Volvo 2008 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

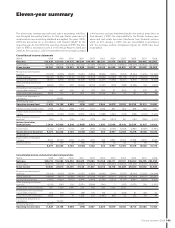

147

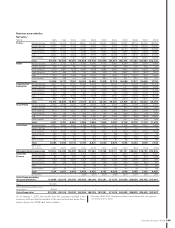

Financial information 2008

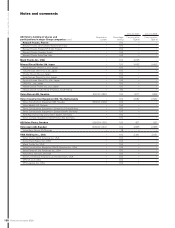

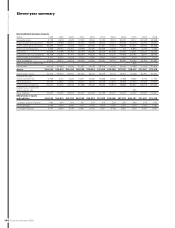

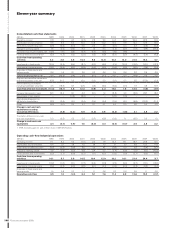

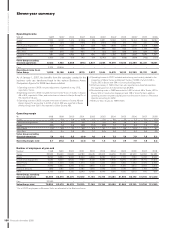

Key ratios

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Gross margin, %123.2 20.3 19.3 17.2 17.9 19.2 21.6 21.8 22.7 22.6 21.3

Research and development

expenses as percentage of

net sales14.9 3.9 4.1 3.0 3.3 3.9 3.8 3.3 3.4 4.0 4.9

Selling expenses as percentage

of net sales19.0 7.0 7.7 8.1 8.7 9.1 9.1 8.5 8.0 8.9 8.7

Administration expenses as

percentage of net sales13.9 4.0 3.9 3.6 3.1 3.0 2.6 2.7 2.6 2.6 2.3

Return on shareholders’ equity, % 13.0 34.9 5.0 neg 1.7 0.4 13.9 17.8 19.6 18.1 12.1

Interest coverage, times19.6 23.1 4.5 neg 2.2 1.9 11.0 16.7 26.1 20.7 8.8

Self-fi nancing ratio, % 16 29 39 92 110 152 163 116 189 153 5

Self-fi nancing ratio Industrial

operations, % 105 130 72 148 196 243 268 173 235 265 78

Financial position, Industrial

operations, SEK M 12,232 28,758 9,392 (7,042) (6,063) (2,426) 18,110 18,675 23,076 (4,305) (29,795)

Net fi nancial position as

percentage of shareholders'

equity , Industrial operations 17.4 29.3 10.6 (8.2) (7.7) (3.3) 25.8 23.7 29.2 (5.7) (39.4)

Shareholders’ equity as

percentage of total assets 34.1 50.2 44.3 32.8 32.8 31.4 31.3 30.6 33.7 25.7 22.7

Shareholders’ equity as

percentage of total assets,

Industrial operations 51.2 67.3 60.8 41.8 42.4 40.5 40.0 40.4 40.6 30.8 28.4

Shareholders’ equity excluding

minority interest as percentage of

total assets 33.7 49.9 44.0 32.6 32.7 31.3 31.2 30.5 33.6 25.6 22.6

1 Pertains to the Industrial operations. For periods before 2006, Financial Services is included and consolidated according to the equity method.

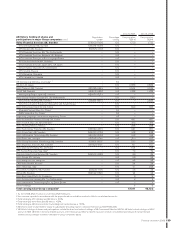

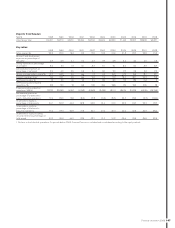

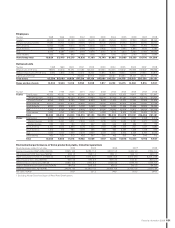

Exports from Sweden

SEK M 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Volvo Group, total 64,401 52,719 46,251 50,394 52,730 49,300 62,653 71,133 80,517 88,606 96,571