Volvo 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133

Financial information 2008

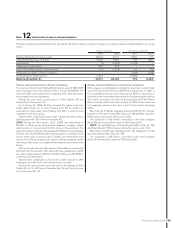

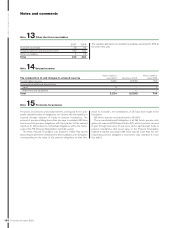

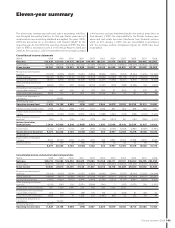

Note 12 Investments in shares and participations

Holdings of shares and participations are specifi ed in AB Volvo’s holding of shares. Changes in holdings of shares and participations are shown

below.

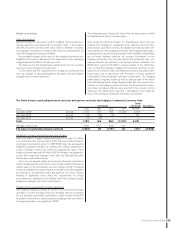

Group companies Non-Group companies

2007 2008 2007 2008

Balance December 31, previous year 40,419 47,011 6,400 772

Acquisitions/New issue of shares 2,909 2,660 148 1,891

Divestments (1) (3,225) (2,103) –

Shareholder contributions 342 679 ––

Write-downs/Participations in partnerships (151) (1,003) 24 (59)

Revaluation of shares in listed companies ––(204) (324)

Reclassifi cation, Nissan Diesel 3,493 – (3,493) –

Balance, December 31 47,011 46,122 772 2,280

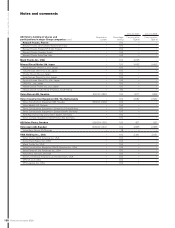

Shares and participations in Group companies

The shares in Volvo Korea Holding AB with a book value of SEK 2,655

were transferred from Volvo Group Finance Europe BV (VGFE). The

shares in VGFE were written down completely with 1,003 whereupon

the company has been liquidated.

During the year, newly issued shares in Volvo Bussar AB was

acquired with the amount of 5.

As of January 31, 2008, AB Volvo divested the shares in the sub-

sidiary Mack Trucks Inc to Volvo Holding USA AB for 3,225 cor-

responding to book value. Volvo Holding USA AB is a wholly-owned

subsidiary in the Volvo group.

Shareholders’ contributions were made in 2008 with 529 to Volvo

Italia Spa and with 150 to Volvo Powertrain AB.

2007: During the fi rst quarter 2007, 2,886 was transferred to

N.A.KK, a wholly-owned newly-formed Japanese company, whose

main business is to acquire and hold the shares in Nissan Diesel. The

parent company’s holding in Nissan Diesel (19%) with a carrying value

of 2,001 was sold to N.A.KK and remaining shares consisting of pref-

erence shares with a carrying value of 3,493, were reclassifi ed from

shares in non-Group companies to shares in Group companies at the

time Nissan Diesel was consolidated in the balance sheet of the Volvo

Group.

During the year, Ericsson AB’s share in Alviva AB was acquired by

AB Volvo with the amount of 23. Alviva AB was established in 2002

as a joint venture between AB Volvo (51%) and Ericsson AB (49%) in

order to pursue healthcare.

Shareholders’ contributions were made in 2007 with 35 to VNA

Holding Inc and with 307 to Volvo Financial Services AB.

Write-downs were carried out at year-end on the holdings in Volvo

Penta UK Ltd, 16, VFS Servizi Finanziari Spa 22, and Volvo Informa-

tion Technology AB, 113.

Shares and participations in non-Group companies

Other shares and participations include the direct and indirect hold-

ings of VE Commercial Vehicles (VECV) for total amount of 1,845. In

the consolidated accounts of the Volvo group, VECV is reported as a

joint venture and consolidated according to the proportionate method.

The indirect ownership is an effect of the acquisition of 8.1% of Eicher

Motors Limited, which is the other venturer of VECV. These shares are

not separately valued as they form a part of the indirect ownership

VECV.

Blue Chip Jet II HB was capitalized during 2008 with 43. The par-

ticipations in the partnerships Blue Chip Jet I HB and Blue Chip Jet II

HB decreased during the year by a net of 59.

The revaluation of AB Volvo’s ownership in the listed company

Deutz AG has decreased the value by 324 during 2008.

2007: The participations in the partnerships Blue Chip Jet I HB

and Blue Chip Jet II HB increased during the year by a net of 24.

Blue Chip Jet II HB was capitalized with 145. Repayment of 102

was received from Blue Chip Jet I HB.

The revaluation of AB Volvo’s ownership in the listed company

Deutz AG decreased the value by 204 during 2007.