Volvo 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

Financial information 2008

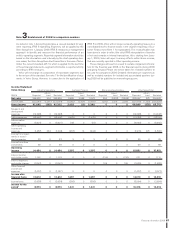

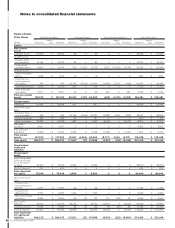

Note 2 Key sources of estimation uncertainty

Volvo’s signifi cant accounting principles are set out in note 1, Account-

ing Principles and conform to IFRS as endorsed by the EU. The prep-

aration of Volvo’s Consolidated Financial Statements requires the use

of estimates, judgements and assumptions that affect the reported

amounts of assets, liabilities and provisions at the date of the fi nancial

statements and the reported amounts of sales and expenses during

the periods presented. In preparing these fi nancial statements, Volvo’s

management has made its best estimates and judgements of certain

amounts included in the fi nancial statements, giving due considera-

tion to materiality. The application of these accounting principles

involves the exercise of judgement and use of assumptions as future

uncertainties and, accordingly actual results could differ from these

estimates. In accordance with IAS 1, preparers are required to provide

additional disclosure of accounting principles in which estimates,

judgments and assumptions are particularly sensitive and which, if

actual results are different, may have a material impact on the fi nan-

cial statements. The accounting principles applied by Volvo that are

deemed to meet these criteria are discussed below:

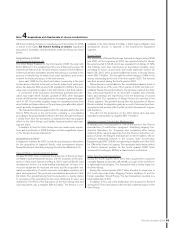

Impairment of goodwill, other intangible assets

and other non-current assets

Property, plant and equipment, intangible assets, other than goodwill,

and certain other non-current assets are amortized and depreciated

over their useful lives. Useful lives are based on management’s esti-

mates of the period that the assets will generate revenue. If, at the

date of the fi nancial statements, there is any indication that a tangible

or intangible non-current asset has been impaired, the recoverable

amount of the asset should be estimated. The recoverable amount is

the higher of the asset’s net selling price and its value in use, esti-

mated with reference to management’s projections of future cash

fl ows. If the recoverable amount of the asset is less than the carrying

amount, an impairment loss is recognized and the carrying amount of

the asset is reduced to the recoverable amount. Determination of the

recoverable amount is based upon management’s projections of

future cash fl ows, which are generally made by use of internal busi-

ness plans or forecasts. While management believes that estimates of

future cash fl ows are reasonable, different assumptions regarding

such cash fl ows could materially affect valuations. Intangible and tan-

gible non-current assets amounted to 126,657 (106,220) whereof

24,813 (19,969) represents goodwill. For Goodwill and certain other

intangible assets with indefi nite useful lives, an annual impairment

review is performed. Such an impairment review will require manage-

ment to determine the fair value of Volvo’s cash generating units, on

the basis of projected cash fl ows and internal business plans and

forecasts. Volvo has since 2002 performed a similar impairment

review. No impairment charges were required for the period 2002

until 2008. See note 14 for the allocation and impairment tests of

goodwill.

Revenue recognition

Revenue from the sale of goods is recognized when signifi cant risks

and rewards of ownership have been transferred to external parties,

normally when the goods are delivered to the customers. If, however,

the sale of goods is combined with a buy-back agreement or a re sidual

value guarantee, as described below regarding residual value risks,

the sale is accounted for as an operating lease transaction under the

condition that signifi cant risks of the goods are retained by Volvo. In

certain cases Volvo enters into a buy-back agreement or residual

value guarantee after Volvo sold the product to an independent party

or in combination with an undertaking from the customer that in the

event of a buy-back to purchase a new Volvo product. In such cases,

there may be a question of judgement regarding whether or not sig-

nifi cant risks and rewards of ownership have been transferred to the

customer. If it is determined that such an assessment was incorrect,

Volvo’s reported revenue and income for the period will decline and

instead be distributed over several reporting periods.

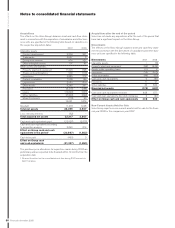

Residual value risks

In the course of its operations, Volvo is exposed to residual value risks

through operating lease agreements and sales combined with repur-

chase agreements. Residual value commitments amount to SEK

16.422 million at December 31, 2008. Residual value risks are

refl ected in different ways in the Volvo consolidated fi nancial state-

ments depending on the extent to which the risk remains with Volvo.

In cases where signifi cant risks pertaining to the product remain

with Volvo, the products, primarily trucks, are generally recognized in

the balance sheet as assets under operating leases. Depreciation

expenses for these products are charged on a straight-line basis over

the term of the commitment in amounts required to reduce the value

of the product to its estimated net realizable value at the end of the

commitment. The estimated net realizable value of the products at the

end of the commitments is monitored individually on a continuing

basis. In monitoring estimated net realizable value of each product

under a residual value commitment, management makes consider-

ation of current price-level of the used product model, value of options,

mileage, condition, future price deterioration due to expected change

of market conditions, alternative distribution channels, inventory lead-

time, repair and reconditioning costs, handling costs and overhead

costs in the used product divisions. Additional depreciations and esti-

mated impairment losses are immediately charged to income.

The total risk exposure for assets under operating lease is reported as

current and non-current residual value liabilities. See notes 26 and 27.

If the residual value risk commitment is not signifi cant, independent

from the sale transaction or in combination with a commitment from

the customer to buy a new Volvo product in connection to a buy-back

option, the asset is not recognized on balance. Instead, the risk

ex posure is reported as a residual value provision equivalent to the

estimated residual value risk. See note 25. To the extent the residual

value exposure does not meet the defi nition of a provision, the remain-

ing residual value risk exposure is reported as a contingent liability.

See note 29.

Deferred taxes

Under IFRS, deferred taxes are recognized for temporary differences,

which arise between the taxable value and reported value of assets

and liabilities as well as for unutilized tax-loss carryforwards. Volvo

records valuation allowances for deferred tax assets where manage-

ment does not expect such assets to be realized based upon current

forecasts. In the event that actual results differ from these estimates

or management adjusts these estimates in future periods, changes in

the valuation allowance may be needed that could materially impact

the fi nancial position and the income for the period. At December 31,

2008, the valuation allowance amounted to 245 (156) for the value of

deferred tax assets. Net of this valuation allowance, deferred tax

assets net of 16,003 (12,208) were recognized in the Group’s balance

sheet.