pliers’ fi nancial instability could result in deliv-

ery disturbances. A sound balance between

short- and long-term borrowing, as well as bor-

rowing preparedness in the form of overdraft

facilities, is intended to meet the long-term

fi nancing needs of the Volvo Group.

In the course of its operations, Volvo is

exposed to residual value risks through oper-

ating lease agreements and sales combined

with repurchase agreements. The estimated

net realizable value of the products is continu-

ously monitored on an individual basis. A

decline in prices for used trucks and equip-

ment may negatively affect the consolidated

operating income.

High inventories in the truck industry and the

construction equipment industry and low demand

may have a negative impact on the prices of used

trucks and construction equipment.

The reported amounts for contingent liabili-

ties refl ect Volvo’s risk exposure. Total contin-

gent liabilities at December 31, 2008,

amounted to SEK 9.4 billion, an increase of

SEK 1.2 billion compared to December 31,

2007. Included in the total is a contingent lia-

bility of SEK 0.6 billion pertaining to a claim on

Volvo Powertrain to pay penalties following a

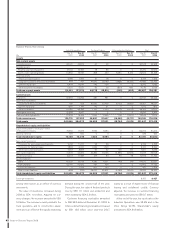

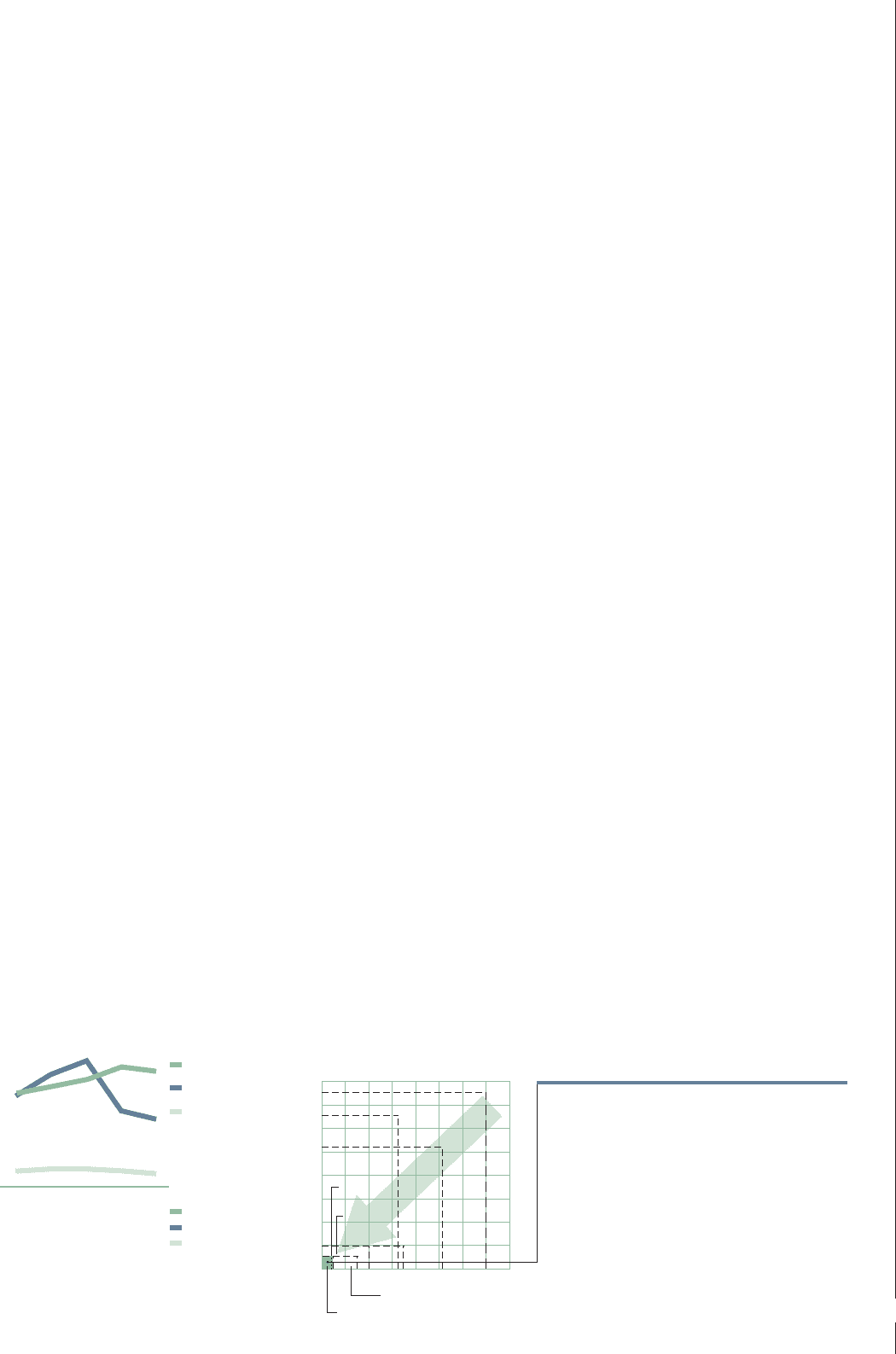

Heavy truck registrations, > 16 tons Emissions regulations for trucks and buses

Europe

North America

Vehicles, thousands

0807060504

319329295277255

185

208349308249

35

43484842

Japan

US 10, 2010

US 07, 2007

0,16

0,14

0,12

0,10

0,08

0,06

0,04

0,02

0,00

Particles, g/kWh

NOx, g/kWh

012345678

Euro II, 1996

Euro III, 2002

Euro IV, 2006

Euro V, 2009

US 02, 2002 The currently applicable emissions standards are Euro IV

in Europe and US 07 in North America. The difference

between Euro III and Euro IV is considerable. Emissions of

particles have been reduced by 80%, and of NOx, by 30%.

During 2009, emission regulations will be lowered further

with the Euro V implementation. Euro V will entail a 50%

reduction of NOx emissions compared to Euro IV.

1) NOx value measured according to ECT.

Euro VI, 20131)

45

Board of Directors’ Report 2008