Volvo 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

demand by the US Environmental Protection

Agency (EPA). The demand is a consequence

of dissenting opinions on whether an agree-

ment between EPA and Volvo Powertrain

regarding lower emitting engines also should

include engines sold by Volvo Penta.

The former labour agreement between

Mack Trucks, Inc. and the United Auto Workers

Union (“UAW”) expired on September 30,

2007. Since that time, the parties have been

operating under a mutually agreed upon day-

by-day extension of the previous agreement.

Negotiations on a new labor agreement are

ongoing. Both Mack Trucks, Inc. and the UAW

are parties to similar lawsuits fi led in the U.S

federal courts addressing the issue of retiree

healthcare benefi ts. Mack Trucks’ lawsuit, the

fi rst of the two lawsuits fi led, seeks a declaration

from the court that it is permitted to unilater-

ally amend the terms of the existing retiree

health care plan. The lawsuit fi led by the UAW

in response to the Mack lawsuit, seeks a ruling

from the court that the plan of benefi ts must

remain unchanged. On request by Mack, the

two cases have been consolidated. At present,

it is not possible to estimate the outcome of

the negotiations or the pending lawsuits, but

there is a risk that the outcome may have a

signifi cant negative effect on the consolidated

operating income.

Volvo verifi es annually, or more frequently if

necessary, the goodwill value of its business

areas for possible impairment. The size of the

overvalue differs between the business areas

and they are, to a varying degree, sensitive to

changes in the business environment.

The annual goodwill tests performed for all

business areas in the fourth quarter have not

resulted in any write-down. A continued fi nancial

crisis and volatility in interest and currency

rates could lead to indications of impairment

for some business areas in the forthcoming

periods, which would require goodwill valua-

tion tests to be performed for those areas as

long as indications remain.

General risks

External-related risk

The commercial vehicles industry

is cyclical

The Volvo Group’s markets have undergone

signifi cant changes in demand as the general

economic environment has fl uctuated. Invest-

ments in infrastructure, major industrial

projects, mining and housing construction all

impact the Group’s operations, since its prod-

ucts are central to these sectors. The cyclical

demand for the Group’s products makes the

fi nancial result of the operations dependable

on the Group's ability to react to changes in

demand, and in particular to the ability to adapt

production levels and production and operat-

ing expenses.

Intense competition

Continued consolidation in the industry is

expected to create fewer but stronger com-

petitors. Our major competitors are Daimler,

Paccar, Navistar, MAN, Scania, Caterpillar,

Komatsu, Cummins and Brunswick. In recent

years, new competitors have emerged in Asia,

particularly in China. These new competitors

are mainly active in their domestic markets,

but are expected to increase their presence in

other parts of the world.

Prices may change

The prices of commercial vehicles have, at

times, changed considerably in certain mar-

kets over a short period. This instability is

caused by several factors, such as short-term

variations in demand, shortages of certain

component products, uncertainty regarding

underlying economic conditions, changes in

import regulations, excess inventory and

increased competition. Overcapacity within

the industry can occur if there is a lack of

demand, potentially leading to increased price

pressure.

Extensive government regulation

Regulations regarding exhaust emission levels,

noise, safety and levels of pollutants from pro-

duction plants are extensive within the industry.

Most of the regulatory challenges regarding

products relate to reduced engine emissions.

The Volvo Group is a signifi cant player in the

commercial vehicle industry and one of the

world’s largest producer of heavy-duty diesel

engines. The product development capacity

within the Volvo Group is well consolidated to

be able to focus resources for research and

development to meet tougher emission regula-

tions. Future product regulations are well known,

and the product development strategy is well

tuned to the introduction of new regulations.

