Volvo 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated fi nancial statements

84

THE VOLVO GROUP

Financial information 2008

Pensions and similar obligations (Post-employment benefi ts)

Volvo applies IAS 19, Employee Benefi ts, for pensions and similar

obligations. In accordance with IAS 19, actuarial calculations should

be made for all defi ned-benefi t plans in order to determine the present

value of obligations for benefi ts vested by its current and former

employees. The actuarial calculations are prepared annually and are

based upon actuarial assumptions that are determined close to the

balance sheet date each year. Changes in the present value of obliga-

tions due to revised actuarial assumptions and experience adjust-

ments are treated as actuarial gains or losses. These are amortized

according to function over the employees’ average remaining service

period to the extent they exceed the corridor value for each plan. Devi-

ations between expected return on plan assets and actual return are

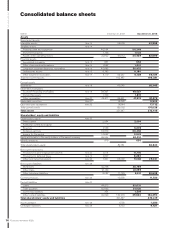

also treated as actuarial gains or losses. Provisions for post-employ-

ment benefi ts in Volvo’s balance sheet correspond to the present

value of obligations at year-end, less fair value of plan assets, unrec-

ognized actuarial gains or losses and unrecognized unvested past

service costs. See note 24.

As a supplement to IAS 19, Volvo applies UFR 4, in accordance with

the recommendation from the Swedish Financial Reporting Board in

calculating the Swedish pension liabilities.

For defi ned contribution plans premiums are expensed as incurred

over the income statement according to function.

Provisions for residual value risks

Residual value risks are attributable to operating lease contracts or

sales transactions combined with buy-back agreements or residual

value guarantees. Residual value risks are the risks that Volvo in the

future would have to dispose used products at a loss if the price devel-

opment of these products is worse than what was expected when the

contracts were entered. Provisions for residual value risks are made

on a continuing basis based upon estimations of the used products’

future net realizable values. The estimations of future net realizable

values are made with consideration to current prices, expected future

price development, expected inventory turnover period and expected

direct and indirect selling expenses. If the residual value risks are per-

taining to products that are reported as tangible assets in Volvo’s bal-

ance sheet, these risks are refl ected by depreciation or write-down of

the carrying value of these assets. If the residual value risks are per-

taining to products, which are not reported as assets in Volvo’s bal-

ance sheet, these risks are refl ected under the line item current

provisions.

Contingent liabilities

A contingent lliability is reported for a possible obligation, for which it

is not yet confi rmed that a present obligation exists that could lead to

an outfl ow of resources; or for a present obligation that do not meet

the defi nitions of a provision or a liability as it is not probable that an

outfl ow of resources will be required to settle the obligation or when a

suffi ciently reliable estimate of the amount cannot be made.

Warranty expenses

Estimated costs for product warranties are charged to operating

expenses when the products are sold. Estimated costs include both

expected contractual warranty obligations as well as expected good-

will warranty obligations. Estimated costs are determined based upon

historical statistics with consideration of known changes in product

quality, repair costs or similar. Costs for campaigns in connection with

specifi c quality problems are charged to operating expenses when the

campaign is decided and announced.

Restructuring costs

Restructuring costs are reported as a separate line item in the income

statement if they relate to a considerable change of the Group struc-

ture. Other restructuring costs are included in Other operating income

and expenses. A provision for decided restructuring measures is

reported when a detailed plan for the implementation of the measures

is complete and when this plan is communicated to those who are

affected.

Income taxes

Tax legislation in Sweden and other countries sometimes contains

rules other than those identifi ed with generally accepted accounting

principles, pertaining to the timing of taxation and measurement of

certain commercial transactions. Deferred taxes are reported on dif-

ferences that arise between the taxable value and reported value of

assets and liabilities (temporary differences) as well as on tax-loss

carryforwards. However, with regard to the valuation of deferred tax

assets, that is, the value of future tax reductions, these items are rec-

ognized provided that it is probable that the amounts can be utilized

against future taxable income.

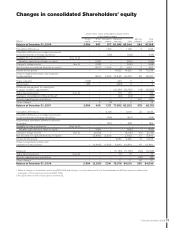

Deferred taxes on temporary differences on participations in sub-

sidiaries and associated companies are only reported when it is prob-

able that the difference will be recovered in the near future.

Tax laws in Sweden and certain other countries allow companies to

defer payment of taxes through allocations to untaxed reserves.

These items are treated as temporary differences in the consolidated

balance sheet, that is, a split is made between deferred tax liability

and equity capital. In the consolidated income statement an allocation

to, or withdrawal from, untaxed reserves is divided between deferred

taxes and net income for the year.

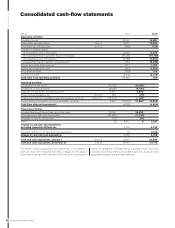

Cash-fl ow statement

The cash-fl ow statement is prepared in accordance with IAS 7, Cash

fl ow statement, indirect method. The cash-fl ow statements of foreign

Group companies are translated at the average rate. Changes in

Group structure, acquisitions and divestments, are reported net,

excluding cash and cash equivalents, in the item Acquisition and

divestment of subsidiaries and other business units and are included

in cash fl ow from Investing activities.

Cash and cash equivalents include cash, bank balances and parts

of marketable securities, with date of maturity within three months at

the time for investment. Marketable securities comprise interest-

bearing securities, the majority of which with terms exceeding three

years. However, these securities have high liquidity and can easily be

converted to cash. In accordance with IAS 7, certain investment in

marketable securities are excluded from the defi nition of cash and

cash equivalents in the cash-fl ow statement if the date of maturity of

such instruments is later than three months after the investment was

made.

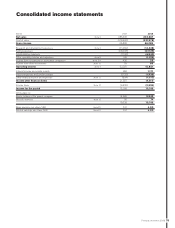

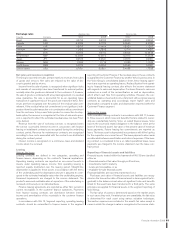

Earnings per share

Earnings per share is calculated as the income for the period attrib-

uted to the shareholders of the parent company, divided with the aver-

age number of outstanding shares per reporting period. To calculate

the diluted earnings per share, the average number of shares in the

denominator is adjusted with the average number of shares that would

be issued as an effect of ongoing sharebased incentive programs and

employee stock option programs that have been exercised or can-

celled during the period. See note 23