Volvo 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

Financial information 2008

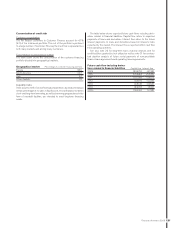

Derecognition of fi nancial assets

Financial assets that have been transferred in such a way that part or

all of the fi nancial assets do not qualify for derecognition, are included

in reported assets of the Volvo Group. In accordance with IAS 39

Financial Instruments, Recognition and Measurement, an evaluation

is made whether substantially all the risks and rewards have been

transferred to an external part. When Volvo has concluded that it is

not the case, the part of the fi nancial assets that refl ect Volvo’s con-

tinuous involvement are being recognized. On December 31, 2008,

Volvo recognizes SEK 3.9 (3.4) billion corresponding to Volvo’s con-

tinuous involvement, mostly within the customer fi nancing operations.

Of this balance, SEK 3.8 (3.0) billion derives from credit guarantees

for customer fi nance receivables that Nissan Diesel has entered into.

A corresponding amount is reported as a fi nancial liability.

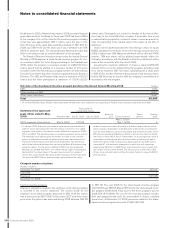

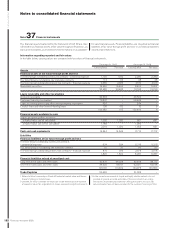

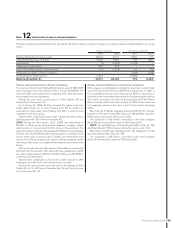

Gains, losses, interest income and expenses related to fi nancial instruments

The table below shows how gains and losses as well as interest income and expense have affected income after fi nancial items in the Volvo

Group divided on the different categories of fi nancial instruments.

2007 2008

Gains/

Losses

Interest

income

Interest

expenses

Gains/

Losses

Interest

income

Interest

expenses

Financial assets and liabilities

at fair value through profi t and loss

Marketable securities 898 00864 00

Derivatives for fi nancial exposure (403) 00(924) 00

Loans receivable and other receivables 0 37 0011 0

Financial assets available for sale

Shares and participations for which a market value

can be calculated 8––42 ––

Shares and participations for which a market value

cannot be calculated 98 ––60 ––

Cash and cash equivalents – 249 00362 0

Financial liabilities valued at amortized cost 30(4,048) (1) 0 (5,083)

Effect on income 604 286 (4,048) 41 373 (5,083)

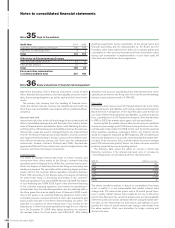

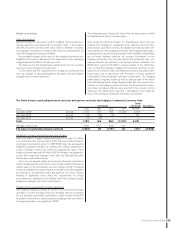

Net effect of foreign exchange gains and losses

Foreign exchange gains and losses pertaining to fi nancial instruments have affected income after fi nancial items in

the Volvo Group according to the below below.

2007 2008

Derivative instruments 1,364 (812)

Cash and cash equivalents (191) (421)

Loans originated by the company and Financial liabilities value at amortized cost – Volvo internal (133) 12,373

Loans originated by the company and Financial liabilities value at amortized cost – External (965) (11,041)

Effect on income 75 99

Various categories of fi nancial instruments are treated separately in

specifi c notes. See note 15 for Shares and participations, notes 16

and 19 for Customer-fi nancing receivables, note 20 for Other short-

term receivables, note 21 for Marketable securities, note 22 for Cash

and cash equivalents, note 26 for Non-current liabilities and note 27

for Current liabilities.