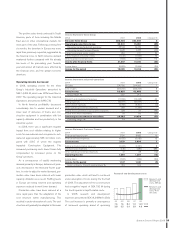

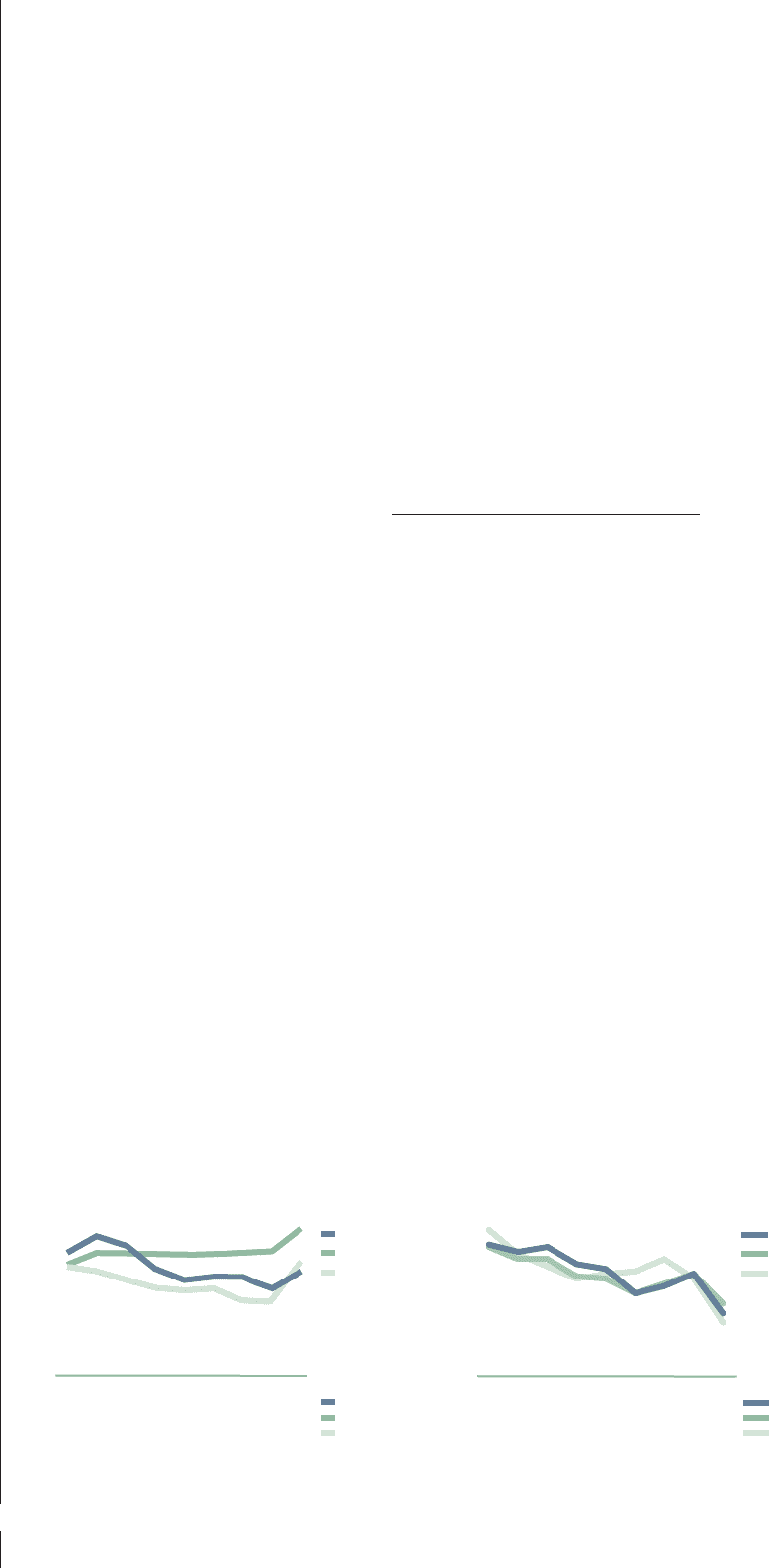

Currencies Interest rates in Sweden, Europe and the US, %

08

7.8

10.9

03

8.0

9.1

04

7.3

9.1

05

7.5

9.2

06

7.4

9.3

07

6.8

9.3

02

9.7

9.1

01

10.3

9.2

00

9.2

8.4

SEK/USD

SEK/EUR

SEK/100 JPY

8.66.7 6.5 6.7 5.8 5.87.37.98.2

Source: Reuters

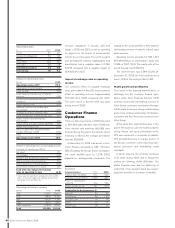

Sweden

Europe

The U.S.

06

3.7

3.8

4.8

07

4.3

4.3

4.0

08

2.4

2.9

2.2

01

5.1

4.8

5.0

02

5.3

4.8

4.5

03

4.6

4.1

4.0

04

4.4

4.0

4.2

05

3.4

3.4

4.3

00

5.4

5.3

6.0

Government bonds, 10 year benchmarks

Source: Reuters

46 Board of Directors’ Report 2008