Volvo 2008 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

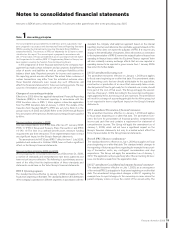

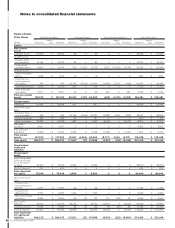

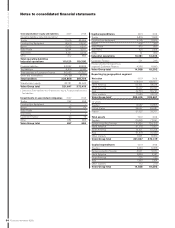

Notes to consolidated fi nancial statements

86

THE VOLVO GROUP

Financial information 2008

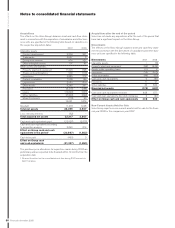

Inventory obsolescence

Inventories are reported at the lower of cost, in accordance with the

fi rst-in, fi rst-out method (FIFO), and net realizable value. The esti-

mated net realizable value includes management consideration of

out-dated articles, over-stocking, physical damages, inventory-lead-

time, handling and other selling costs. If the estimated net realizable

value is lower than cost, a valuation allowance is established for inven-

tory obsolescence. The total inventory value, net of inventory obsoles-

cence allowance, is per December 31, 2008, 55,045 (43,645).

Credit loss reserves

The establishment of credit loss reserves on customer fi nancing

receivables is dependent on estimates including assumptions regard-

ing past dues, repossession rates and the recovery rate on the under-

lying collaterals. At December 31, 2008, the total credit loss reserves

in the segment Customer Finance segment amounted to 1.37% (1.59)

of the total credit portfolio in the segment. See note 36 for a descrip-

tion of the credit risk.

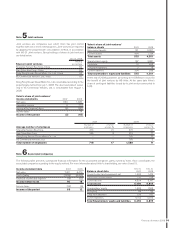

Pensions and other post-employment benefi ts

Provisions and costs for post-employment benefi ts, mainly pensions

and health-care benefi ts, are dependent on assumptions used by

actuaries in calculating such amounts. The appropriate assumptions

and actuarial calculations are made separately for the respective

countries of Volvo’s operations. The assumptions include discount

rates, health care cost trends rates, infl ation, salary growth, long-term

return on plan assets, retirement rates, mortality rates and other fac-

tors. According to IAS 19, actuarial assumptions such as the discount

rate shall be based on market expectations at the balance sheet date

for the period over which the obligations are to be settled and refl ect

the time-value of money but not the actuarial or investment risk. The

market situation at the end of the fi nancial year 2008 makes discount

rate assumptions specially diffi cult to determine. Volvo’s assumptions

regarding discount rate are presented in note 24. Health care cost

trend assumptions are developed based on historical cost data, the

near-term outlook, and an assessment of likely long-term trends. Infl a-

tion assumptions are based on an evaluation of external market indi-

cators. The salary growth assumptions refl ect the long-term actual

experience, the near-term outlook and assumed infl ation. Retirement

and mortality rates are based primarily on offi cially available mortality

statistics. The actuarial assumptions are revieved on an annual basis

and modifi cations are made to them when it is deemed appropriate to

do so. Actual results that differ from management’s assumptions are

accumulated and amortized over future periods. See Note 24 for more

information regarding costs and assumptions for post-employment

benefi ts. At December 31, 2008 net provisions for post-employment

benefi ts amounted to 9,264 (7,643).

Product warranty costs

Estimated costs for product warranties are charged to cost of sales

when the products are sold. Estimated warranty costs include con-

tractual warranty and goodwill warranty (warranty cover in excess of

contractual warranty or campaigns which is accepted as a matter of

policy or normal practice in order to maintain a good business relation

with the customer). Warranty provisions are estimated with considera-

tion of historical claims statistics, the warranty period, the average

time-lag between faults occurring and claims to the company and

anticipated changes in quality indexes. Differences between actual

warranty claims and the estimated claims generally affect the recog-

nized expense and provisions in future periods. Refunds from sup-

pliers, that decrease Volvo’s warranty costs, are recognized to the

extent these are considered to be certain. At December 31, 2008

warranty cost provisions amounted to 10,354 (9,373).

Legal proceedings

Volvo recognizes obligations in the Group accounts as provisions or

other liabilities only in cases where Volvo has a present obligation

from a past event, where a fi nancial responsibility is probable and

Volvo can make a reliable estimate of the size of the amount. In

instances where these criteria are not met, a contingent liability may

be disclosed in the notes to the accounts.

Volvo regularly reviews the development of signifi cant outstanding

legal disputes in which Group companies are parties, both civil law

and tax disputes, in order to assess the need for provisions and con-

tingent liabilities in the fi nancial statements. Among the factors that

Volvo considers in making decisions on provisions and contingent

liabilities are the nature of the dispute, the amount claimed, the

progress of the case, the opinions or views of legal counsels and other

advisers, experience in similar cases, and any decision of Volvo’s man-

agement as to how Volvo intends to handle the dispute. The actual

outcome of a legal dispute may deviate from the expected outcome of

the dispute. The difference between actual and expected outcome of

a dispute might materially affected future fi nancial statements, with

an adverse impact upon our results of operation, fi nancial position and

liquidity. See note 29 for the Volvo Group’s gross exposure to contin-

gent liabilities.