Volvo 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

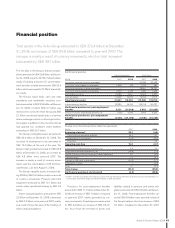

Financial performance

Net sales increased by 6% to SEK 303.7 billion, while operating income

declined by 29% to SEK 15.9 billion. Income for the year amounted to SEK 10.0

billion, down 33%. Basic and diluted earnings per share was SEK 4.90 (7.37).

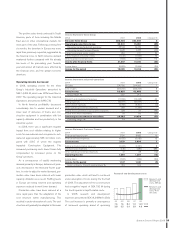

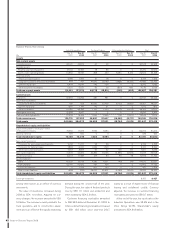

Net sales by business area

SEK M 2007 2008 %

Trucks 187,892 203,235 8

Construction

Equipment 53,633 56,079 5

Buses 16,608 17,312 4

Volvo Penta 11,719 11,433 (2)

Volvo Aero 7,646 7,448 (3)

Eliminations and

other (703) (575) (18)

Industrial

operations1276,795 294,932 7

Customer

Finance 7,705 8,485 10

Reclassifi cations

and eliminations 905 250 –

Volvo Group 285,405 303,667 6

1 Adjusted for acquired and divested units and changes in

currency rates, net sales for Industrial operations

increased by 4%.

Operating income (loss) by business area

SEK M 2007 2008

Trucks 15,193 12,167

Construction Equipment 4,218 1,808

Buses 231 (76)

Volvo Penta 1,173 928

Volvo Aero 529 359

Eliminations and other (761) (732)

Industrial operations 20,583 14,454

Customer Finance 1,649 1,397

Volvo Group 22,231 15,851

Net sales by market area

SEK m 2007 2008 %

Western Europe 124,239 123,881 0

Eastern Europe 27,116 28,126 4

North America 49,435 47,600 (4)

South America 15,638 19,553 25

Asia 42,429 55,641 31

Other markets 17,938 20,131 12

Total Industrial

operations 276,795 294,932 7

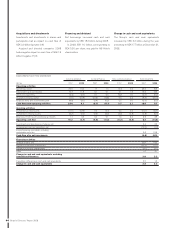

The Volvo Group

Net sales

Net sales for the Volvo Group increased by 6%

to SEK 303,667 M in 2008, compared with

SEK 285,405 M in 2007.

Operating income

Volvo Group operating income decreased by

29% in 2008 to SEK 15,851 M compared with

SEK 22,231 M in the year-earlier period.

Operating income for the Industrial oper-

ations declined by 30% to SEK 14,454 M

compared with SEK 20,583 M in the preced-

ing year. The Customer Finance operations

achieved an operating income of SEK 1,397 M

(1,649) a decline of 15%. Since return on

shareholders' equity for the Volvo Group

exceeded 12% in 2008, a provision of SEK

150 M was made for the Group's global profi t-

sharing system for employees.

Net fi nancial items

Net interest expense was SEK 764 M, com-

pared with SEK 170 M in 2007. The increased

interest expense is partly attributable to

increased debt level and it was also negativley

impacted by approximatley SEK 200 M prim-

arily from adjustments in pension liabilities

related to the closure of the plant in Goderich,

Canada.

During the year, market valuation of deriva-

tives mainly used for the customer fi nancing

portfolio had a negative effect on Other fi nan-

cial income and expenses in an amount of SEK

1,029 M (neg. SEK 384 M). The negative

impact is mainly due to long-term interest

rates decreasing sharply during the last quar-

ter, with the two-year euro interest rate drop-

ping 1.80 percentage points and the two-year

US interest rate coming down 2.07 percent-

age points. Volvo intends to keep these deri-

vates to maturity, why, over time, the market

valuation will not affect the result or cause any

cash fl ow. The derivates are mainly held to

match the lending in the customer fi nancing

portfolio. It is however not practically possible

to apply hedge accounting in accordance with

IAS 39 due to the fact that the customer

fi nance portfolio consists of a large number of

contracts.

Income Taxes

The income tax expense for the year amounted

to SEK 3,994 M corresponding to a tax rate of

29%. During 2007 the income tax expense

amounted to SEK 6,529 M and a tax rate of

30%.

Income for the period and earnings

per share

Income for the period amounted to SEK 10,016

M (15,028), corresponding to a basic earnings

per share of SEK 4.90 (7.37). Diluted earnings

per share was SEK 4.90 (7.37). The return of

shareholders’ equity was 12.1% (18.1).

Industrial Operations

In 2008, net sales for the Volvo Group’s Indus-

trial Operations increased by 7% to SEK

294,932 M (276,795). Adjusted for changes

in currency exchange rates and acquired and

divested operations, net sales increased by

4%.

38 Board of Directors’ Report 2008