Volvo 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

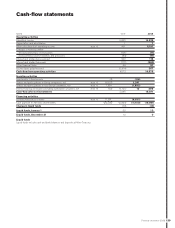

126

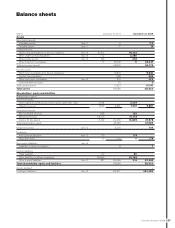

PARENT COMPANY AB VOLVO

Financial information 2008

Parent Company AB Volvo

Corporate registration number 556012-5790.

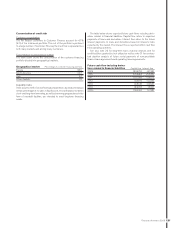

Income statements

Board of Directors’ report

AB Volvo is Parent Company of the Volvo Group and its operations

comprise the Group’s head offi ce with staff together with some corpo-

rate functions.

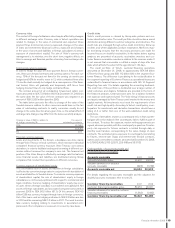

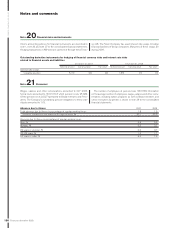

Other operating income and expenses include expenses of 117

(USD 19,6 M) due to the settlements reached by AB Volvo with the US

authorities during the fi rst quarter. The settlements include fi nes and

disgorgement of past profi ts on contracts from two of the subsidiar-

ies´ activities in Iraq under the Oil-for-Food Program.

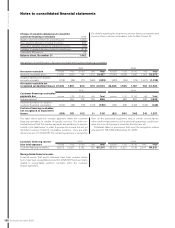

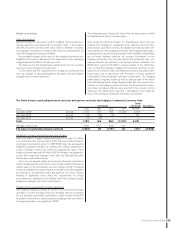

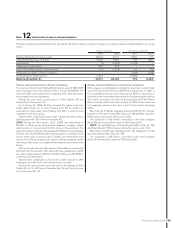

In the beginning of 2008, AB Volvo divested the shares in the sub-

sidiary Mack Trucks Inc to Volvo Holding USA AB for 3,225 cor-

responding to book value. Volvo Holding USA AB is a wholly-owned

subsidiary in the Volvo group.

In the third quarter the shares in Volvo Korea Holding AB with a

book value of 2,655 were transferred from the subsidiary Volvo Group

Finance Europe BV (VGFE). The shares in VGFE were written down to

zero and the company was liquidated, which resulted in an income of

net 1,659 in the parent company.

Income from investments in Group companies includes dividends

amounting to 15,356 (841), Group contributions and transfer price

adjustments, net of neg 1,521 (5,944), a capital gain of 2,662 from the

liquidation of VGFE and write-downs of shareholdings of 1,003 (135).

The dividends were received from Volvo Holding Sverige AB, 12,935,

Volvo Construction Equipment NV, 1,134 and from Sotrof AB, 1,041.

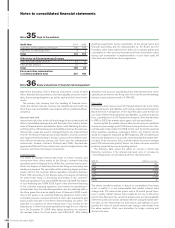

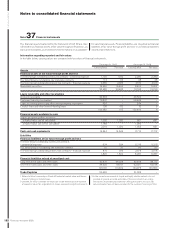

The carrying value of shares and participations in Group companies

amounted to 46,122 (47,011), of which 45,596 (46,461) pertained to

shares in wholly owned subsidiaries. The corresponding shareholders’

equity in the subsidiaries (including equity in untaxed reserves but

excluding minority interests) amounted to 92,009 (94,345).

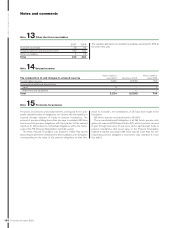

Other shares and participations include the direct and indirect

acquisition of Volvo Eicher Commercial Vehicles (VECV) for total

amount of 1,845. In the consolidated accounts of the Volvo group,

VECV is reported as a joint venture and consolidated according pro-

portional method. The indirect ownership is an effect of the acquisi-

tion of 8.1% of Eicher Motors Limited, which is the other venturer of

VECV. These shares are not separately valued as they form a part of

the indirect ownership in VECV.

Shares and participations in non-Group companies included 199

(214) in associated companies that are reported in accordance with

the equity method in the consolidated accounts. The portion of share-

holders’ equity in associated companies accruing to AB Volvo totaled

303 (286). Shares and participations in non-Group companies include

listed shares in Deutz AG with a carrying value of 212, corresponding

to the quoted market price at year-end. In 2008 revaluation of the

ownership has decreased the value by 324, recognized in equity.

Financial net debt amounted to 11,510 (20,894).

AB Volvo’s risk capital (shareholders’ equity plus untaxed reserves)

amounted to 38,273 corresponding to 65% of total assets. The com-

parable fi gure at year-end 2007 was 59%.

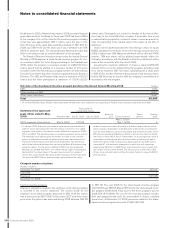

SEK M 2007 2008

Net sales 781 790

Cost of sales (781) (790)

Gross income 00

Selling expenses (5) –

Administrative expenses Note 2 (619) (524)

Other operating income and expenses Note 3 13 (126)

Income from investments in Group companies Note 4 6,651 15,494

Income from investments in associated companies Note 5 (118) (59)

Income from other investments Note 6 030

Operating income 5,922 14,815

Interest income and similar credits Note 7 13 2

Interest expenses and similar charges Note 7 (527) (845)

Other fi nancial income and expenses Note 8 36 97

Income after fi nancial items 5,444 14,069

Allocations Note 9 (1,230) 2,530

Income taxes Note 10 (1,022) 226

Income for the period 3,192 16,825