Volvo 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

has had an ever increasing impact on airlines’

total costs while the climate and environmen-

tal concerns have increased demand for

engines with lower emissions.

By using Volvo Aero’s knowledge of light-

weight design, simulation and new, patented

production methods, engine manufacturers

can shorten lead times for the development of

new engines while at the same time produce

engines that are lighter and less noisy.

Through the acquistion of ACAB in 2007

Volvo Aero was able to complement the light-

weight konowledge with composite technolo-

gies, which are expected to have a great

importance for future aircraft engines.

Largest contracts so far

Lowered weight and lowered production costs

were success factors when Volvo Aero signed

its largest engine contracts to date with the

engine manufacturers Pratt & Whitney and

Rolls-Royce. The involvement in the two engine

programs is expected to lead to net sales for

Volvo Aero of approximately SEK 90 billion in

the coming 40 years. The contracts are impor-

tant successes for Volvo Aero’s lightweight

technology since the contracts were signed in

stiff competition from conventional technolo-

gies.

During the year, an important milestone was

passed for another new and important aircraft

engine: the GEnx, which received certifi cation

from the U.S. Federal Aviation Administration.

Volvo Aero has been responsible for the de-

velopment of three important components but

in total manufactures six parts of the engine.

The important testing of Volvo Aero com-

posite technology in EU’s VITAL environmental

project was successful. The Fan Blade Out

test is crucial in order to demonstrate the abil-

ity of the components to cope with maximum

strain.

During the year, Volvo Aero and Boeing

extended their marketing and distribution

partnership agreement for an additional 10

years. Volvo Aero’s aftermarket company in the

US will continue to provide services to support

the distribution of aircraft parts for a wide

range of Boeing aircraft.

Declining air traffi c

World airline passenger traffi c increased

somewhat during the fi rst eleven months of

2008. However, almost all regions showed a

clear decline towards the end of the year. The

domestic North American market in particular

had a signifi cant downturn.

According to IATA, the airlines’ fi nancial

problems increased in 2008. In spite of this,

order backlog for large commercial jets

increased. The order backlog increased from

6,848 aircraft at the beginning of 2008 to

7,429 at the end of the year. Airbus and Boe-

ing received 1,586 new orders and delivered

858 new aircraft.

Lower profi tability

In 2008, Volvo Aero’s sales amounted to SEK

7,448 M compared to SEK 7,646 M the pre-

ceding year, a decline of 3%.

Operating income amounted to SEK 359 M, a

decline of 32% compared to SEK 529 M in 2007.

Operating margin declined from 6.9% to 4.8%.

The lower profi tability is mainly attributable to

lower sales and lower margins in the American

aftermarket business, while delays in new aircraft

programs at both Boeing and Airbus impacted

profi tability through lower production volumes and

lower capacity utilization.

The development of composite struc-•

tures has been running according to

plan.

Successful FBO test (FanBlade Out) •

conducted in Derby together with

Rolls-Royce.

The work to meet higher volumes with •

increased productivity and lower prod-

uct cost has developed according to

plan, but will continue in 2009.

Successful activities in the aftermarket •

business, but the sharp decline among

airlines resulted in the American after-

market business not reaching its goals.

Adjust operations to the expected •

downturn and lower volumes.

Continue working on improving pro-•

ductivity and lowering product cost.

Handle the development of com-•

ponents to the new engine programs

Trent XWB and PW1000G.

Increase volumes and profi tability in •

the aftermarket business.

Continue to expand the customer offer •

of composites for cold structures.

Develop composite offerings for cold •

structures within the framework of the

acquisition of ACAB.

Meet increased volumes through •

improved productivity and lower prod-

uct costs.

Continued improvements in volumes •

and profi tability within the aftermarket

business.

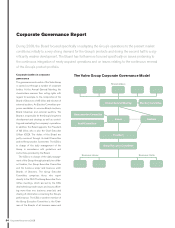

Outcome 2008 Ambitions 2009Ambitions 2008

VOLVO AERO

Net sales by market

Volvo Aero, SEK M 2007 2008

Europe 3,462 3,497

North America 3,723 3,534

South America 127 58

Asia 234 234

Other markets 100 125

Total 7,646 7,448

Key ratios

Volvo Aero 2007 2008

Net sales as percentage

of Volvo Group sales 32

Net sales, SEK bn 7.6 7.4

Operating income, SEK M 529 359

Operating margin, % 6.9 4.8

Many aircraft

the world over have

components from Volvo Aero.

Many aircraft

the

wo

rld

ov

er

hav

e

components from Volvo Aero.

Business areas 2008

62